Federal Reserve rate cycle to begin in March, markets reverse on warning

- Federal Reserve statement and Chair Jerome Powell indicate a March liftoff for rates.

- Bond purchases to end in March as scheduled, Fed issues guidelines for reducing balance sheet.

- Powell comments on rates and the balance sheet send Treasury rates higher and scrub equity gains.

- Asian equities continue Wall Street losses, Dow futures drop 380 points as markets address Fed policy.

The Federal Reserve kept its rate policy on schedule, indicating in its statement and Chair Jerome Powell’s press conference that it will raise the fed funds rate at the March meeting for the first time in three years.

In doing so the governors refused to be distracted by January’s turbulent equity correction or preliminary signs that the US economy may be slowing, preferring their new focus on inflation. (US Fourth Quarter GDP Preview: What have you done for me lately?)

“With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate,” said the Federal Open Market Committee (FOMC) statement.

The bond buying program will end as previously set in March, with a reduction of the $9 trillion balance sheet to begin at an undetermined point after. The Fed also released a "Statement on Longer-Run Goals and Monetary Policy Strategy Principals for Reducing the Size of the Federal Reserve's Balance Sheet" that laid out the logic and purpose of the bank's asset portfolio.

A tightening cycle beginning in March had been widely expected for several months and market response was minimal with the major equity averages higher by substantial amounts and Treasury yields stable after the 2 pm announcement. A 0.25% rise in March would be the first increase since December 2018.

Powell press conference

Markets lost their sanguine view of Fed policy once Chairman Jerome Powell’s press conference started.

“I think there’s quite a bit of room to raise interest rates without threatening the labor market.” “Both sides of our mandate [inflation and employment] are leading us to move away from the highly accommodative monetary conditions needed in the pandemic.” “The balance sheet is substantially larger than it needs to be.” The committee is “of a mind” to raise rates in March, were some of Mr. Powell’s comments that sent equities spinning lower and left the short end of the Treasury curve at pandemic highs.

From a 2.2% gain before Mr. Powell began answering questions, the S&P 500 closed down 0.15% at 4,349.93. The Dow had been ahead 1.5% at 34,815.82, but finished off 129.64 points, 0.38% at 34,168.08. The NASDAQ composite shed its 3.4%, 463.36 point gain to conclude flat at 13,542.12, up 2.82 points.

Dow

CNBC

Treasury yields saw the reverse movement. The 2-year yield added 16 basis points to 1.186% and the 5-year return rose 12 points to 1.688%, both pandemic highs. The commercial benchmark 10-year Treasury interest rate climbed 7 points to 1.855%, just below the 1.868% two-year high set on January 18. The 30-year bond yield added 2 points to 2.153% and alone remains well below its March 2021 high close at 2.476%.

2-year Treasury yield

CNBC

Inflation has continued to worsen, admitted Mr. Powell, and the Fed's response will require higher rates.

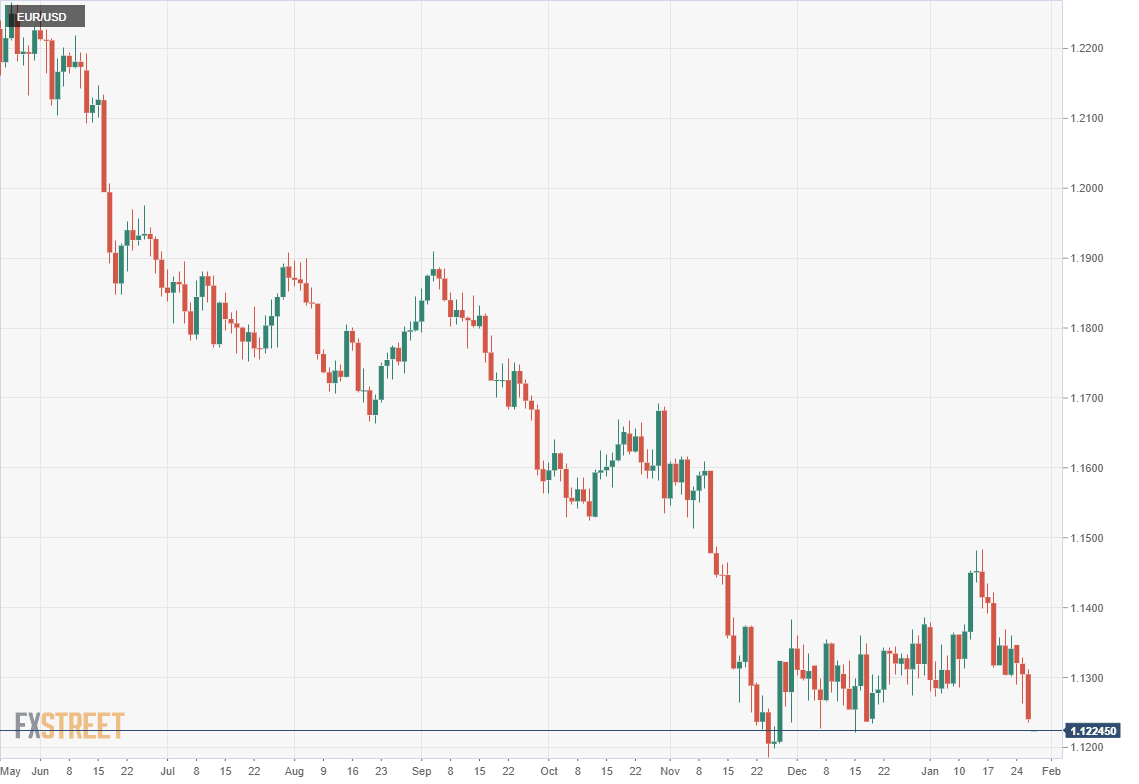

The dollar fared well in the hectic trading during the hour-long press conference. The greenback rose in every major pair, closing versus the euro at 1.1240, its best level since December 17.

Asian equity markets continued the US losses with the Nikkei dropping 2.55% in Tokyo morning trading, the Hang Seng down 2.26% and the Shanghai Composite off 0.59%.

Conclusion: Consider this a warning

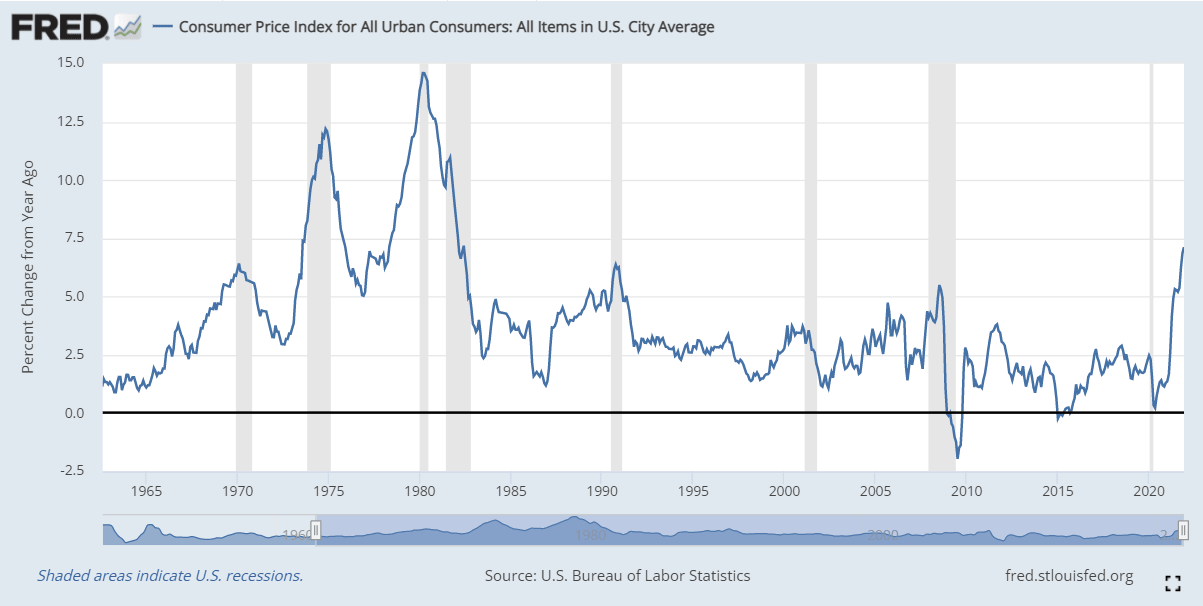

Fed policy is facing the fastest inflation rate in nearly 40 years with the Consumer Price Index (CPI) at 7% in December and the Personal Consumption Expenditure (PCE) Price Index at 4.7% in November.

It is the economic situation, strong growth, 5.4% annualized GDP is expected in the fourth quarter, coupled to a tight labor market and exceptionally high inflation that has dictated Fed policy.

Though Chairman Powell was decidedly more hawkish than markets anticipated, the weight of his comments stemmed from the focus of the press questions, which were heavily skewed to inflation, interest rate and balance sheet topics.

Repetition forced Mr. Powell to address these issues time and again. That made it seem as if the Chairman was determined to drive the points home to the reporters and markets.

But the stress on inflation came from economic reality that has constrained the Fed to determining when and how much to raise interest rates, not whether higher rates are the correct policy.

Absent an unforeseen US economic collapse, interest rates will probably move higher more quickly than markets expected before Powell's comments.

This evolving economic reality has not been fully priced in credit, equity or currency markets.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.