Fed reduces overnight rate by 50 basis points

With much market chatter heading into the event about whether the US Federal Reserve (Fed) would cut rates by 25 or 50 basis points (bps), the central bank, in an 11-1 vote, cut by an outsized 50bps and signalled further easing is on the table this year (Fed Governor Michelle Bowman dissented and voted for a 25bps cut). This rate cut marks the first time since March 2020 that the central bank has reduced its overnight policy rate and brings the current rate to a target range of 4.75-5.00%.

The outsized reduction should not have raised too many eyebrows as it was largely in line with money market expectations (pricing in around a 60% probability heading into the event). The initial reaction witnessed a softer US dollar (USD), positioning the USD Index at fresh year-to-date lows below range support on the daily timeframe. US Treasury yields also traded lower, and gold (XAU/USD) caught a bid.

Rate statement and summary of economic projections

The accompanying rate statement noted that despite inflationary pressures remaining ‘somewhat elevated’, the Committee has ‘gained greater confidence’ that inflation is moving towards the Fed’s 2.0% inflation target. The statement added: ‘The risks to achieving its employment and inflation goals are roughly in balance’. The statement does not explicitly explain why the Fed opted for a 50bp cut. Still, it does add the sentence: ‘The Committee is strongly committed to supporting maximum employment’, which echoes Fed Chairman Powell’s comments in his speech at Jackson Hole last month: ‘We do not seek or welcome further cooling in labour market conditions […] We will do everything we can to support a strong labour market’.

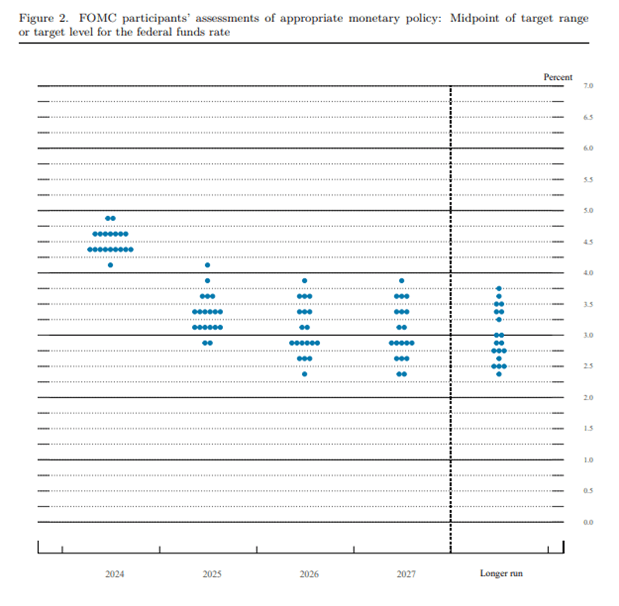

In addition, through the Fed’s Summary of Economic Projections (SEP), the ‘dot plot’ projects another 50bps of easing from the current level by the year-end. However, as of writing, money markets are not buying 50bps; investors are still leaning toward 75bps of cuts by the year-end.

According to the 2024 projections, Fed officials raised the unemployment rate to 4.4% from 4.0% in the last update in June. PCE inflation projections were lowered to 2.3% from 2.6% (previous forecast), with core PCE inflation projections reduced to 2.6% from 2.8% (previous forecast), and the change in real Gross Domestic Product (GDP) is expected to rise to 2.0% down from 2.1% (previous forecast).

You will also see that alongside Fed officials projecting 50bps of cuts this year to 4.4%, it is projected to fall another 100bps in 2025 to 3.4% and another 50bps lower in 2026 to 2.9%, now the central bank’s long-run neutral rate.

Press conference: Fed Chair Powell

Fed Chair Powell communicated that the Fed is not behind the curve, expressing that today’s move is ‘timely’. However, he added that the rate reduction is a ‘sign of our commitment not to get behind’ but emphasised not looking at the 50bp cut as the new pace.

Powell added that the Fed will continue to make decisions meeting by meeting based on the incoming data, noting that ‘it is a process of recalibrating our policy stance away from where we had it a year ago […] to a place that is more appropriate given where we are now’. He stated: ‘There is nothing in the SEP that suggests the Committee is in a rush’, but highlighted that the Fed could go as fast or slow as needed depending on how the economy evolves.

Moving forward, upcoming data will clearly be key for market participants, particularly employment numbers. Do also bear in mind that the next time Fed officials meet – 7 November – the American people will have voted for their next president.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,