Federal Reserve Preview: Powell can play three distinct cards, each with a different US Dollar move

- The Federal Reserve is widely expected to raise rates by 25 bps in July after pausing in June.

- Investors will eye how Fed Chair Jerome Powell is willing to further increase borrowing costs.

- Openness to another hike in September is the US Dollar positive outcome, while a quiet end to tightening is a negative one.

A hike now, but then what? That is the question awaiting markets and the Federal Reserve. The world's most powerful central bank succeeded in preventing runaway inflation, but "the last mile" of bringing price rises down to 2% is the trickiest one, with contradicting economic signs causing confusion. That means high volatility.

Here is a preview of the Fed decision due on July 26 at 18:00 GMT, with three scenarios for the US Dollar, stocks and Gold.

The Fed faces falling inflation, a robust labor market and more confusion

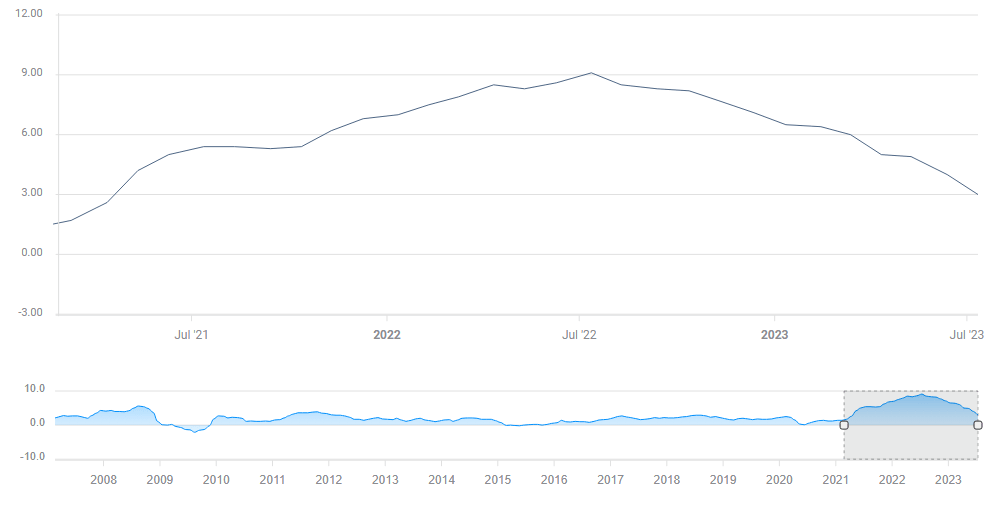

The Federal Reserve has two mandates: price stability and full employment. The bank has been focusing on the first, inflation, which began lifting its ugly head in 2021 and hit a peak of 9.1% YoY in June 2022. The Fed succeeded, pushing headline price rises down to 3% in June 2023.

US CPI growth. Source: FXStreet

The Fed focuses on core inflation, which excludes prices of volatile energy and food prices/costs set on global markets, and are harder to influence. Also on this front, the bank can tap on its back with a sense of achievement – the Core Consumer Price Index (Core CPI) rate fell from 6.6% to 4.8% YoY in June.

However, the bank's goal is to reach an underlying inflation rate of 2%. Is it heading there? While goods prices are down and the cooling of the housing market is set to reach official data, officials remain worried about labor-related inflation.

Costs of services, which depend on people, are still advancing steadily, indicating that inflation is sticky. Wages are driven by the labor market, which has yet significantly to cool down. While Nonfarm Payrolls missed expectations in June – the first after 14 consecutive positive surprises – job growth of over 200,000 per month is substantial.

Moreover, the trend of gradually rising weekly jobless claims – an early sign of changing trends – has reversed. These have dropped to 228,000 from a peak of 265,000.

Initial Jobless Claims data. Source: FXStreet

While the Fed's second mandate is full employment, it accepts risking a less buoyant labor market to see the inflation genie returning to its bottle. That is the reason to raise rates again to a higher range of 5.25-5.50%, which is fully priced in.

The Federal Reserve's complex calculations

What is next? Monetary policy takes time to impact the real economy, especially the labor market, which is considered a lagging economic indicator. Is pushing inflation another 1% down worth a big increase in unemployment next year? Or will signal the end of rate hikes re-heat the economy, unleashing inflation?

Markets expect this hike to be the last, with rates remaining at 5.25-5.50% by year-end.

Source: CME

Before I reach the three potential indicators the Fed can produce, I want to stress several additional factors.

The US manufacturing sector is suffering contraction, according to Purchasing Managers' Indicators (PMIs) and in line with the global trend. The post-pandemic recovery pushed consumers from goods to services. Does the industrial sector's weakness point to ending further tightening? Not so fast.

Ground has been broken for many new factories focused on green energy and infrastructure, resulting from several government bills. Economists foresee a manufacturing boom in 2024. How significant will it be? That is one open question.

The Fed also needs to look beyond America's shores. Economies in Europe are struggling – higher interest rates, the impact of Russia's war in Ukraine and other factors imply lower demand.

But what about China? The world's second-largest economy trades massively with the US, despite tensions. Beijing has shown signs of supporting the economy, which is struggling to bounce from the covid era. Stimulus is on the cards and seems possible as Chinese inflation is lower.

The Asian giant is also grappling with elevated private debt and a growing need for control – curbing its potential for expansion.

All in all, there is a high level of uncertainty – both for the Fed and markets – implying high volatility in any of the following scenarios.

Three scenarios

I want to stress that a 25 bps hike is fully priced in, and will not have an impact on markets. Investors are laser-focused on hints about the next moves. The Fed does not publish new forecasts at this meeting, letting the statement talk first. Then, Fed Chair Powell will take the stage, answering questions and triggering the lion's share of volatility.

1) Powell hints at more hikes, but not imminently: The Fed's latest projections of interest rates from June indicated two more hikes this year, a hawkish move that accompanied its decision to leave borrowing costs unchanged in June.

He may stick to this intention, saying another hike is likely to come, but without a sense of urgency. Such a balance would imply another pause in September and then a final move in November. The bank gradually decreased its pace of hikes from 75 bps to 50 bps, then 25 bps, and then moving at every other meeting.

Therefore, such a tapering down would make sense. This is my baseline scenario, with a high probability.

In such a case, I expect the US Dollar to rise, Gold to fall, and stocks to retreat in the initial reaction. Bond markets would need to adjust to more tightening.

However, I expect any initial move to be short-lived. There are more than three months between now and November, and the data could turn negative, diminishing the chances of another hike. Markets will likely return to shrugging off Fed hawkishness, resuming their rises. My scenario implies a buying opportunity for Gold and a selling one for the US Dollar.

2) Back to back-to-back hikes: This is not a typo and would not be greeted by markets. A return to raising rates every meeting would be hawkish and has a medium probability. If Powell says the Fed is open to raising rates as soon as September, it would serve as a bigger scare for investors, sinking stocks, melting Gold, and supercharging the US Dollar.

While there are two inflation and two jobs reports until then, it would take time for investors to smile again. Thursday's growth and jobless claims figure would need to be especially weak to see a recovery scenario, such as the previous one.

3) Wait and see: The dovish scenario has a low probability. While Powell may prefer ending the tightening cycle here and waiting to see the impact of the headwinds he unleashed, his committee is packed with hawks. Moreover, the recent strong labor market figures seem to forbid closing the door on further hikes.

Nevertheless, falling inflation and worries about global growth leave a narrow probability of Powell signaling the bar is now high for further increases. He would remain data dependent but with the burden of proof on moving to the hawks.

In such a scenario, the US Dollar would decline sharply, while Gold and stocks would party. Any hangover would have to wait.

Final thoughts

The Fed's July decision comes in the middle of a hot summer and simmering tensions in markets. Cooler inflation is unlikely to trigger a favorable scenario for markets, at least not at first.

These events are highly volatile and I urge trading with care and lower leverage.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.