Five fundamentals for the week: Inflation and what the Fed says about it are in focus

- US inflation figures for April are set to trigger high volatility in markets.

- Critical speeches from Fed Chair Powell and his colleague Waller stand out.

- Jobless claims will also be of interest after stealing the spotlight last week.

Will inflation finally fall? That is the question for markets, battered by four consecutive worrying releases of the all-important Consumer Price Index (CPI). A warm-up with PPI, speeches by key Federal Reserve (Fed) officials, and also a look at the central bank's second mandate, employment, all promise an exciting week.

1) US PPI may trigger an opportunity to go contrarian

Tuesday, 12:30 GMT. The Producer Price Index (PPI) is often seen as a leading indicator toward CPI, but the figures are not always well-correlated, especially in a services-based economy. Nevertheless, every inflation figure sparks action, and the release prior to the CPI makes PPI a warmup for nervous traders.

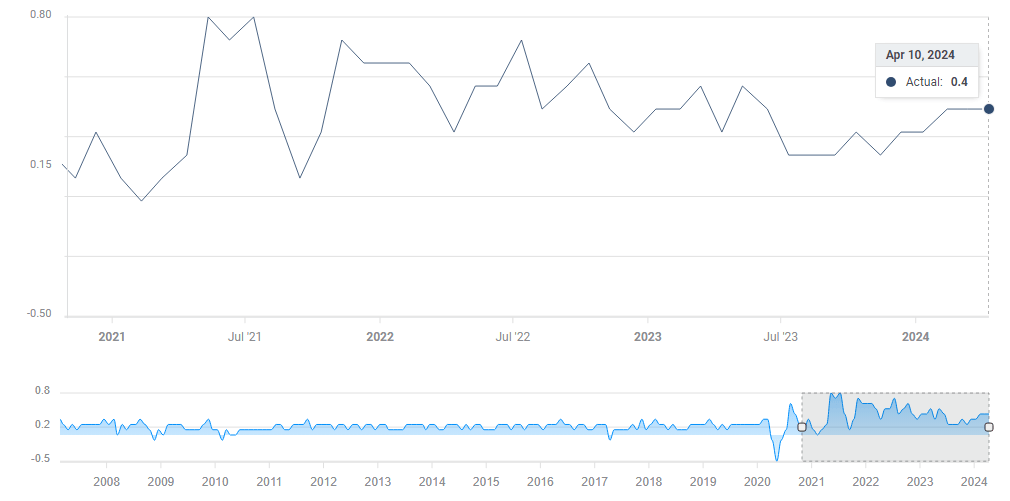

Core PPI. Source: FXStreet

However, any move will likely be short-lived as April's PPI will likely impact only on May's CPI – and the invertors’ focus is on April's CPI due out the following day. The PPI release could prove an opportunity to go against the initial reaction.

2) Fed Chair Powell speaks and may already know something

Tuesday, 14:00 GMT. Federal Reserve Chair Jerome Powell is the world's most important central banker – so every speech matters, including comments made overseas. Powell will address an audience in Amsterdam, and any updates on his thoughts about interest rates could trigger action. A response to PPI numbers would also be interesting but unlikely.

Even if he refrains from saying anything new, markets will probably closely scrutinize every word as a hint of what Powell already knows. The Fed Chair and a handful of other senior officials get early access to data, and they could slip a comment.

Once again, unless there is a clear signal about the data or any drastical change about monetary policy, any knee-jerk reaction to the data could be reversed afterward – providing yet another opportunity.

3) US CPI – the peak of the week (and the month)

Wednesday, 12:30 GMT. The Federal Reserve remains focused on beating inflation, and the Consumer Price Index (CPI) report is the No. 1 market-mover when it comes to inflation. CPI is hard data about what has already happened, which is more reliable than soft data from surveys.

And while the Fed officially targets the Personal Consumption Expenditure (PCE), the CPI is released much earlier and consists of bigger surprises.

So far in 2024, CPI beat estimates in all three releases, causing the Fed to push back the timing of its first rate cut and unnerve markets. Will there be a fourth consecutive hot report this year? The most critical data point is the core CPI MoM, which reflects the most recent change in price rises which the Fed finds easier to impact. It has less control over more volatile energy and food prices set in global markets. Core CPI excludes these items.

Underlying inflation is expected to have risen by 0.3% in April, a touch lower than the 0.4% seen in each of the past three months. Any tenth of a percentage matters. If the forecast materializes, core CPI YoY would drop to 3.6% from 3.8%, getting the annual figure closer to the Fed's 2% target.

US core CPI. Source: FXStreet

Headline inflation matters to non-financial media and politicians. Also here, a monthly increase of 0.3% is on the cards, while annual CPI is set to drop to 3.4% from 3.5%.

All inflation figures tend to move in tandem, so a surprise in one is usually a surprise in all. However, if the core CPI MoM meets estimates, the other figures could have their say.

In case of little or no surprises in the CPI report, Retail Sales figures published simultaneously would also have their say. After an excellent increase in March, more modest figures are on the cards for April.

I would like to stress that any 0.1% surprise in core CPI MoM would obviate retail data.

Generally, the stronger the data, the better for the US Dollar and the worse for other assets. A weak inflation report would boost risk assets and weigh on the Greenback. It is hard to exaggerate the release's long-term implications.

.

4) US jobless claims could be the canary in the coal mine

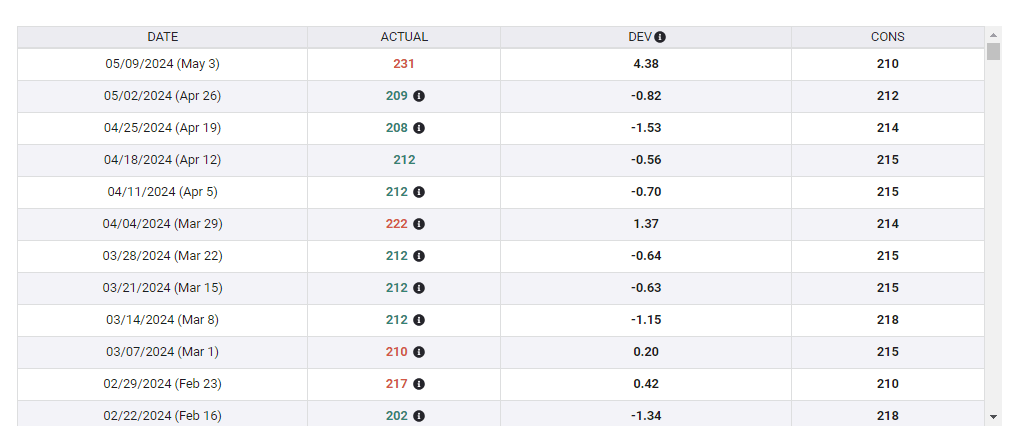

Thursday, 12:30 GMT. On May 1, Fed Chair Powell talked about "unexpected weakness" in labor markets as a reason to accelerate rate cuts. Since then, Nonfarm Payrolls have shown softer hiring, and last week's Unemployment Claims jumped to 231,000, significantly above expectations.

Is the US on the verge of a big unemployment spike? The only certainty is that the data will be of greater interest than usual. Economists expect 220,000, a gradual return to previous levels. Any difference of 5,000 will matter for the short term, and a surprise of above 10,000 would already have a longer impact.

US jobless claims. Source: FXStreet

5) Fed's Waller closes the week

Friday, 14:15 GMT. While several speakers are slated this week except Powell, the one from Fed Governor Christopher Waller is the most important one. Waller is a permanent voter, and someone who tends to lead the Fed's thinking rather than merely repeat Powell's messages.

The Trump-era appointee used to be a clear hawk, cooling hot markets and boosting the US Dollar. However, Waller's recent comments have been more neutral. His words come late in the week, when the data is already out and traders are gearing for the weekend.

Anything Waller says could be interpreted as the bank's thinking after the CPI data, and could trigger significant movements.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.