- The Federal Reserve will release the minutes of the June 13-14 FOMC meeting.

- During the meeting, the FOMC decided to maintain the interest rates within the range of 5-5.25%.

- Market participants will scrutinize the minutes for hints on the Fed's potential actions at the July meeting.

The US Federal Reserve (Fed) will release the minutes of the Federal Open Market Committee’s (FOMC) June 13-14 policy meeting at 18:00 GMT on Wednesday, July 5. They will provide valuable insights into why the central bank decided to take a pause in its hiking cycle and what is the potential for more rate hikes in the near term.

Traders and investors will scrutinize the minutes for any indications of what it would take for the Fed to tighten its monetary policy further. The Fed's views on inflation, economic growth, and interest rates are likely to have an impact on financial markets.

At the June meeting, the FOMC decided to maintain the policy rate at 5.00% - 5.25%, which was in line with market expectations. This decision followed a cumulative increase of 500 basis points since March 2022. In its statement, the central bank stated that keeping the interest rate steady would allow them to evaluate additional information and its implications for monetary policy. The FOMC reiterated that despite recent declines, inflation remains elevated, and they remain committed to achieving the 2% inflation objective.

According to the economic projections from FOMC members, the terminal rate projection for the end of 2023 was revised upward to 5.6% from 5.1% in March. These projections imply that there could be two more 25 basis point rate hikes before the end of the year. Fed Chair Jerome Powell has reiterated this forecast every time he has spoken publicly, including twice before the US Congress and during conferences in Sintra and Spain. This hawkish perspective has been bolstering the US Dollar.

The Fed's forecast did not come as a surprise, but prior to the latest developments, markets had a different perspective that included a lower terminal rate and an increased likelihood of rate cuts before year-end. However, comments from Fed officials and the latest round of economic data from the US, particularly regarding the labor market, have brought market sentiment closer to the Fed's.

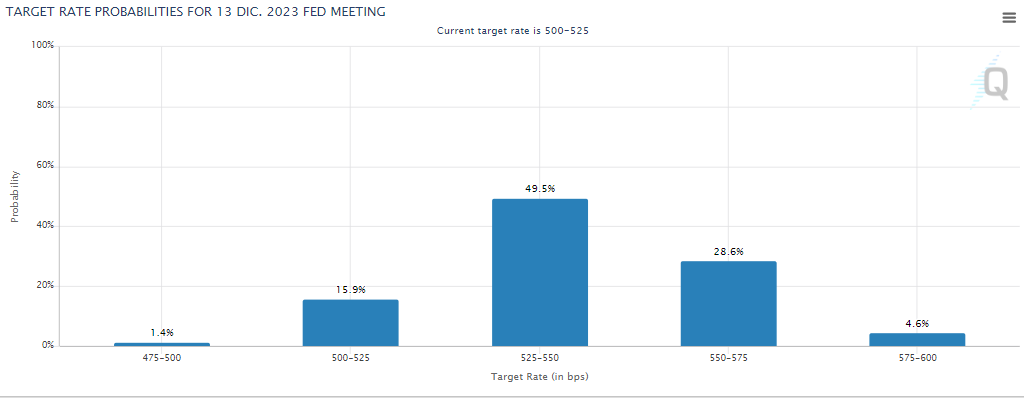

According to the CME FedWatch Tool, the probability of a rate hike at the upcoming July 25-26 meeting is currently above 85%, and it also shows an increasing expectation of another rate hike before the end of the year. This represents a complete reversal from market expectations just months ago.

Source: CME FedWatch Tool

Expected hawkish minutes: Policymakers anticipate further rate hikes

During the June post-meeting press conference, Powell stated that "nearly all policymakers view some further rate hikes this year will be appropriate." Therefore, the minutes are likely to reflect this perspective, which has been reiterated not only by Powell but also by other FOMC members, including some who are considered "dovish.”

Powell also mentioned in June that reducing inflation "is likely to require below-trend growth, some softening of labor conditions." However, Q1 GDP and the latest jobs numbers have not yet indicated such a trend, leaving the door open for more rate hikes. Inflation has slowed down but remains above the target.

"By taking a little more time on tightening, we reduce the chance of going too far," mentioned the Fed's Chair, and the minutes are likely to contain similar comments. References to rate cuts are unlikely as Powell has explained several times that not a single member "wrote down a rate cut this year." The bond markets appear to have started to believe the Fed's stance that rate cuts this year "will not be appropriate," as Powell described.

The minutes could offer clues about the Fed's next move, but they are unlikely to provide significant new information. The next meeting will probably focus on the jobs figures to be released on Friday and the Consumer Price Index (CPI) to be published next week. These are the last two high-impact reports that FOMC members will receive before the July 25-26 meeting.

US Dollar Index: No clear signs

The US Dollar Index (DXY) currently lacks a clear direction, as the Dollar overall. The hawkish expectations from the Fed have been offset by other central banks maintaining a similar stance and improving market sentiment.

The DXY is hovering around 103.00, with no signs from technical indicators and the price near key moving averages. A drop below 102.70 would deteriorate the outlook and suggest a test of the 102.00 zone. On the contrary, if the DXY breaks above a downtrend line currently at 103.50, it could point toward Dollar strength ahead.

The impact of the minutes is expected to be limited, considering that not much has happened since the meeting and that Powell has spoken in public several times. However, the minutes are always a document that markets scrutinize and look for hints, and they could contain some surprises. As usual, if those are hawkish, the Dollar could benefit moderately, and if they are (unexpectedly) dovish, they would likely have a more significant impact in weakening the Greenback.

Fed FAQs

What does the Federal Reserve do, how does it impact the US Dollar?

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

How often does the Fed hold monetary policy meetings?

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

What is Quantitative Easing (QE) and how does it impact USD?

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

What is Quantitative Tightening (QT) and how does it impact the US Dollar?

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stabilizes above 1.1350 on Easter Friday

EUR/USD enters a consolidation phase above 1.1350 on Friday as the trading action remains subdued, with major markets remaining closed in observance of the Easter Holiday. On Thursday, the European Central Bank (ECB) announced it cut key rates by 25 bps, as expected.

GBP/USD fluctuates below 1.3300, looks to post weekly gains

After setting a new multi-month high near 1.3300 earlier in the week, GBP/USD trades in a narrow band at around 1.32700 on Friday and remains on track to end the week in positive territory. Markets turn quiet on Friday as trading conditions thin out on Easter Holiday.

Gold ends week with impressive gains above $3,300

Gold retreated slightly from the all-time high it touched at $3,357 early Thursday but still gained more than 2% for the week after settling at $3,327. The uncertainty surrounding US-China trade relations caused markets to adopt a cautious stance, boosting safe-haven demand for Gold.

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-638240799103030394.png)