Financial astrology: Should you be selling your stocks again in May? [Video]

![Financial astrology: Should you be selling your stocks again in May? [Video]](https://editorial.fxstreet.com/images/Macroeconomics/EconomicIndicator/EconomicHealth/GDP/graphs-and-charts-stock-image-gm489590395-39592386_XtraLarge.jpg)

-

MAY MARKETS

-

UP STARS/DOWN STARS

-

GOLDEN OPPORTUNITIES

-

QUOTES

-

ON THE WEB

-

LETTERS

1. May markets

SHOULD YOU BE SELLING YOUR STOCKS AGAIN IN MAY? Yes & then again No!

Markets WILL be lower in/by August but can be higher (or not) next 30-60 days. ~ 3000 SPX is a year-end target for some analysts (GS says 2400 first) so we are now watching – our original plan was to begin to protect end (not beginning) of May.

Intermediate term, the upside above SPX 3000 is limited for now. Short term a short squeeze and/or Covid-19 “miracle” is possible but long positions now sport more risk. Unlike last year, I believe it may be too early to sell but rather better to begin towards the end of May, not the beginning, to slowly protect. However a sell April 30 obviously would not have been wrong. Most consumers and businesses are in cash preservation mode. A notable exception are Vulture aka Hedge & VC Funds.

Earnings are likely to less influence markets than forward guidance and especially COVID-19 numbers. .

Going forward there is currently a better than 60% chance of a H1 2020 bottom in place.

Conversely, we are getting closer in time and price when it will again be prudent to protect & reduce portfolios.

DJIA R1 23780 R2 24K R3 25K R4 27800

Good stock picking should GREATLY outperform index investing in 2020. Money Management & Know whether investing or trading & be patient.

However by late May, our 2020 market forecast plan was to begin to protect and/or reduce Market exposure again.

For a number of reasons, (including the FOMC & Trump’s Horoscope) we saw markets stabilize in April. Given we are looking to start to protect an reduce later in May or possibly sooner, we see markets NOT V. L or U but W & with NO RUSH to buy.

SOME KNOWN UNKNOWNS:

US Politics (August - & November ?)

Oil (+ May-June)

Covid Vaccine/treatment/testing & Reopening Progress + (May-June)

Debt Defaults - (ongoing)

US GDP Slowing - (Negative Q2 2020) & High Unemployment –

Large short positions a contrarian + signal?

Stock Buybacks & Dividends reduced or dropped -

China

Assorted geopolitical hotspots (black & white swan events) -

The Good News this = Opportunity

OUR VIEWS:

There continues to be a lot of risk in the market.

The markets were overly pessimistic if you are a long term investor. Just as the markets > SP 3200 were highly excessive, so was it < 2400 or DJIA 21500.

There is NO rush to buy, but smart to slowly & selectively invest.

HOWEVER SOON IT WILL BE TIME AGAIN TO PROTECT/EXIT especially since many analysts have a ~ 3000 SPX yearend target and we more or less saw that level last week.

TRADERS SHOULD DAY TRADE OR HAVE VERY DEEP POCKETS;

Current high volatility making directional bets dangerous.

After hard rallies or market drops, it is smart to book profits.

INVESTORS REQUIRE A LONGER TERM HORIZON THAN NORMAL.

Many share buy backs reduced or eliminated is negative just as Q2 2020 GDP.

Accumulate stocks from companies that are winners from this crisis, or those that will recover first or quickly and are highly discounted.

Distinguish between companies that Benefit from current crisis: BioTechs, Home Delivery, Cleaning Services, Streaming Video services Online Education, etc. & those that have a long hard road ahead such as restaurants, cruise lines, airlines and hotels.

Additionally conservative investors may buy companies hardly effected either way such as Water Utilities and hence offer less downside risk.

Note low oil prices are a positive for consumer and many companies, but it will be a difficult year for the energy sector. Still, Oil companies may do well short term over the next 30-60 days.

AT THE RIGHT PRICE, AND RIGHT TIME FRAME THE COVID CRISIS REPRESENTS DANGER & OPPORTUNITY.

Commodity Trading Buys:

GOLD ~1550 OB (+ Astro is Fall, ++ Astro Nov/Dec) First buy 14.88 Second Buy 14.80 Sold 16.50 & 1580 Rebuy < 1580

Oil ~20 OB (but + Astro is April-June). First Buy 30 Second Buy 21 Third Buy 21.22 Fourth 12

Silver ~14 OB (but Astro is negative March/April) First long term Buy 11.80 Second buy 14-12

Copper <2.40 but is a deep pocket H2 2020 or 2021/2022 hold) Fully allocated otherwise potentially long term add 2.25 OB.

We suggest positional trading the same as when we recommended selling SPX 3050 to 3350:While we enter early and exit early, lots of profit none-the-less. We intend to slowly begin to reduce/protect/sell in late May to July.

DJIA BUYS 23185, 20000 SOLD 22400 Buy 20981, 22000 STOP 2780

SPX BUYS 2400, 2300 SOLD 2550 & 2600

NASDAQ BUY 7350, 7800 STOP 8500

The Following prices remain comfortable accumulation zones for us if/when next seen (late Summer?).

Hence additional buying will largely be either day or positional trades or undervalued special situations.

DJIA 21000-22500

NASDAQ 6800-7400

SP 2400-2600

IMHO “Improper” Valuations

COPPER < 2.40

BITCOIN > 1000

GOLD > 1550

Oil < 22

HYDE PARK SOAPBOX: Stock Market Rallied Back Too Far, and Way Too Fast

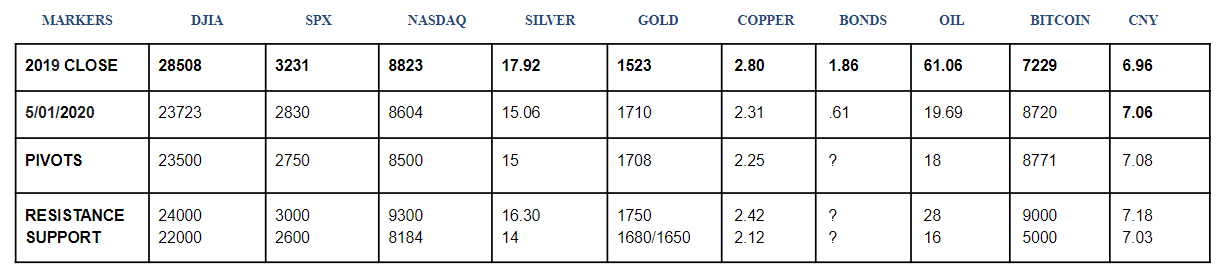

DJIA: 23000 SUPPORT? 24000 RESISTANCE?KEY DATES: May 4, 9

SPX: 2750 SUPPORT 3000 RESISTANCE

NASDAQ: 8500 PIVOT

GOLD: S1 1680 S2 1650 S3 1625 S4 1600 1800 RESISTANCE

SILVER: SLOW ACCUMULATE 14 OB

OIL: R1 20 R2 25 R3 28 R4 30

COPPER: R1 2.40 R2 2.46 R3 2.50

US 10 year: WATCH

CNY: 7.08 PIVOT

2019 CLOSE: DJIA 28508 SPX 3231 & NASDAQ 8823

2018 CLOSE: DJIA 23327 SPX 2506 & NASDAQ 6635

2017 CLOSE: DJIA 24719 SPX 2673 & NASDA 6903

2016 CLOSE: DJIA 19762 SPX 2238 & NASDAQ 5383

AFUND Fair Value: GOLD $1550.

Reduce Risk and Focus on Capital Preservation:

THINK TRADITIONAL SWISS AND PRESERVE CAPITAL: HEDGE AND PROTECT AGAINST DOWNSIDE RISK.

2. Up stars / Down stars

Dividend income is a new minefield for financial advisers

We are looking to buy ONLY special situations now as well as accumulate undervalued quality stocks for the long term while keeping plenty of powder dry for August. Choose your favorite stocks and patiently bid for them approaching 2020 lows if seen again [August?]. Use NO margin and it isn’t over the Fat lady sings.

Favorite 2020 Sectors:

Entertainment, Mining, Select Health Care (lower cost/better outcome) & Technology (Undervalued & Highly Scalable)

Stock selection is important. When possible, we prefer to recommend stocks sporting strong cash flows, sound balance sheets & growing dividends.

Active well managed portfolios can easily outperform index funds in 2020.

3. Golden opportunities

Be-prepared-for-major-correction-in-gold-price-in-the-coming-months-says-analyst.

There have been and will again be so many good buys in the precious metal space depending on your time frame and risk/reward desires.

Do review past WSNW for many good ideas that should be quite profitable this coming Fall/Winter.

We are positioned a second Silver buy circa 14 OB

Copper remains highly undervalued. It was a pawn of the US/China trade spat, while now Chinese coronavirus is hugely hurting sentiment. Short term is mixed to bearish, but longer term this remains a “deep pockets” BIG win.

Gold: Fundamentally there is short term decrease in mine supply COUPLED with increasing investor interest. We note gold is generally under highly favorable astrological influences later in Q3 & Q4.

Gold bugs are also happy now that more generalist investors are beginning to join the party: In addition, several major brokerage houses have $2000+ price targets. These views now seem achievable!

We believe gold valuations will largely sport at or above Fair Value in this Year of the White Metal Rat (2020).

Just as it was undervalued for a long time, it CAN and is likely to be overvalued for a LONG time. While fundamentally gold is currently overvalued, in much of the Fall, the astro is positive for gold hence we maintain a full portfolio allocation.

We advise precious metal investors to pay attention to stock selection but only selectively add before Q3 2020.

Gold remains cheap geopolitical crisis insurance.

For investors who cannot or will not buy the $US currency as well as investors who wish to safely and cheaply hedge their US$ exposure, ONLY GOLD IS AS GOOD AS GOLD!

Previously some investors were hedging record equity prices by buying gold. They were not unhappy until recently. Currently it is no longer an active factor.

Gold FV $1550= Commodity FV: 1468 + Currency FV: 1584 + Inflation Metal FV: 1410 + Crisis FV: 1738.

INVESTORS: We plan to stay LONG in 2020 (recommending a precious metal sector buy/hold rating and occasional hedging, selling or profit taking).

We will be happy to reBUY Gold cheaper ideally < 1550 & Silver at that time (14 OB) in Q2 2020.

4. Quotes

“Even if March 23 turns out to be the ultimate low (and it does look like it) that does not mean the next six months or more are going to be pure rally to new highs. In fact new highs are not likely for quite some time and we will likely retest the lows.”

Jeff Hirsch, editor, Stock Trader’s Almanac

HW: That is a common view among many experienced market professionals.

“Now we’re looking at a very deep recession in 2020 (and) into 2021 a recovery, and then another recession still in 2023 to 2025.”

Jeffrey Christian, managing partner, CPM Group

HW: Cheery thoughts.

“This is what you expect at the beginning of a rally. We’re getting better news on getting back to a more normal economic environment, and thinking that in the third and fourth quarter U.S. GDP will start to accelerate.”

Steven DeSanctis, equity analyst, Jefferies

HW: A lot of wall streeters are bullish intermediate term.

5. On the web

expert-who-called-the-2008-crisis-says-the-signal-to-sell-stocks-is-coming-soon

dont-be-fooled-a-40-drop-could-hit-by-next-year-after-this-bear-market-rally-fades-veteran-economist-warns-2020-04-30

why-the-march-low-for-the-stock-market-may-hold-even-though-another-test-may-come

6. Letters

READER: I do not agree with you. Regret. ^DJIA, S & P 500 and NASDAQ COMP will not re-test their highs of Jan / Feb 2020. In fact these indices will re-test their March 2020 lows within June 2020.

HW: I did not say they would retest their highs (although a others say that)

Any down test more likely later in the summer- August (July), but not sure that low again pre US election.

Author

Henry Weingarten

The Astrologers Fund

Henry Weingarten, was the founder of the NEW YORK SCHOOL OF ASTROLOGY and the NY ASTROLOGY CENTER and has been a professional astrologer for over forty years.