Fed Preview: Three ways in which Powell could down the dollar, and none is the dot-plot

- The Federal Reserve is set to refrain from tapering bond-buying and signal a delay.

- Indicating that withdrawing stimulus would be lengthy could also weigh on the dollar.

- Fed Chair Powell may opt to stress the separation between bond-buying and rate hikes.

No taper now, but when? That is the main question investors have for the Federal Reserve in its all-important September meeting. The bank buys $120 billion worth of bonds every month and it is set to reduce the pace at some point – the first step toward raising interest rates. Timing is everything.

Downbeat data empowers doves

Back in August, Fed Chair Jerome Powell already indicated that a "Septaper" is off the agenda, citing the spread of the Delta COVID-19 variant as a critical factor. Since his August 27 speech, the bank's two mandates – employment and inflation – have softened, vindicating his dovish approach.

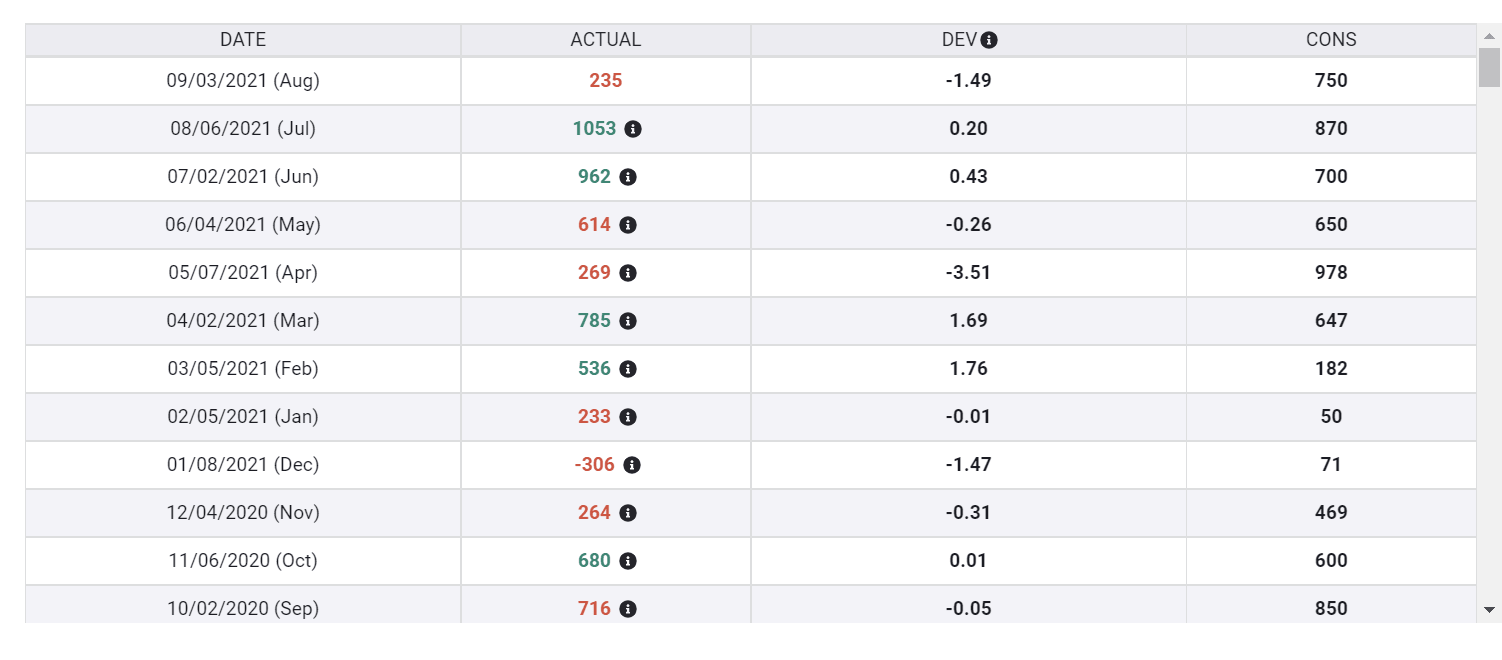

August's Nonfarm Payrolls report badly disappointed, showing an increase of only 235,000 jobs. That figure would have been satisfactory in pre-pandemic days, but it is far from reflecting a recovery that justifies any tightening.

NFP disappointment:

Source: FXStreet

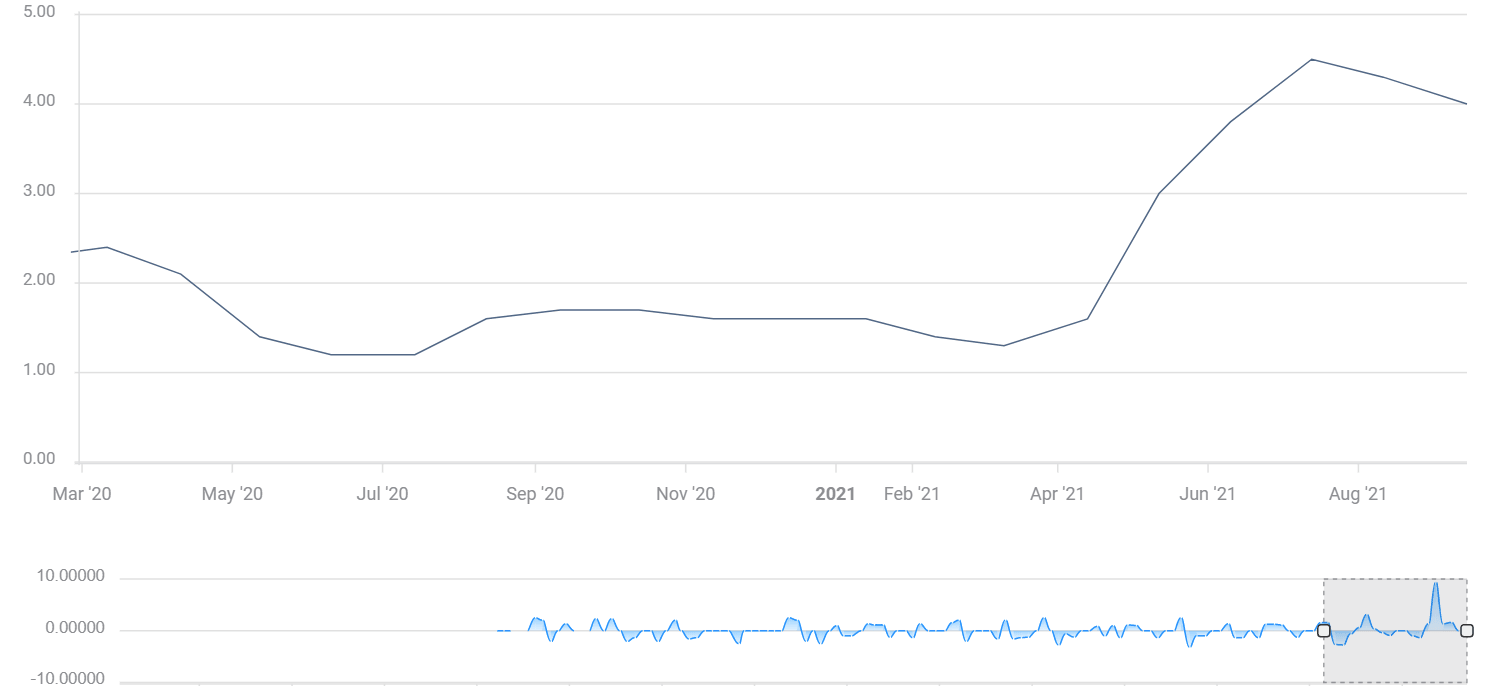

The Core Consumer Price Index (Core PCI) for last month also surprised to the downside, decelerating to 4%. That seems to vindicate Powell's insistence that inflation is transitory – the result of bottlenecks originating from the rapid reopening.

Inflation is off the highs:

Source: FXStreet

Powell more important than dot-plot

Nevertheless, while Powell is the leader, he is not alone, and hawks would like to take the pedal off the printing press. Members eligible to vote this year may dissent by voting for immediate tapering while others could opt to raise their projections for when interest rates may rise.

However, both Robert Kaplan and James Bullard – the most vocal hawks – are not voters this year. Regarding signaling rate hikes via the dot-plot, that already happened in June, and there is little chance of a repeat. Back then, the Fed shifted from signaling a rate hike in 2024 to indicating two increases in borrowing costs in 2023. Changes to growth, inflation and employment outlooks carry less weight with markets.

Overall, with the lack of a taper decision and little chances of surprises in the dot-plot, the focus is on Fed Chair Powell's words.

Here are three ways the uber-dove could down the dollar.

1) Hint toward December

As mentioned at the outset, the taper timing is critical. Will it come in the following November meeting or only in December? Powell promised to give markets a heads-up "well in advance." Does his Jackson Hole speech count as a pre-announcement? That remains unclear, and he could use the September meeting to signal that it is still "a ways off."

Powell could point to softer inflation figures and more importantly, uncertainty about the labor market. August's weak NFP, uncertainty about the virus' spread and the fact that millions of Americans have yet to return to work would fuel Powell's arguments to wait longer.

Prospects of more dollars printed would weigh on the greenback.

2) Paint-dry taper

Giving markets an advance notice could also consist of details about the pace of the Fed's tapering. How soon will the bank decelerate from $120 billion to 0? Some speculate it could take eight months, but the Fed could spread it out over a longer period of time.

Powell's predecessor at the Fed's helm, Janet Yellen, once referred to the shrinking of the Fed's balance sheet as "watching paint dry" – a boring process. By signaling it could take ten or even 12 months, Powell would further soothe markets.

3) Delink rate hikes from tapering

Markets are not only worried by the slower pace of dollar creation but about what comes afterward – rate hikes. When borrowing costs rise, investing in stocks becomes less attractive and the dollar rises. Stopping to expand the Fed's balance sheet would be followed by a hike, but there is a gap between the two events.

Several Fed officials have already talked about rate rises as a separate event. As part of preparing markets for tapering, Powell could take an extra step and emphasize that between the end of tapering and raising rates, there would be a long wait. He could use the words "considerable" or "patience" that Yellen used, or pick a new term.

Forward guidance that interest rates would stay lower for longer would also weigh on the dollar.

Overall, Powell has good reasons to wait, he is a dove, and has the tools above to soothe markets. The central scenario is for Powell to down the dollar.

The alternative hawkish scenario

Lower probability outcomes would be focusing on the fact that inflation still remains high and that global supply bottlenecks seem to persist and push prices higher. Prospects of higher inflation would embolden the hawks to demand a taper decision sooner than later and they could pressure Powell.

On the labor front, one could argue that while America is yet to reach full employment, average job gains in recent months point to reaching that goal, enough to warrant withdrawing some stimulus. That is probably not Powell's thinking, but he could be cornered.

In this more hawkish scenario, the dollar would rise as markets would begin pricing a November taper announcement and rate hikes coming in early 2023 or even beforehand. However, the chances are lower.

Conclusion

The Fed is set to leave its policy unchanged but hint about the next steps. There is a high chance that Chair Powell conveys a dovish message, downing the dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.