Focus on the real gains

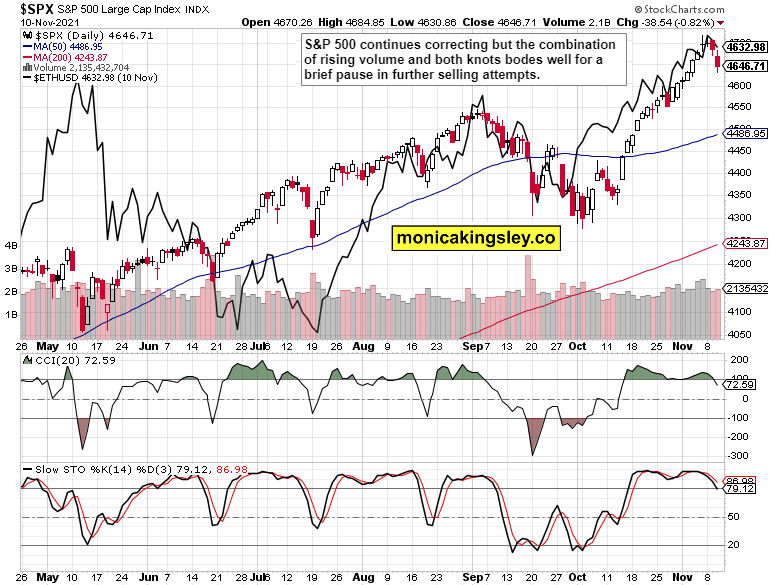

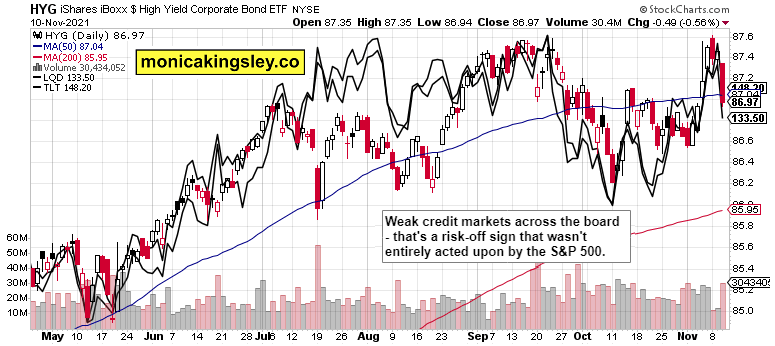

S&P 500 declined, and not enough buyers arrived in my view. Still, we‘re likely to see a brief pause in selling, and that‘s giving the bulls a chance. Credit markets were a bit too beaten down by the troubled 30-year Treasury auction and Evergrande moving into the spotlight somewhat again. VIX managed another upswing and doesn‘t point to the S&P 500 has gotten to an excessively bearish positioning just yet.

I think some treading the water before stocks make up their mind, is most likely next. The downswing doesn‘t appear to be totally over, but we have arguably seen the greater part of it already. Tech isn‘t yet stabilized, but the increasing volume spells a pause in selling. I‘m still looking for clues to the bond markets.

And it‘s clear that not even higher rates can sink the precious metals run – neither the late day rush to the dollar had that power. Miners continue behaving, and their daily black candle doesn‘t scare me – the realization of inflation not having peaked, and being as stubborn as I had been pounding the table since eternity, is working its magic:

(…) inflation expectations are moving higher – the more you shorten the maturity, the higher they go, let alone RINF, their key ETF. Markets will be proven very wrong about the transitory inflation complacency – inflation rates aren‘t going to decline if you just leave them alone. And taper coupled with rate hikes hesitancy won‘t do the trick either.

S&P 500 is still primed to go higher – the only question is the shape of the current consolidation. Liquidity is still ample, the banking sector is strong, and the Russell 2000 isn‘t really retreating.

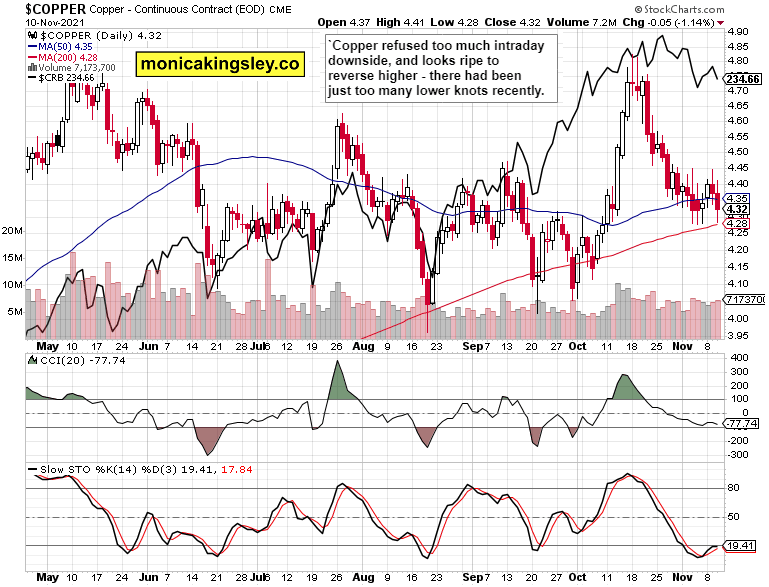

Precious metals are consolidating – it‘s almost a pre-CPI ritual, but under the surface, the pressure to go higher keeps building. I‘m looking for a strong Dec in gold and silver, with unyielding oil and copper gradually waking up. Cryptos aren‘t taking prisoners either.

Crude oil is well bid in the $78 till $80 zone, and would overcome $85 – we aren‘t looking at a reversal but at temporary upside rejection. Likewise copper would kick in with vengeance, and the shallow crypto consolidations are barely worth mentioning at all.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

S&P 500 decline continues, and the very short-term picture favors a little consolidation – the selling might not be over just yet.

Credit markets

HYG, LQD, and TLT – weakness anywhere you look, without tangible signs of stabilization, which makes any S&P 500 upswings a doubtful proposition.

Gold, silver and miners

Gold and silver look to be just getting started – the growing money flows aren‘t sufficient to push prices lower. Miners are pulling ahead, and the ever more negative real rates coupled with surging inflation fears (and Fed policy mistake recognition) are powering it all.

Crude oil

Crude oil bulls would have to step in around the $80 level again, and it seems they wouldn‘t find it too hard to do. Yesterday‘s downswing looks like a daily setback only.

Copper

Copper downswing was again bought, and I‘m not looking for the bears to make much further progress as commodities appear ready to turn up again regardless of temporary dollar strength.

Bitcoin and Ethereum

Bitcoin and Ethereum are again briefly consolidating, and the bulls haven‘t really spoken their last word. It‘s a nice base building before another upleg.

Summary

S&P 500 is likely pausing for a moment here, and any further pullback isn‘t likely to reach for on the downside. The late-day selloff in real assets was merely a brief, news-driven correction that would be reversed before too long, and precious metals are showing the way as inflation is moving back into the spotlight, and the talk about Fed‘s policy mistake is growing louder.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.