Five events traders can't ignore this week

This week promises to be busy for financial markets after a news-filled weekend that included Trump’s assassination attempt and the Euro 2024 victory for Spain. Here are the key events traders and analysts will be watching.

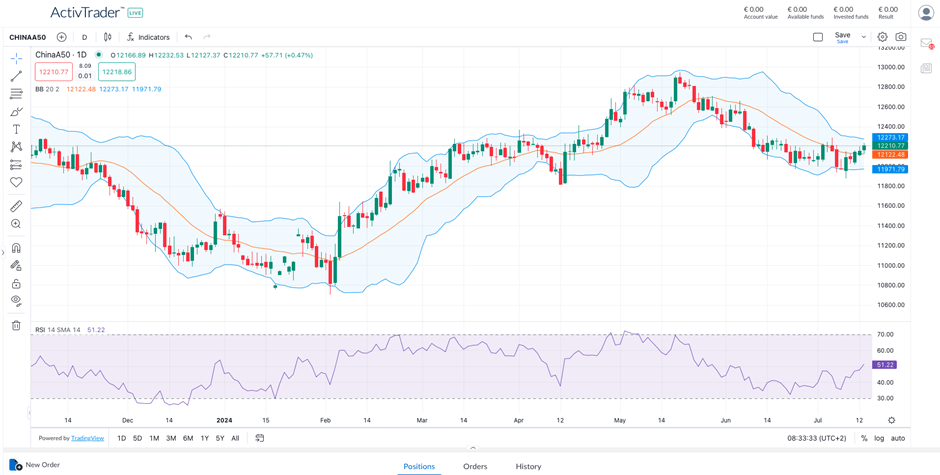

Chinese’s third plenum meeting - From Monday to Thursday

The economic data from China that was made public today was not encouraging. The country's GDP grew at its worst rate since the first quarter of 2023 in the second quarter of 2024, coming in at only 4.7% year over year. This is considerably below analyst estimates of 5.1% growth, and is also below the 5.3% increase of the prior quarter.

This significant global economy appears to be slowing down for a number of reasons. Consumer confidence has been weakened as a result of the real estate industry's struggles and the stock market's downturn. People are cutting back on discretionary spending and tightening their belts due to worries about their job security, which is further impeding economic development.

A ray of optimism, meanwhile, could appear this week when China's top officials meet for the much awaited Third Plenum, which is set for July 15–18. With a focus on "further comprehensively deepening reform and advancing Chinese modernization," this crucial gathering could assist the nation in enacting new changes that would lead to a new direction for economic growth.

Daily China50 Chart - Source: Online trading platform ActivTrader

Canadian CPI and US Retail Sales on Tuesday

Canada's inflation rate nudged upwards in May 2024, raising eyebrows among economists. Year-over-year, the Consumer Price Index (CPI) climbed to 2.9%, edging out the previous month's 2.7% increase. This uptick was primarily fueled by rising service costs. Canadians are seemingly prioritising experiences over physical goods, with notable price jumps in areas like cellular plans, travel packages, rent, and airfare.

The Bank of Canada closely monitors "core" inflation measures that exclude volatile food and energy prices. These core measures also inched upwards in May, reaching 2.9% year-over-year compared to 2.7% in April. On a three-month annualised basis, the average core inflation rate jumped from 1.6% to 2.5%.

This trend has economists and traders watching closely to determine whether it's a temporary blip or a sign of potentially more persistent inflation that could require adjustments in monetary policy. For the month of June, market participants expect the Canadian CPI to slightly slow down to 2.8% from 2.9%.

Daily USD/CAD Chart - Source: Online trading platform ActivTrader

After a downward revision to April's data indicating a 0.2% decline, May's US retail sales figures revealed pitiful growth of only 0.1%. This means that the second quarter of 2024 may have had lower economic activity than previously believed.

Although total sales increased 2.3% year over year in May 2023, experts are concerned about the slow month-to-month growth. Rising interest rates and the pressure of inflation are probably major factors driving this decline.

Because they are feeling the squeeze, many consumers are probably prioritising necessities like groceries and utilities above luxuries like gadgets or clothes, which might eventually slow down economic development. For the month of June, market participants are expecting retail sales to keep falling, dropping -0.2% over the previous month.

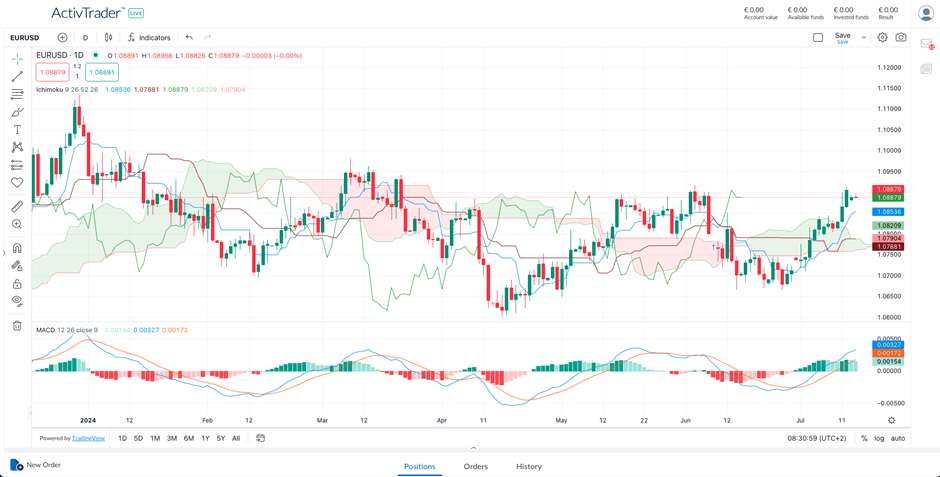

ECB meeting on Thursday

While the European Central Bank (ECB) did lower key interest rates by 0.25% in June, several policymakers expressed concerns about the Eurozone's economic recovery. The data presented at the last meeting lacked "convincing evidence" of a significant pick-up in private consumption, a crucial driver of sustained economic growth. This cast doubt on previous, more optimistic forecasts for the region's expansion. Adding to the concerns, some ECB members highlighted the uncertain trajectory of inflation.

Given these concerns, the ECB is widely expected to refrain from implementing any more rate reductions. Traders and analysts, on the other hand, continue to be interested in any signals that the ECB members could make regarding potential policy adjustments. The markets expect the European Central Bank to reduce its benchmark deposit rate by 0.25 percentage points to 3.5% in September, according to current expectations.

Daily EUR/USD Chart - Source: Online trading platform ActivTrader

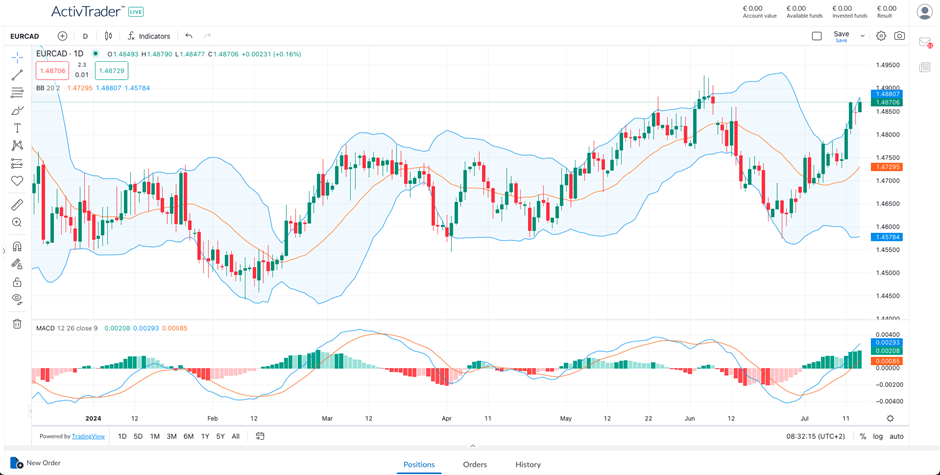

Canadian retail sales on Friday

Canada's retail sector showed some tentative signs of life in April, defying expectations of a continued slump. After three consecutive months of decline, sales rose by 0.7%, a modest increase but a welcome change nonetheless.

This comes despite a challenging economic climate for Canadian consumers. The highest interest rates in over two decades have put a strain on household budgets, leading to tighter spending habits across the board. However, economists had predicted a slight uptick in April specifically due to rising gas prices.

Looking ahead to May, the picture appears less optimistic, as market participants are anticipating a slowdown in retail sales, with projections hovering around a 0.2% decline. This could signal a return to the downward trend observed earlier in the year.

Daily EUR/CAD Chart - Source: Online trading platform ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

Stay up to date with what's moving and shaking on the world's markets and never miss another important headline again! Check ActivTrades daily news and analyses here.

Author

Carolane de Palmas

ActivTrades

Carolane graduated with a Masters in Corporate Finance & Financial Markets and got the AMF Certification (Financial Markets Regulator in France). Afterward, she became an independent trader, investing mostly in European and American stocks/indices.