Federal Reserve: Shift in focus

US growth has clearly moderated in the first half of the year and the latest data for the Federal Reserve’s preferred inflation metric (core personal consumption expenditures inflation) have been welcomed by the Fed and financial markets. The latter are now pricing in a high likelihood of a first rate cut in September. Faced with a still low but rising unemployment rate, the focus of the Federal Reserve is shifting. From exclusively looking at inflation, economic activity and employment also start to matter now, even more so considering the latest progress in terms of disinflation.

The latest issue of the Federal Reserve Bank of Richmond’s National Economic Indicators -a weekly chart book providing a comprehensive overview of how the US economy is doing-, shows an economy that is clearly losing steam1 . Looking at the trend in recent months, there is a slowdown in retail sales, real disposable income, home sales, housing starts and building permits. In June the Institute for Supply Management survey was basically stable for manufacturing (48.5 versus 48.7 in May), remaining in contraction territory, but the non-manufacturing index recorded a huge drop, from 53.8 to 48.8, on the back of a significant worsening of incoming orders. The level of manufacturers’ new orders has been without any clear direction since the beginning of 2022 and this also applies to core capital goods -i.e. nondefense capital goods excluding aircraft-, which doesn’t bode well for corporate investment. Investment in intellectual property remains an exception and has seen accelerating growth in recent quarters. The business inventory/ sales ratio continues to rise in the retail sector, although it remains well below the pre-Covid levels. The monthly pace of job creations remains healthy -an average of 220.000 new jobs per month since the start of the year- but the pace is slowing. The job openings rate has dropped from an exceptionally high level – despite its decline it is still close to the pre-Covid high that was reached in 2018-, and the hiring rate and quits rate are on a downward path, reaching a level below that seen before the start of the recession in December 2007. Finally, the unemployment rate has been moving higher in recent months, reaching 4.1% in June, which admittedly is still a low level.

The Federal Reserve Bank of Atlanta’s GDPNow indicator -a real-time estimate of real GDP growth based on available economic data-, helps to see the forest for the trees. For the second quarter, it points to a seasonally adjusted annualised growth rate of 2.0% versus the previous quarter. This number had declined in recent weeks to 1.5%, especially on the back of the ISM data published at the beginning of June and July, before rebounding following the latest labour market report. In his testimony before the US Senate, Jerome Powell sounded confident is his summary of recent cyclical developments.

“Recent indicators suggest that the U.S. economy continues to expand at a solid pace. Gross domestic product growth appears to have moderated in the first half of this year”, adding that the labour market remains strong but no longer overheated2. Importantly, in terms of inflation, “more good data would strengthen our confidence that inflation is moving sustainably toward 2 percent.” The use of the word ‘good’ was undoubtedly inspired by core personal consumption expenditures inflation, the Federal Reserve’s preferred metric, which in May came in at 2.6% year over year and 1.0% annualised versus the month before.

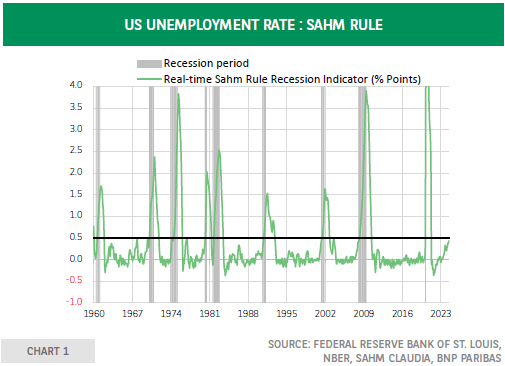

Fixed income markets have obviously reacted to these developments. The 2-year Treasury yield, which is very sensitive to expectations about monetary policy, has dropped about 35 basis points since the end of May and federal funds futures contracts are now pricing in a 75% probability of a rate cut at the September FOMC meeting3. Probably, investors think that further progress in terms if disinflation will push the Federal Reserve to start cutting rates to avoid keeping rates high for too long. In this respect, the rise in the unemployment rate needs to be closely monitored keeping in mind the ‘Sahm rule’. The Sahm recession indicator “signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months.4” Chart 1 illustrates this relationship and shows that we are getting close to the critical level of 0.5. Breaching this level would fuel concerns about mounting recession risk. Against this background, the words of Jerome Powell during his testimony show that the Fed’s focus is shifting, and that greater emphasis is put on risk management: “Elevated inflation is not the only risk we face. Reducing policy restraint too late or too little could unduly weaken economic activity and employment.”

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.