Fed vs ECB: What their rate cuts mean for EUR/USD

A tug of war of rate cut, where is the EUR/USD heading?

As the market anticipates whether the Fed will cut interest rates by 25 or 50 basis points in September, the European Central Bank (ECB) is also expected to lower rates. ECB Governing Council member François Villeroy de Galhau supports a rate cut after inflation in the eurozone fell sharply to 2.2% in August. With both the Fed and ECB likely to cut rates, the EUR/USD is expected to remain range-bound.

Impact of changes in interest rate differentials

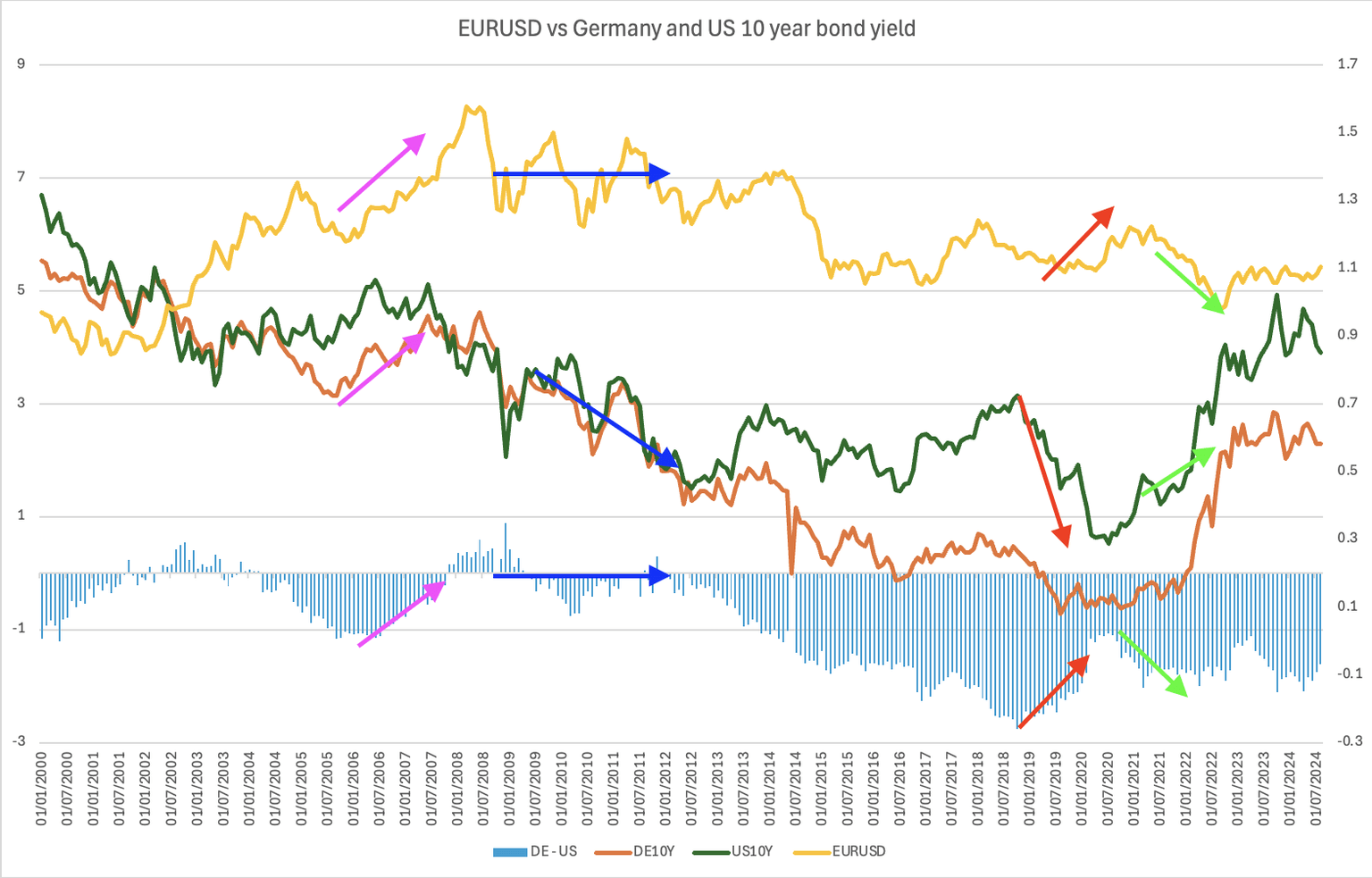

The chart shows that the EUR/USD typically follows the yield difference between the German 10-year Bund and the U.S. 10-year Treasury bond. Currently, the market expects a more aggressive rate cut from the Fed than the ECB, which has lifted the EUR/USD slightly.

Source: adopted from Reuters

JPMorgan expects the Fed to cut interest rates by 100 basis points by year-end. With only three meetings left, this would likely involve one 50-basis-point cut and two 25-basis-point cuts (source: Fortune). If inflation rises again in winter or unemployment remains stable, market sentiment regarding the Fed's rate cut path may shift.

The key question is whether the Fed or the ECB will cut interest rates faster. Currently, the U.S. interest rate minus inflation is 2.43%, while in the Eurozone, it is 2.05%. This gives the Fed more room to cut rates, which has elevated the EUR/USD as the market anticipates Fed action. Additionally, lower U.S. interest rates could reduce foreign direct investment, weakening the dollar.

Factors driving EUR/USD appreciation

Source: adopted from Reuters

Apart from the rate differential, U.S. foreign direct investment (FDI) increases when the Fed raises rates and decreases when rates are cut. As the Fed starts cutting rates, FDI usually declines, leading to initial dollar weakness. However, once the initial FDI reduction ends, FDI typically resumes, strengthening the dollar again.

Source: Adopted from Reuters

Factors causing EUR/USD depreciation

GDP forecast for 2025 Q1

Source: OECD

GDP size of European countries

Source: Country economy

The Eurozone economy is expected to slow more than the U.S. in Q1 2025, with Germany's economy contracting by 0.1% in Q2 2024, raising recession fears. Consumer confidence has dropped, investments have weakened, and the economy has significantly underperformed other major nations (source: Euronews). If the ECB cuts rates faster than the U.S., the EUR/USD is likely to depreciate.

Safe-haven behavior of the US Dollar influencing other currencies

There is ongoing talk of de-dollarisation, but the US dollar remains dominant, holding 60% of global foreign reserves, down slightly from 70% in the early 2000’s. The euro, in second place, accounts for just 20%. The US dollar's role in debt issuance has also grown, from 55% in 2005 to 65% in 2022, underscoring its importance in global finance. During crises, such as in March 2020 with COVID-19, demand for the US dollar spikes, driving the dollar index higher and other currencies lower. After the initial surge, demand eases with currency swaps, weakening the dollar and boosting EUR/USD.

Source: The Fed

Source: The Fed

Technical analysis

The EUR/USD weekly chart shows a short-term overbought condition on the stochastic indicator, suggesting an imminent possible correction. For the rally to continue, EUR/USD should stay above the 50-day moving average at 1.0860. The major resistance level is 1.11.

Source: deriv MT5

Source: deriv MT5

The DAX index is also in the overbought zone and near resistance. While a breakout is uncertain, the slowing German economy increases the risk of a correction.

Conclusion

The EUR/USD is expected to have limited upside potential despite the anticipated rate cuts by both the Fed and ECB. Economic challenges in the Eurozone and shifting market sentiment indicate the pair may remain range-bound, with minimal room for significant movement, similar to the 2009-2012 pattern.

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.