FOMC surprise move

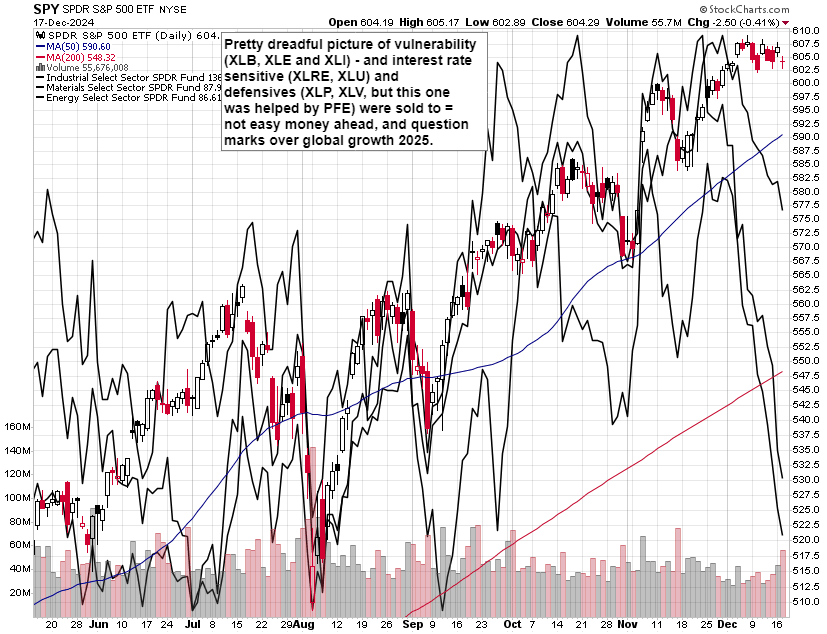

S&P 500 saw intraday rallies being sold into, and that included tech as well – the sectors picked seeing most inflows last few weeks. Market breadth was awful, equal weighted S&P 500 (that‘s RSP) tanked, and weren‘t it for TSLA, PFE and AAPL with MU, the S&P 500 would have finished worse off than it did.

The select few sectors I had been cautioning about lately, took a dive – and the message of energy, oil stocks can‘t be ignored either. This all has a reason, many reasons actually, and in today‘s in-depth video charting the FOMC positioning in a 360-degrees view, I talk everything from yields, USD, emerging market bonds to the trio of XLB, XLE and XLI vs. SPY – all alongside the backdrop of latest US economic data compared against the key other economy, that of China.

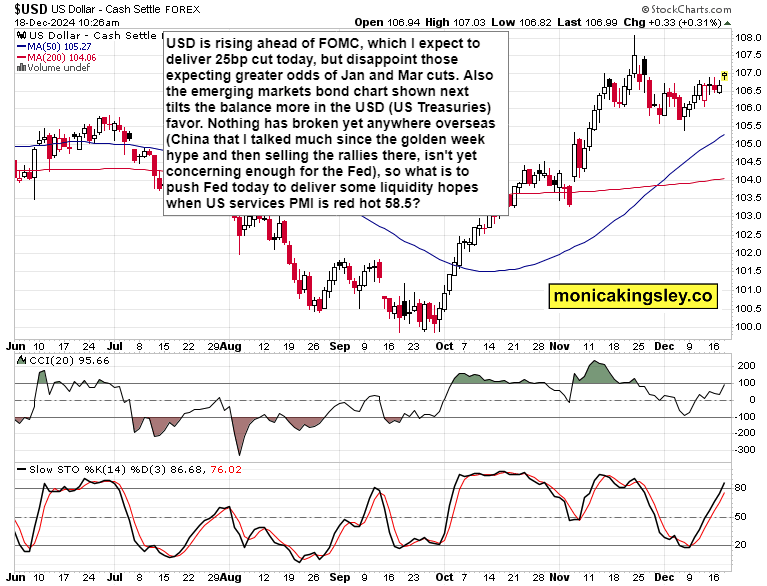

And into this environment, the Fed is going to cut, and in a not dovish way. Considering the slowly accelerating (for now PPI) inflation, red hot services PMI (most of the US economy), very decent consumer confidence and retail sales (have you checked upon yesterday‘s driver, the auto sales that I discussed on Dec 07?), all of which are opening a gap vs. rest of the world that‘s being reflected in rising USD and economically sensitive commodities under pressure (incl. Dr. Copper).

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.