Fiscal policy helping construction cut through interest rate headwinds

Prospects for the built environment

The construction sector seems to be defying restrictive monetary policy. Total construction spending ended April up 10% on a year-over-year basis. To be sure, the recent rise in financing costs and tighter lending standards have weighed on project outlays, in particular residential and commercial development. A downdraft in new project starts for these types of construction suggests a drop in activity is ahead in the near-term.

That noted, several segments of construction have performed considerably better, thanks in large part to fiscal policy. Notably, there has been a boom in manufacturing project spending directed toward the build-out of electric vehicle and semiconductor supply chains following the passage of the CHIPS and Science Act. The Inflation Reduction Act and Bipartisan Infrastructure Law have been a boon for investment in energy and infrastructure projects.

Looking ahead, the fiscal tailwinds look set to only intensify over the next few years as more funding from these federal programs is distributed. Meanwhile, the drags imposed by restrictive monetary policy should begin to fade as the Federal Reserve gradually lowers the federal funds target rate. Currently, inflation appears on the path back to 2% and, as such, the FOMC looks to be getting ready to initiate an interest rate cutting cycle at some point this fall. Although likely to remain elevated compared to recent norms, lower interest rates should ultimately lead to a stronger pace of construction.

On the surface, construction navigating higher rates relatively well

The construction sector seems to be defying restrictive monetary policy. Since early 2022, efforts from the Federal Reserve to quell inflation have resulted in the federal funds target rate increasing from essentially zero to 5.5%, with interest rates across the yield curve taking a similar trajectory. Despite interest rates remaining high, overall construction activity continues to expand at a strong rate, with total private construction spending up 10% on a year-over-year basis in April. The gain reflects broad improvements in both residential and nonresidential outlays, which were up 8.1% and 11.5% respectively.

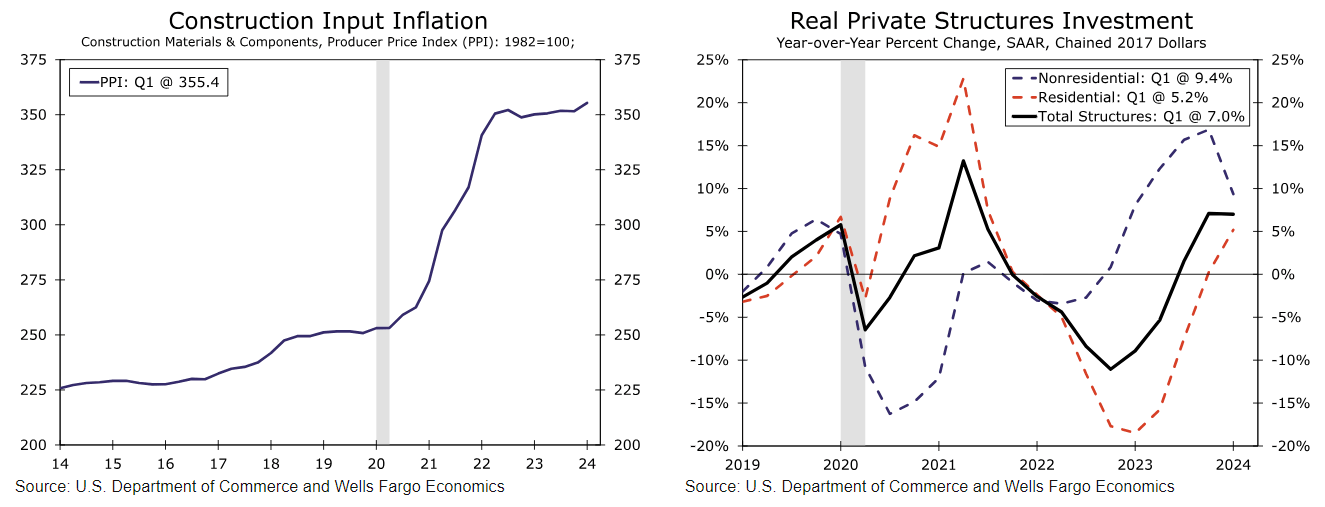

The uptrend in construction spending, which historically has been highly sensitive to interest rates, in part is explained by rising input prices. The rapid post-pandemic rise in building materials and labor costs has boosted spending in nominal terms, yet has likely overstated the increase in actual activity. As shown in the below chart, the Producer Price Index for materials and components for construction was up nearly 25% year-over-year at its recent peak in early 2022. Although the level of input prices is still up sharply from pre-pandemic levels, price growth has slowed considerably more recently (chart). Even after accounting for the up-shift in construction input prices, however, inflation-adjusted private construction spending, or "real" spending, strengthened over the course of 2023. According to the BEA, real private fixed structures investment expanded 7.0% year-over-year in Q1-2024, with nonresidential and residential up 9.4% and 5.2%, respectively (chart).

Author

Wells Fargo Research Team

Wells Fargo