- The Federal Reserve is set to cut rates by 25bps but send a relatively hawkish signal for 2025.

- Central banks in the UK and Japan will likely leave borrowing costs unchanged.

- US Retail Sales and core PCE will add to volatility in the last full trading week of 2024.

Christmas is coming – but there's a high likelihood of wild price action before the holiday season begins. Central banks take center stage, and there is enough data to keep traders busy outside these critical decisions.

1) US Retail Sales set to paint a healthy consumption picture

Tuesday, 13:30 GMT. Personal consumption is roughly two-thirds of the world's largest economy, making this report critical for markets and the Federal Reserve (Fed).

Black Friday sales are the highlight of the upcoming Retail Sales report in the US – but Americans do not need special events to shop. Consumption has been rising satisfactorily throughout the year.

The economic calendar projects a 0.5% increase in headline Retail Sales in November, after 0.4% in October. Apart from the headline figure, the Control Group is of interest. This "core of the core" retail sales measure dropped last month by 0.1%, and another decline would cause some doubts about the aforementioned resilience of the consumer. There is a good chance it will bounce back.

2) Fed may go for "hawkish cut" to end the year

Wednesday, 19:00 GMT, press conference at 19:30 GMT. The Federal Reserve is set for a third consecutive rate cut – but the focus is on 2025.

Inflation is down, but not out, with core CPI still hovering above 3%, making it hard for officials to declare victory. There is a reason for that – the economy is doing well, with a robust jobs market to back it up. The world's most powerful central bank is cutting rates due to a fall in inflation and would like to focus on its second mandate – full employment. However, it may have to slow down this pivot.

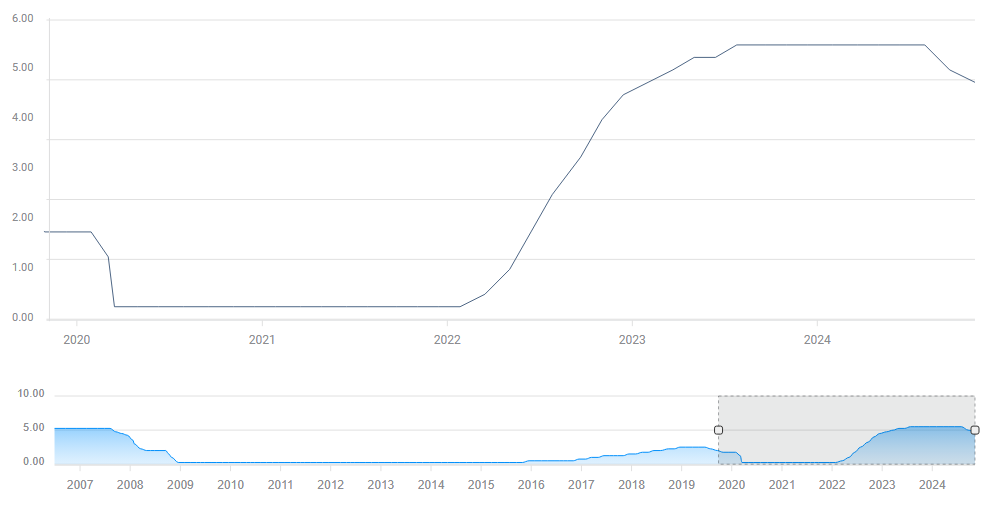

Interest rates are gradually falling

Federal Funds Rates. Source: FXStreet

Investors will be closely watching the central bank's "dot plot" – forecasts for inflation, unemployment, growth, and most importantly, interest rates. The bank's projected borrowing costs at the end of 2025 may rise from current levels, indicating a slower path of rate cuts. Any change to forecasts will have a material impact on markets.

I expect a relatively hawkish dot plot, disappointing markets that prefer a clearer path of quick rate cuts.

Fed Chair Jerome Powell will dominate the second act. In the post-decision press conference, Powell will likely try to set a balanced approach between the two mandates but may find himself calming markets, promising to act rapidly if the economy deteriorates. That would ease a potential hawkish narrative.

3) BoJ may prefer not rocking the boat once again

Thursday, during the Asian session. The Bank of Japan (BoJ) raised interest rates twice in 2024, moving them from negative to positive territory. Officials in Tokyo have been talking about further tightening to keep inflation in check. They would also like to buoy the Yen's exchange rate.

However, inflation is not an acute problem in Japan, and political uncertainty after the recent elections also means a more cautious approach by Governor Kazuo Ueda and his colleagues.

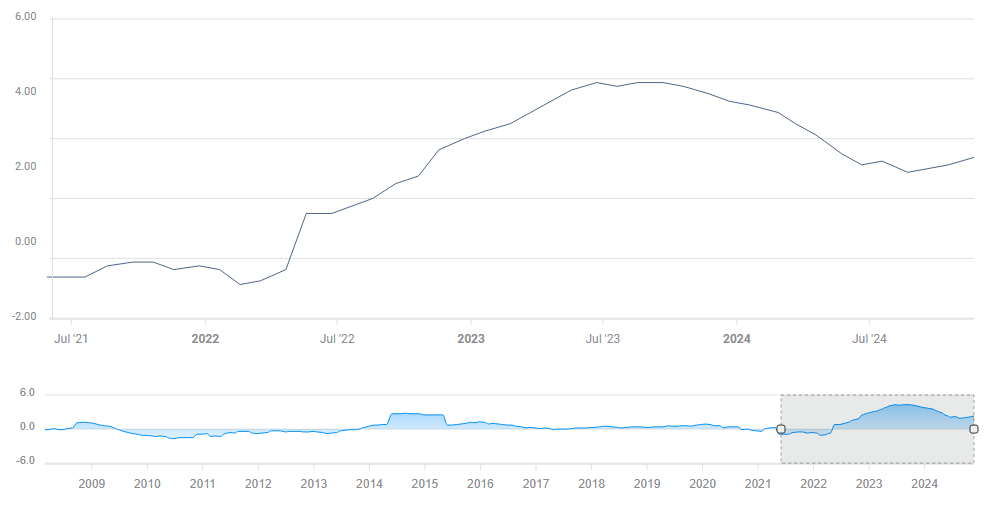

Core inflation in Japan stood at 2.3% in October:

Japanese core inflation. Source: FXStreet.

In its last decision of the year, the BoJ will likely keep murmuring about raising rates but will probably refrain from action. That would keep the Japanese Yen (JPY) under pressure, especially if the Fed conveys a hawkish message a few hours earlier.

4) BoE to hold rates on stubborn core inflation despite lackluster growth

Thursday, 12:00 GMT. The budget is out – but having more certainty from the government does not mean more certainty for the Pound Sterling (GBP). The Bank of England (BoE) has cut interest rates twice in 2024 but is set to hold them unchanged in the last rate decision of the year.

Similar to the US, Britain's battle against underlying inflation has stalled. One day before the rate decision, fresh data for November is set to show an increase in the core Consumer Price Index (CPI) from its already dissatisfying 3.3% level.

However, I expect BoE Governor Andrew Bailey to signal that the next moves in interest rates remain down, just on a slower path. That would hurt the Pound. It is essential to note that the economy has cooled down, and that may eventually be reflected in price rises.

I expect the BoE to put pressure on the Sterling, and indirectly somewhat weigh on the Euro.

5) Core PCE may counter any hawkish Fed tone

Friday, 13:30 GMT. Last but not least comes the Fed's preferred inflation gauge. The core Personal Consumption Expenditure (PCE) is where the central bank wants to see 2%. It's always close, but no cigar.

While CPI is released before PCE, the latter is not only watched by the Fed but also adapts to changes in consumption patterns. After two months of rising at 0.3% MoM, a slower pace is expected in the November report.

A 0.1% or 0% would boost Gold and Stocks while weighing on the US Dollar (USD). A 0.2% read would be neutral, while a third consecutive 0.3% rise would boost the Greenback while weighing on the precious metal and equities.

I think some expect a 0.1% read, and if that fails to materialize, markets would be disappointed.

Final thoughts

The last full trading week of the year tends to see lower liquidity – with small surprises potentially triggering big movements in markets. In addition, beware of end-of-year flows. While these usually come on the last days of the year, some money managers might already be adjusting their portfolios.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD consolidates near 1.1350 amid a quiet start to a Big week

EUR/USD keeps its range play intact near 1.1350 in Monday’s European session. The upbeat market mood and easing US Dollar demand fail to provide lift to the main currency pair amid a quiet start to a critical week ahead.

GBP/USD recaptures 1.3300 as US Dollar buying stalls

GBP/USD has picked up fresh bids and regained the 1.3300 mark in the European trading hours on Monday. A pause in the US Dollar advance and a mildly positive risk sentment help the pair recover ground. However, the technical outlook on the daily time frame suggests a weakening bullish trend.

Gold price hangs above $3,265-3,260 support amid receding safe-haven demand and mildly positive USD

Gold price sticks to its bearish bias for the second successive day on Monday and trades just above the $3,265-3,260 pivotal support during the first half of the European session. Despite of mixed signals from the US and China, the optimism over the potential de-escalation of trade tensions between the world's two largest economies turns out to be a key negative factor.

Monero Price Forecast: XMR soars over 50% amid rising demand for privacy coins

Monero (XMR) price is extending its gains by 50% at the time of writing on Monday, following a 9.33% rally the previous week. The main reason for XMR’s rally is speculation that the token, which is widely known for its status as a privacy coin, was used to launder a suspected theft involving 3,520 BTC worth $330.7 million.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.