Five fundamentals: Markets ready for fireworks with Powell, full buildup to Nonfarm Payrolls

- The first week of April is packed with top-tier US releases culminating in Nonfarm Payrolls.

- Easter Monday's super-strong ISM Manufacturing PMI starts the week with a risk-off mood.

- Fed Chair Powell's speech is set to add to volatility.

Only one Easter Egg – a critical inflation indicator showed some moderation, but two other events over the long weekend proved adverse for markets. Jerome Powell, Chairman of the Federal Reserve (Fed), sounded somewhat hawkish – and he gets to speak again on Wednesday. In addition, the first significant release of the week on Easter Monday set a downbeat tone.

Here are five fundamentals for the week.

ISM Manufacturing PMI

Monday, 14:00 GMT. The ISM Manufacturing PMI has already been released, but it is worth mentioning. Government subsidies in the industrial sector have finally created optimism among purchasing managers in that part of the economy. The foward-looking indicator topped 50 – the threshold separating expansion and contraction – for the first time since 2022.

The news sent US 10-year yields to the recent peak above 4.30% and the Greenback up. It weighed on stocks and held back the Gold rally. The indicator shapes expectations for the next releases this week.

JOLTS Job Openings

Tuesday, 14:00 GMT. While the data is for February – contrary to Nonfarm Payrolls which is for March – hiring levels in America's labor market are closely watched by the Fed. After hitting 8.86 million in January, a small drop to 8.74 is on the cards for February. That may be an underestimation, as the job market has often surprised investors in the past two years.

Any outcome above nine million would trigger further US Dollar strength, while only a drop toward 8.5 million would provide some relief. A worsening labor market would change the Fed's mind faster than anything else.

ISM Services PMI

Wednesday, 14:00 GMT. After the super-hot ISM Manufacturing PMI, investors may expect fresh strength in the larger services sector. The employment component is of importance here, as a hint toward Friday's jobs report.

The release comes before Powell speaks, and may cause significant jitters in nervous markets. The economic calendar points to stability in March – a score close to the 52.6 points recorded in February. A dip toward 50 would cheer markets and weigh on the Greenback, while any increase would worry stocks and Gold.

Fed Chair Jerome Powell´s speech

Wednesday, 16:10. The world's most powerful central banker goes to California to speak at Stanford University. On Friday, he talked about keeping rates for longer if high inflation persists – but did not mention cutting them this year. It is essential to note that it was a panel discussion, and Powell was not asked about reductions to borrowing costs.

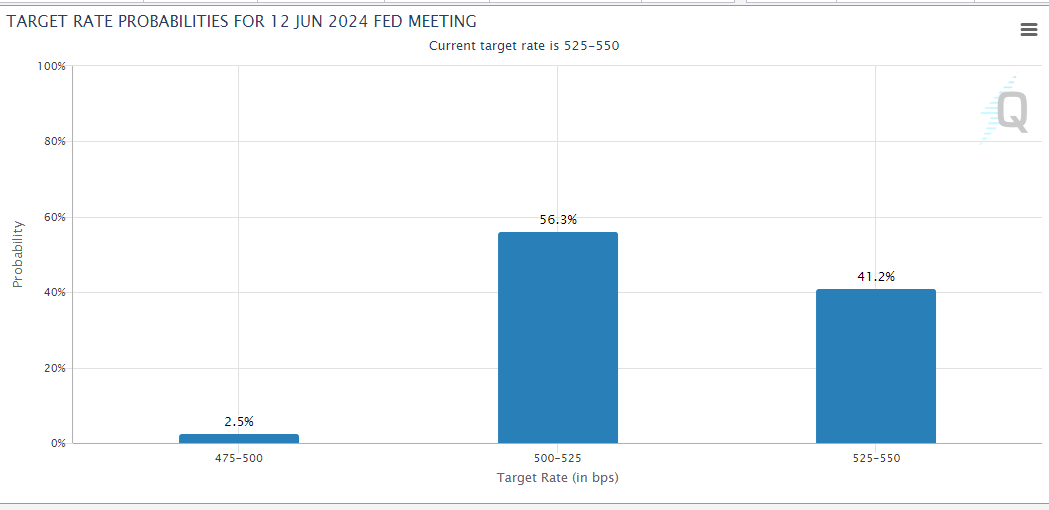

Bond markets are unsure about a rate cut in June:

Target rate probabilities for June 2024. Source: CME Group.

With more data at hand, he will likely mention cuts, but perhaps signal that June is too soon. That would strengthen the US Dollar.

Any mention of the labor market is also critical. By midday on Wednesday, Powell may have already received Nonfarm Payrolls figures. Even if he is not privy to the information, markets may perceive any remarks as a hint. Fears of a downturn would boost Gold and stocks, while weighing on the Greenback. Reiterating that the job market is tight would do the opposite.

Nonfarm Payrolls

Friday, 12:30 GMT.

Friday, 12:30 GMT. The "King of forex indicators" is set to show a moderate increase of 200,000 jobs in March after the 275,000 advance seen in February. Leading indicators and Powell's speech will help shape expectations.

The headline number will likely dominate the initial reaction, while any surprise in wage data would impact markets afterward. Average Hourly Earnings are set to rise by 0.3% MoM and 4.1% YoY.

As mentioned earlier, any rapid deterioration in the labor market would cause the Fed to change course and shift its tone to cutting rates sooner – even if inflation is high. A drop to 150,000 jobs gained or lower would trigger wild action.

Conversely, another positive surprise, such as an increase of 250,000 positions, would boost the US Dollar, weigh on Gold, and trigger a mixed reaction in stocks. While companies prefer lower rates, they need customers with money in their pockets.

Closing thoughts

The first week of the month tends to be very busy, and volatility will likely be high. I recommend trading with care.

To get an indication if Powell's speech – or one by any other Fed member – is hawkish or dovish, sign up our Fed Tracker. It's free.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.