- Mid-East tensions could keep markets moving all week.

- The European Central Bank is set to cut interest rates as concerns of an economic downturn grow.

- US Retail Sales will provide an update on the health of the US consumer after the blockbuster jobs report.

Even on a bank holiday, markets are on the move. Concerns about Chinese stimulus and the Middle East stir markets, but the calendar offers several important events with the potential to shake things up. Here are five fundamentals for the week starting on October 14.

1) Fears of an Israeli strike against Iran move markets

The US will send Israel its THAAD defense systems. These advanced capabilities will allow Israel to withstand another Irani missile barrage – which could come as a response to an expected move to hit Iranian military or oil installations. The American move raises fears that an escalation is imminent.

Such concerns support Oil, whose shipping could be at risk, and Gold, a safe-haven asset. The US Dollar (USD) and the Swiss Franc (CHF) are additional beneficiaries.

Tensions keep these assets bid, but a limited Israeli attack in Iran could trigger a sell-off in these assets – a "buy the rumor, sell the fact" pattern.

However, there is a risk that an attack would drag the US into a direct confrontation with the Islamic Republic.

Mid-East headlines will continue rocking markets throughout the week.

2) Markets want more Chinese stimulus after underwhelming weekend

A highly anticipated press conference in Beijing over the weekend yielded more promises – but no numbers that markets could chew on. This vagueness triggered a "buy the rumor, sell the fact" response. However, it is not the end yet.

China is the world's second-largest economy, and authorities have been pumping out various announcements in recent weeks, mostly focused on the monetary side. Additional help from the government in the form of fiscal stimulus may still come.

Any piece of good news – or reports of an upcoming announcement – would boost stocks. A lack of any of these could weigh on them.

3) UK CPI watched after the surprising bounce in US inflation

Wednesday, 6:00 GMT. The Bank of England is set to cut rates in its next meeting, but there is uncertainty about the pace – and fresh inflation figures will set the tone. After hitting 2.2% in August, another decrease is on the cards for September.

Investors will also watch core CPI, which is set to decline slightly from the relatively high rate of 3.6%.

Apart from rocking the Pound Sterling (GBP), Britain's inflation data will likely shape expectations for the European Central Bank (ECB) and perhaps also the Federal Reserve (Fed). The ECB is set to cut rates by 25 bps on the following day, and there is a correlation between UK and Eurozone inflation rates.

The American angle is also of interest after recent US Consumer Price Index (CPI) data showed a surprising bounce. Is inflation rearing its ugly head again?

4) ECB to cut rates and could promise more

Thursday, decision at 12:15 GMT, press conference at 12:45 GMT. After pausing in July, the European Central Bank (ECB) slashed borrowing costs in September. It will likely repeat the move in its October meeting.

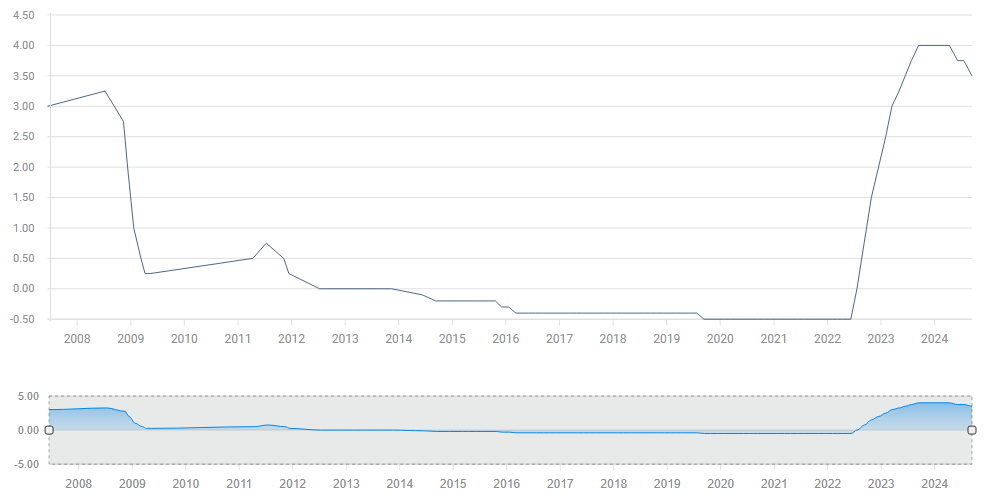

ECB Depoist Rate. Source: FXStreet

Coming only five weeks after the previous gathering, another cut would imply growing worries about the European economies, especially Germany. A series of announcements of layoffs have caused concern that the drop in inflation is not isolated but rather a result of a wider downturn.

ECB President Christine Lagarde will hold a press conference after the decision, and her tone will be critical to the direction of the Euro (EUR) and the mood about the global economy.

A signal that the Frankfurt-based institution may further lower rates in December would hurt the common currency and hit global stocks, while a more confident message would send the Euro up and stabilize markets.

Lagarde may say that the next decision, due only in December, will hinge on the fresh forecasts the ECB staff provides. Nevertheless, doves seem to be gaining ground as inflation falls and unemployment fears grow.

5) US Retail Sales may disappoint after three consecutive beats

Thursday, 12:30 GMT. Never underestimate the American consumer – but every trend also has a countertrend. Some two-thirds of the world's largest economy comes from consumption, making this report significant.

After the robust Nonfarm Payrolls report, there is room for optimism about consumption. The economic calendar points to another increase in Retail Sales.

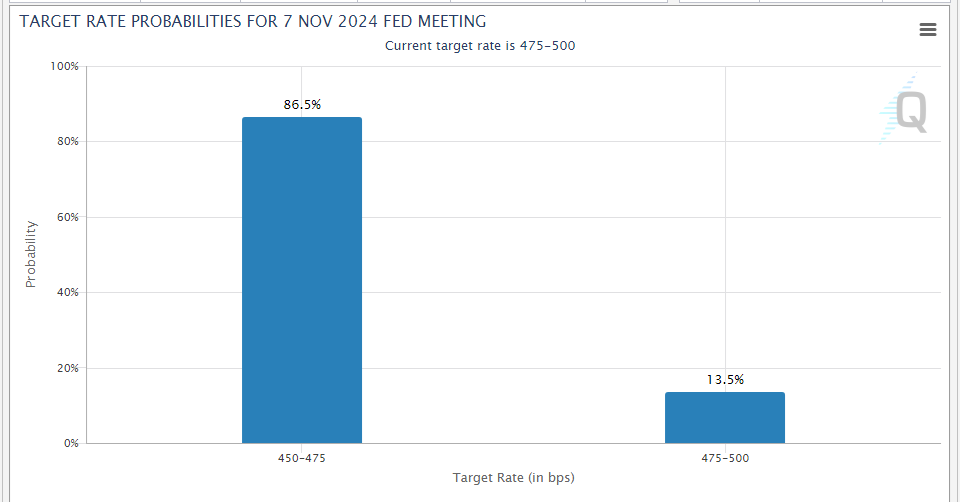

Bond markets currently price a high chance for a small, 25 bps cut, at the Fed’s next meeting in November.

Target rate probabilities for the November 7 meeting. Source: CME Group.

However, there are three reasons to be wary of a weak Retail Sales report.

First, the indicator has beaten consensus three times in a row, and that could mean a disappointing one this time.

Secondly, Americans will soon be going to the polls, and political anxiety ahead of the presidential elections may limit their consumption.

Third, the bump up in inflation last month may have held back some consumption.

All in all, there is room for a downside surprise, which could send stocks and the US Dollar down, while boosting Gold.

Final thoughts

As discussed, two of this week’s big themes do not have a fixed date, which means they could come at any time and trigger sharp reactions in markets. Trade with care.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.