FOMC statement: Not bringing in any major surprise

S&P 500 withstood strong ADP employment change, overlooking soft landing incompatibility and focusing on the no stagflation angle as that was what helped sink stocks Tuesday (ignore crude oil inventories). Both manufacturing PMI and JOLTS supported soft landing, yet stocks didn‘t rally before FOMC.

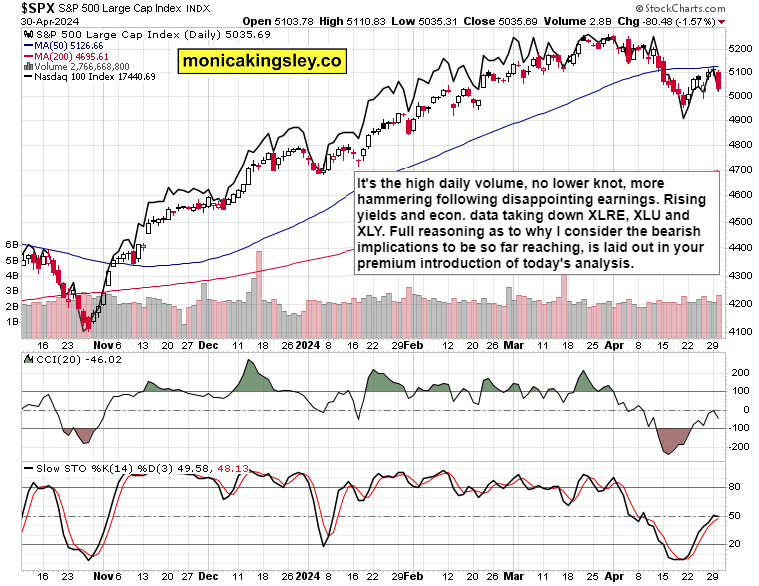

S&P 500 and Nasdaq daily charts have been both bearish – this is how I summed it up yesterday European morning in our channel.

What else to think with yields not really retreating, earnings with guidance mostly underwhelming (even the good ones such as MSFT, KLAC etc get sold – no AMZN to $187) and heavy selling hitting in the final hour of trading (institutional positioning)?

Such was the daily chart and sectoral reasoning yesterday.

And then comes the FOMC statement, not bringing in any major surprise. Given the stubborn and not really retreating inflation, the pushed farther away odds of a rate cut (Nov now the base case), the expectations were for not really dovish Powell, especially since he acknowledged no real progress in the taking inflation to the 2% objective. It was likewise surprising that he mentioned not seeing signs of stagflation, in spite of latest GDP, Chicago PMI, both services and manufacturing PMIs and consumer confidence, to name a few.

Instead of bringing up rate hike (while that‘s not on the table for the bond market will do the hiking for the Fed), slowdown as of Jun in balance sheet shrinking (from $60bn to $25bn) was announced. Yields accelerated their intraday retreat, and stocks were first pumped, and then dumped as both the 10y Treasury and EURUSD got second thoughts.

S&P 500 and Nasdaq made daily lower lows, and rejected the upswing that would have changed the technical picture as FOMC days typically have follow through the other day, which is out of the question (there won‘t be overcoming yesterday‘s intraday highs, and once again selling before the close is likely to overpower the prior buyers, resulting in a notable upper knot).

What‘s been most amazing about yesterday, was the willingness and degree of buying into the statement and conference that didn‘t bring any game changer, and objectively wasn‘t a macro bullish catalyst.

As for tomorrow‘s NFPs, I doubt it would come on the cold side given Wednesday‘s employment change – only services PMI have a chance of coming in below 51.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.