Federal Reserve tapers, Treasury rates rise and markets yawn

- Fed bond buying reduced $15 billion in November, monthly thereafter.

- US monetary policy begins withdrawal from emergency economic support.

- Markets barely stir after the Fed’s six-month communication effort.

The Fed has to be well pleased with Wednesday's market reaction to its taper announcement. Without being facetious, the market whimpered, there was no tantrum.

Bond purchases will be reduced by $15 billion a month starting in November. A monthly reduction is anticipated by the Federal Open Market Committee (FOMC) but subject to economic conditions. The amount and schedule were exactly as expected.

In response, the dollar lost a bit, Treasury rates rose a few points and equities climbed modestly.

The Fed has been preparing markets for this eventuality for six months since introducing the topic in the minutes of the April FOMC meeting released on May 19. Federal Reserve Chair Jerome Powell confirmed that the policy change was coming on October 22 when he said, "I do think it's time to taper; I don't think it's time to raise rates.”

Inflation was again referred to as transitory in the accompanying statement but a small change in wording was emblematic of the Fed’s waning confidence that its prognosis is correct.

FOMC statement

The long awaited withdrawal from the emergency $120 billion a month in credit market purchases will begin with a $10 billion reduction in Treasuries and a $5 billion cut in mortgage back securities (MBS). November purchases will drop to $70 billion in government paper and $35 billion in MBS followed by $60 billion and $30 billion in December. A $15 billion cut each month would take until June to eliminate the program.

“The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook,” noted the FOMC statement.

Inflation has become the Fed’s main concern over the past several months as consumer prices have soared at rates not seen in a generation. The Fed’s confidence prediction in the first and second quarters that the increases would prove temporary and ebb as soon as the base effect from last year’s lockdown passed and the supply shortages eased, has given way to a worrying notion that the economic dislocations are far more serious than the committee anticipated.

A small change in the wording around inflation highlights the Fed’s rising concern over prices. In September the FOMC statement said, “Inflation is elevated, largely reflecting transitory factors.”

Wednesday’s description was, “Inflation is elevated, largely reflecting factors that are expected to be transitory.” (my italics)

September’s FOMC version is a factual assertion; November’s is conditional. The Fed is no longer sure.

Powell press conference

Inflation was the main topic of the hour-long press conference the Fed chief holds after every FOMC meeting.

Core PCE prices have more than doubled from 1.5% since January. The 3.6% average from June to September is the highest in 30 years.

Core PCE Price Index

When questioned whether Fed policy is sufficient, Mr Powell said,“I don’t think that we’re behind the curve. I actually believe that policy is well-positioned to address the range of plausible outcomes, and that’s what we need to do.”

He noted, though, that the current level of inflation is clearly not consistent with the bank’s mandate for price stability.

On the topic of the labor market recovery Mr. Powell noted that there is “still ground to cover” before the economy reaches “maximum employment.”

Mr. Powell took pains to clarify the use of ‘transitory’ in describing inflation. In general usage transitory means brief or quickly passing. That is not the Fed meaning.

“Transitory is a word that has had different understandings,” observed Mr Powell. “For some, it carries a sense of short-lived. There’s a real time component, measured in months, let’s say. Really for us, what transitory has meant is that if something is transitory it will not leave behind permanently – or very persistently higher – inflation. So that’s why we took a step back from transitory. We said ‘expected to be transitory.”

What the Fed means is that rising prices are not permanent. Whether that is what the Fed meant when it first used the term is open to questoin.

Market response

Treasury rates rose with the 30-year bond leading the way adding 7 basis points to 2.025%. The 10-year yield gained 6 points to 1.602%. The 10-year is 14 points below its high for the year of 1.746% on March 31. The long bond is almost half-a-percent, 47 points, beneath its March 18 top of 2.476%.

Equites rose modest amounts with the S&P 500 and Dow reaching new closing records. The Dow rose 104.95 points, 0.29% to 36,157.58. The S&P 500 added 29.92 points, 0.65% to 4.660.57.

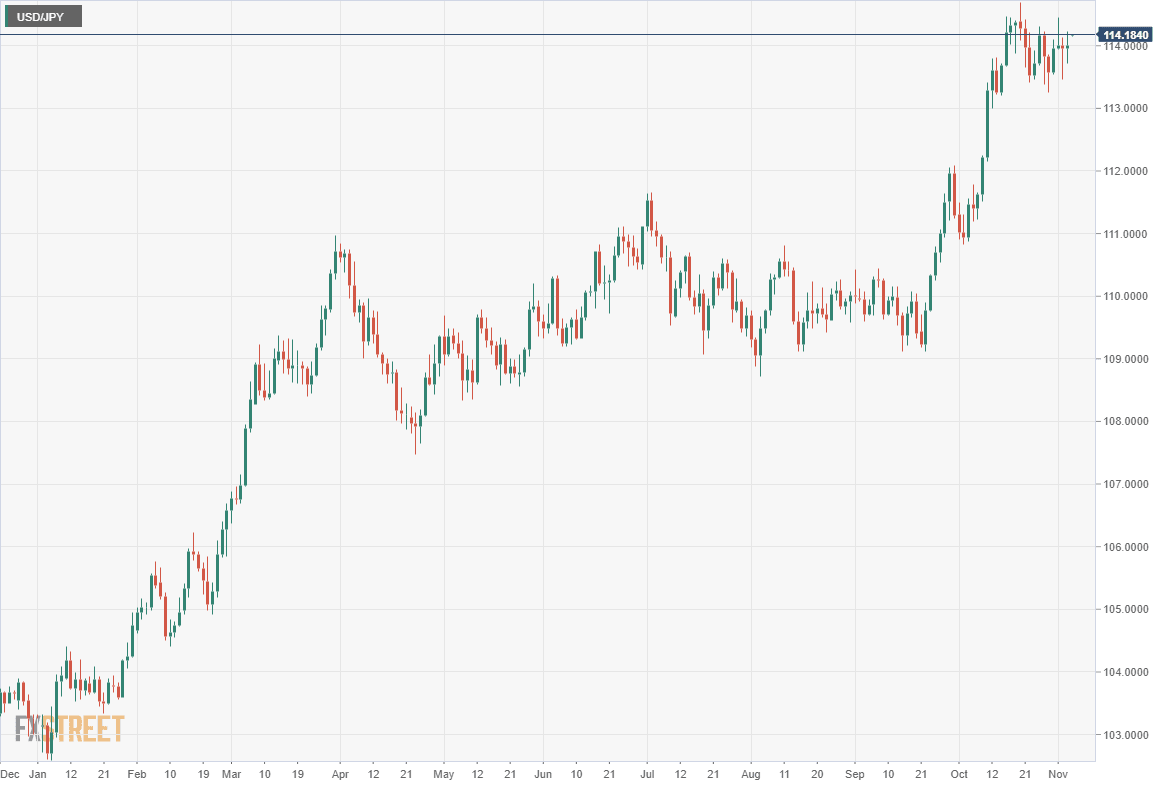

The dollar was a minor loser Wednesday in all the major pairs except the USD/JPY where it gained 4 points to 114.00. The greenback shed 33 points versus the euro to a 1.1612 close and 74 points against the sterling finishing at 1.3686.

At one point during Mr. Powell’s press conference, a discussion of US economics problems caused a sharp 45 point surge to a high of 1.1616, not by coincidence nearly the close for the day.

Fed funds futures were unmoved after the taper announcement. The first rate hike is expected at the June 15 meeting next year with a second in November.

CBOE

Conclusions: A rate hike by any other name

Mr. Powell has repeatedly stated that tapering and eventually ending the bank’s bond program is not a rate hike, nor does it imply that one is near.

In the strict sense of the fed funds rate he is correct.The FOMC has not begun to debate a move beyond the current 0.25% upper target.

By every market definition, however, the rate increases have already begun. The 10-year yield is 28 basis points higher than it was at the open of the last FOMC meeting on September 22. The 30-year at 2.03% is 18 points to the good.

The dollar has generally paced Treasury yields with the largest gains against the yen. Japanese Government Bond (JGB) rates have been stationary as the newly elected government of Fumio Kishida prepares yet another fiscal and monetary package.

Treasury yields could potentially go much higher. The five-year range on the long bond is between 2.5% and 3.0%. The 20-year range stretches to 5% and higher. For the 10-year Treasury note the five -year spread is 2% to 3% and the two-decade run also heads toward 5%.

10-year Treasury yield

CNBC

The historical decline in interest rates over the past generation has been a worldwide phenomenon predicated on the steady drop in inflation. The two trends are intertwined and mutually dependent. If the long subsidence of price increases is over, the yield curve is sure to tilt higher.

The Fed is betting that the US economy is strong enough to tolerate higher rates. Where the Fed leads other central banks will follow.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

%2030%20min-637715911745866342.png&w=1536&q=95)