Federal Reserve Interest Rate Decision Preview: Inflation, Omicron and equities

- Fed expected to reaffirm the March end of bond purchases, rate hike.

- Balance sheet disposition is of prime interest to markets.

- Equity declines reflect rising interest rates and economic concerns.

- Dollar and Treasury yields will rise if Fed accelerates rate hikes.

The Federal Reserve enters the maelstrom on Wednesday when it is expected to confirm an initial rate hike in March and to elaborate on the reduction of its vast balance sheet, a policy with more potential to derange markets than anything to date.

Since its last meeting in December when the governors terminated bond purchases this March, credit markets have moved heavily towards higher rates, pricing in four 0.25% increases this year. Signs of a first quarter economic slowdown have also emerged, complicating the Fed’s new inflation focus.

Equities have entered a violent correction with all three major indexes down sharply in the last three weeks and NASDAQ shedding 14.5% this year. Treasury yields rose steeply in the first two weeks of January, and are part of the equity story, but they have since given back about one-third of the year’s increase.

More than anything else, credit and equity markets are concerned that the Fed’s first inflation fight in four decades will escalate to a reduction in its nearly $9 trillion balance sheet, doubled in the last two years.

When the Fed begins rolling-off maturing assets or actively selling from its portfolio, the potential impact on Treasury and commercial yields is substantially greater than what credit markets have enacted so far this year.

Fed officials discussed reducing the balance sheet at the December meeting, according to the minutes, without providing any details of the procedure or timing.

The Fed has been buying $120 billion a month in Treasuries and mortgage securities since March 2020, before dropping the amount by $15 billion in November and then $30 billion in December. The program was intended to force Treasury yields and their commercial equivalents below historical limits, providing extended support for the pandemic economy. In that the governors were successful. The 10-year yield reached a record low close of 0.498% on March 9, 2020 and stayed below 1% for the next ten months.

US 10-year Treasury yield

CNBC

As the Fed reduces and ends its Treasury purchases, bond prices, which trade inversely to yields, will weaken on the bid. If the Fed begins to sell its portfolio, it will add downward pressure on bond prices and, more importantly, encourage widespread imitation as traders attempt to cut potential losses from long positions in a falling market.

With equities already in correction and the condition of the US economy becoming more frayed by the week, it seems unlikely the Fed will add to the uncertainty with an intensified rate tightening.

First, let's look at the US economic background to the Fed’s decision.

US Inflation and wages

The Consumer Price Index (CPI) has been above 5% for seven months, above 6% for the last three and at 7% in December. The last time inflation was this high was June 1982 as Paul Volker at the Federal Reserve drove the fed funds rate to 20% targeting the inflationary psychology that had built up in the economy over the previous two decades, and induced America's deepest post-war recession .

Annual gains in Average Hourly Earnings (AHE) have been trailing inflation for most of the past year. The last month when annual wage increases were higher than CPI was March 2021. In December AHE rose 4.7%. With CPI at 7%, the average wage-earner lost 2.3% in purchasing power in 2021.

Present inflation is not just a drain on household and individual budgets, it is a shock to consumers. Someone born under the previous bout of 7% inflation is now 40. No one under 60 has felt the frustrating responsibility of trying to maintain a family budget constantly eroded by rising prices.

Consumer Confidence

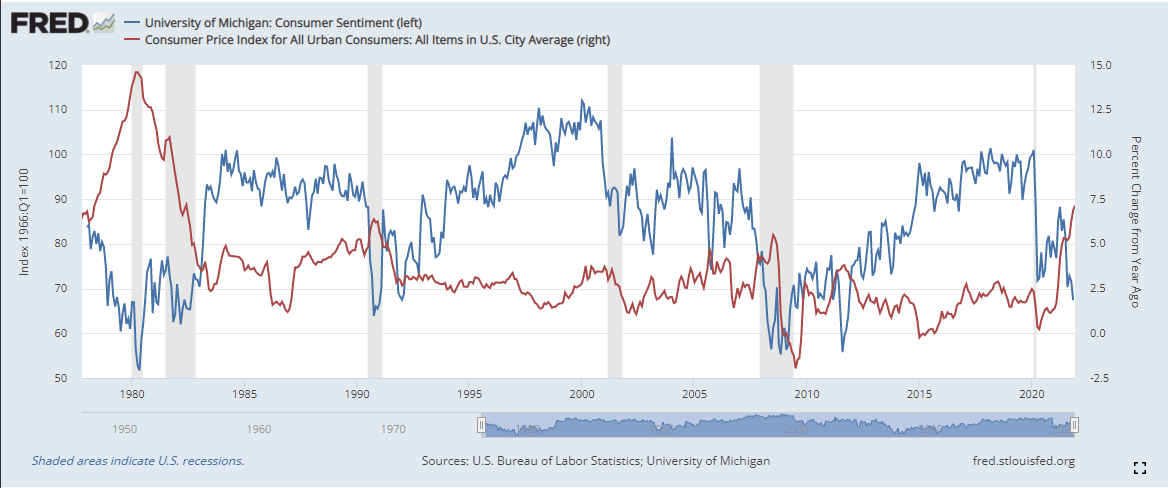

The Consumer Confidence Index from the Conference Board dropped to 113.8 in January from 115.8 in December. The Michigan Consumer Sentiment Index slipped to 68.8 in this month from 70.6. For the last six months the index has averaged 70.3 which is below the pandemic low of 71.8 in April 2020.

Inflation has had a negative correlation with consumer outlook over the last 40 years.

Retail Sales

Retail Sales held up well until the final two months of the year despite the erosion of real wages from the second quarter on. Sales increased 1.8% in October and 0.2% in November, but December’s 1.9% decline left the quarter just 0.1% higher, or 0.03% monthly.

This year's inflationary price spiral may have made more people seek out bargains in October. Or it could be normal variation in the wide range of sales results. Over the second half of the year when CPI averaged 6%, sales rose 0.12% month, which is about mid-point for results of the last two years. In 2019 sales averaged 0.45%, in 2018 they were 0.08% per month.

Initial Jobless Claims and Nonfarm Payrolls

Initial Jobless Claims are rising. Filings for unemployment insurance were 286,000 on January 14, far more than 231,000 prior week and the third increase in a row. Jobless claims have shot up 43% from 200,000 on December 24. Though they are still low by historical standards, the increases indicate that the Omicron wave has not been without economic impact.

Hiring was much weaker at the end of the year than expected despite the record number of unfilled positions. Nonfarm Payrolls added just 488,000 workers in November and December, barely half the 950,000 forecast

US economy

Fourth quarter annualized growth is expected to be 5.4% when it is released on Thursday. The Atlanta Fed GDPNow model posits 5.1%.

The question for the Federal Reserve is not the final quarter of 2021 but the direction of the economy in the first half of 2022.

Hiring slowed substantially at the end of 2021. The sharp rise in unemployment claims, bringing back the debacle of the lockdowns, has to be a concern for the governors. Retail sales were weak in the fourth quarter but the reason is elusive. Are consumers beginning to cut back on spending because inflation has straitened budgets or did the Omicron phase depress enthusiasm without reflecting an economic outlook. Consumer confidence has been mired near recession levels since mid-year but consumption has not suffered appreciably.

How much has the pandemic and the Omicron restrictions in a number of US states combined with inflation, labor and manufacturing shortages and supply chain impediments, damaged economic growth? Has the equity correction removed the final plank in the economic floor? Can US consumers continue to spend and keep the expansion afloat?

Conclusion: Federal Reserve options

Fed policy is centered on three responses to inflation: the fed funds rate, the bond program and the disposition of the balance sheet.

Current market expectations are for the Fed to keep its March bond terminus, hike rates 0.25% at that meeting and use balance sheet reductions, passive or active, as a hedge against future inflation.

A more aggressive approach would be to end the bond program on Wednesday, leaving the March hike intact and the balance sheet for future consideration. Adding a January rate hike would be a step up in action, as would the commencement of balance sheet reduction immediately.

Conclusion: Fed choice

It is probably enough that the Fed has executed a complete reversal of rate policy in six months. More surprises should not be expected. Any further tightening, an immediate end to the bond program, a rate increase or portfolio reduction would rout the bond and equity markets.

While the governors are willing to let traders and investors know where policy is headed and take the consequences, they are loath to shock markets unless the economic need is dire. This is not March 2020.

The US economy appears to be slowing. How much is uncertain. Whether it is a temporary product of the Omicron wave or more deeply sourced in the dislocations and mistakes of the last two years is unknown. The Fed still believes that inflation will moderate, though it is being much more circumspect in its predictions.

Uncertain economic conditions will keep the Fed on its chosen path. The bond program will end in March accompanied by a fed funds increase. The additional powder of the balance sheet will be kept handy and uncommitted for later use.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.