Fed’s jumbo rate cut: Short-term Goldilocks, long-term volatility

Key points

-

Fed cuts 50bps: The Fed’s 50bps rate cut, reducing the target to 4.75-5.00%, was more aggressive than anticipated. The new dot plot suggests further cuts, with a 2024 median rate forecast of 4.4% signalling another 50bps of rate cuts this year.

-

Policy uncertainty: The dissenting vote split and Fed Chair Powell’s press conference took away some of the dovish implications, leaving the market guessing the Fed’s next steps.

-

Goldilocks for risk assets: Given the jumbo rate cut comes despite Fed’s positive view on the US economy, this creates a Goldilocks environment that can be favorable for risk assets.

-

Long term volatility: Lack of forward guidance or the unreliability of the Fed’s dot plot suggests that economic data remains in the driving seat and markets could face bouts of volatility.

The Federal Reserve surprised markets with a 50bps rate cut, bringing the federal funds rate target to 4.75-5.00%. This decision was dovish vs. expectations, as markets had only priced in a 60% chance of a bigger rate cut.

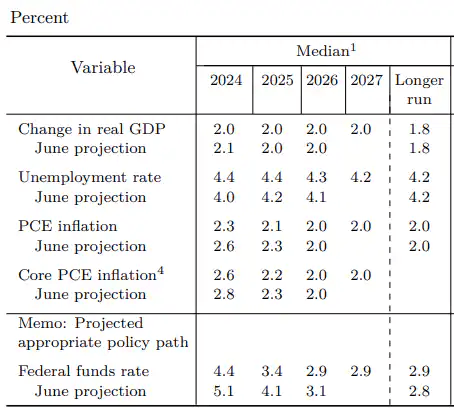

The revised dot plot now suggests the median rate forecast for 2024 at 4.4%, down from 5.1% in June, signaling another 50bps of easing ahead. Additionally, 100bps of cuts are projected for 2025, while the long-term neutral rate estimate has been raised slightly to 2.875%.

Fed's September Dot Plot. Source: Federal Reserve, Bloomberg

Below are some key takeaways from the FOMC announcement and what it can mean for your portfolios

Economics uncertainty drives policy uncertainty

Fed Chair Jerome Powell used the press conference to emphasize that the Fed is not on a pre-set path and warned against assuming that the current pace of rate cuts will continue. He reiterated that decisions will be made on a meeting-by-meeting basis, allowing the Fed to move quicker, slower, or even pause if necessary. Importantly, Powell remained optimistic about the economy, despite signs of a loosening labor market, making it clear that the larger rate cut comes from a position of strength, not weakness.

Mixed economic signals have made policymaking more challenging, as the Fed balances competing forces. The decision to cut rates despite Q3 GDP growth still looking strong underscores rising economic uncertainty and reinforces the "two-lane economy" narrative. Some sectors remain resilient, while others are struggling under the weight of high interest rates.

This ambiguity was also reflected in the FOMC's split vote, with Governor Michelle Bowman dissenting in favor of a smaller 25bps cut. Bowman's dissent marks the first by a Fed Governor since 2005, highlighting the complexities of post-pandemic policymaking and the increasing likelihood of a more fractured Fed committee in the future.

Soft landing focus is a Goldilocks for risk assets

The Fed’s jumbo rate cut clearly signals its intention to support the U.S. economy and guide it towards a soft landing, where inflation is brought under control without triggering a recession. Powell reiterated that rate cuts are not a sign of economic weakness but rather a carefully calibrated approach to maintain growth while managing inflationary pressures.

Source: Federal Reserve

This balancing act is a Goldilocks scenario for risk assets—rate cuts provide support for growth, while the absence of a severe recession keeps risk appetite alive. For investors, this means the current environment could remain favorable for equities and other risk-on assets, as the Fed continues to walk the fine line between supporting the economy and managing inflation.

Lack of forward guidance will mean market volatility

The Fed’s focus on achieving a soft landing, combined with its revised neutral rate expectations, has added more uncertainty to the markets. A key reason is the lack of clear forward guidance from Chair Powell. This meeting marked the first time in years where the market was uncertain whether the Fed would opt for a 25bps or 50bps rate cut. Additionally, the dot plot is losing its significance. Earlier this year, the median projection suggested three rate cuts for 2024, but by June, it had shifted to just one 25bps cut. Yet, within six weeks, the Fed not only delivered a 50bps cut but also projected another 50bps of easing by year-end.

This shift, along with the growing dispersion among FOMC members' forecasts, emphasizes the need for markets to brace for more uncertainty. Although the Fed's direction is clear, the pace of future cuts will be heavily influenced by upcoming economic data. Persistent recession risks, combined with the looming U.S. elections, signal that heightened volatility could persist in the months ahead.

Impact on the US Dollar

The U.S. dollar has traded on the weaker side throughout Q3, largely in anticipation of the Fed's rate cuts. However, the narrative of U.S. economic exceptionalism remains intact, a point emphasized by Fed Chair Jerome Powell’s remarks on the economy's resilience. While the "Dollar Smile" theory suggests the dollar could weaken in a soft-landing scenario, this would require other major economies to outperform the U.S.—a condition that currently seems unlikely. The Eurozone, China, and even Canada (now facing deflation) are showing no signs of eclipsing U.S. economic strength, despite some slowing in American growth.

That said, the dollar's trajectory remains data-dependent. Periods of weakness are possible if certain parts of the U.S. economy falter, but a sustained, structural selloff seems improbable. In fact, a broader global slowdown could bolster the dollar via haven demand. Moreover, upcoming U.S. elections could add volatility, with fiscal policy, tariffs, and geopolitical risks all influencing the currency’s direction. At this stage, the risk-reward remains tilted in favor of dollar strength rather than weakness and the outlook is balanced.

Read the original analysis: Fed’s jumbo rate cut: Short-term Goldilocks, long-term volatility

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.