Fed set to cut rates under the shadow of US elections

-

Fed expected to cut rates for second time, overlook political risks.

-

But will it be the last cut for 2024?

-

Dovish tone and election results pose a risk for dollar bulls.

-

FOMC Decision is due at 19:00 GMT Thursday, Powell conference at 19:30 GMT.

After much back-and-forth, a 25-bps cut is a done deal

The Federal Reserve is almost certain to deliver its second rate cut of this easing cycle on Thursday, with the size of the reduction no longer in question following a string of upbeat economic indicators out of the US. A 25-basis-point cut is more than 98% priced, as investors have shifted their expectations away from large 50-bps reductions to the possibility of a pause at one of the upcoming meetings.

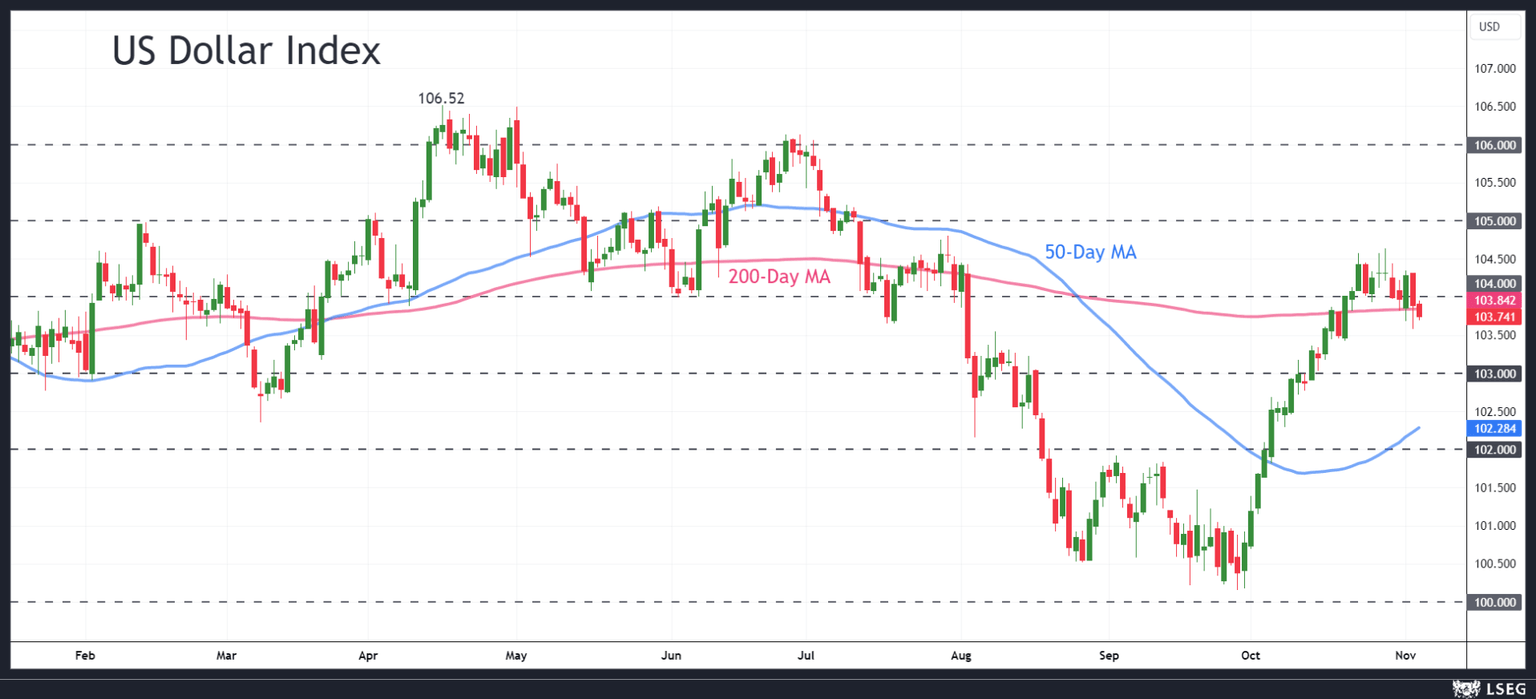

The receding expectations of aggressive easing have spurred a more than 4% rally in the US dollar, as measured by its index against a basket of six major currencies. However, Fed rate cut bets have not been the only factor pushing up the dollar.

Trump energizes Dollar bulls

Increasing odds of Donald Trump winning the presidential race on November 5 have also contributed to the greenback’s incredible bullish run during October as his policies are seen to be inflationary. The clash with the timing of the elections is why the Fed meeting is a day later than usual. However, even if the outcome of the election is known by the time FOMC members cast their own votes, it’s unlikely to influence the decision, at least not before the next president has taken office.

Hence, policymakers will be focusing on how the labour market and inflation picture have evolved since the last meeting. All indications are that the American economy remains in good shape with few signs of a severe downturn or even a slowdown. GDP grew by an annualized rate of 2.8% in Q3 and growth in the current quarter is running at 2.3% according to the Atlanta Fed’s latest GDPNow estimate.

Striking a balance

For the Fed, its primary concern has been the signs of cracks in the jobs market. July’s soft payrolls numbers that swayed the Fed towards cutting rates by 50 bps in September appeared to be a temporary weakness until the October report came along. However, the October readings were heavily affected by the impact of the hurricanes as well as the strike at aerospace giant, Boeing. More importantly, the unemployment rate held steady at 4.1%, having jumped to 4.3% in July.

Overall, though, jobs growth definitely appears to be slowing, and the Fed may need to move faster over the course of next year. But for now, policymakers have to strike a balance with still persistent price pressures. The Fed’s favourite inflation metric – the core PCE price index – was unchanged at 2.7% y/y in September, defying forecasts for a small drop. Other price gauges also support the case for caution; the ISM manufacturing prices paid index jumped from 48.3 to 54.8 in October.

Powell’s tone and election results will be crucial

All this suggests the Fed will stick to its latest messaging of gradual rate cuts going forward but Chair Jerome Powell will probably keep the door open to 50-bps moves. With no updated dot plot or economic projections at the November meeting, investors will be scrutinizing Powell’s every word in his press briefing, hoping to get some fresh hints from his views on the latest data and the state of the economy.

Unless there are any surprises, dovish or hawkish, the US dollar will possibly be driven more by the election headlines. If the early results out on Wednesday point to a Trump victory, both the dollar and Wall Street are likely to gain. But if Kamala Harris gets an early lead, the dollar would be susceptible to a selloff, while US equities will be choppy at the very least even if there is no clear reaction.

Is the Dollar set for a roller-coaster ride?

For the dollar index, another wave upwards would likely face friction at the psychological 105.00 and 106.00 levels. But in the most bearish scenario, the October upleg could be entirely reversed, with supports probably seen at 103.00 and the 50-day moving average around 102.28.

However, if it appears that it could be days or weeks before a decisive winner can be declared, market volatility is sure to spike.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl