Fed Preview: Powell to plunge markets or raise yields, a win-win for the dollar, five scenarios

- The Federal Reserve is set to raise interest rates by 50 bps in its June meeting.

- A tough approach to soaring inflation would sink markets and boost safe-haven flows.

- Soothing investors by mentioning the bank's employment mandate would lift yields.

Between a rock and a hard place – stubbornly high inflation requires hitting inflation on its head, and that may trigger further market sell-off and a stronger dollar. Going softer and taking employment into account would result in a loss of credibility, a sell-off in bonds and higher yields. That is also golden for the greenback.

While the June 2022 Federal Reserve decision consists of many moving parts, I see this dilemma as the gist of the Fed's decision and its impact on the world's reserve currency.

Priorities are a 'changin'

Fed Chair Jerome Powell oversaw a shift in the Fed's thinking back in 2020 – prioritizing full employment and a return of discouraged people to the workforce at the expense of somewhat hotter inflation, at least in the short run. It got more than what it wished for.

Since then, the mix of easy Fed money, more fiscal stimulus, global supply chains, the post-pandemic reopening, America's Great Resignation phenomenon and a lack of sufficient resources in basically everything – have all pushed prices higher. America is exceptional in suffering from high underlying inflation – 6% YoY in the recent Core CPI read – and not only elevated costs originating from the outside. That means inflation that the Fed can influence with rate increases.

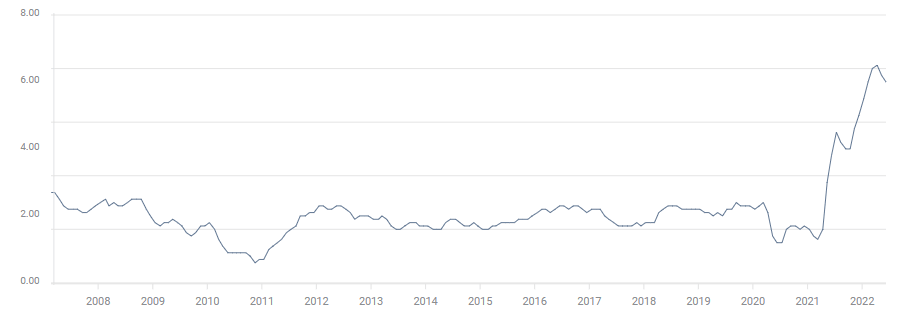

The drop in Core CPI YoY was more moderate than expected. Peak inflation is still far away:

Source: FXStreet

Raising borrowing costs encourages people and businesses to save rather than lend, cooling the economy. The Fed already raised rates to a range of 0.75-1% in two consecutive decisions and has signaled two 50 bps moves in this June meeting and also the next one.

US interest rates:

Source: FXStreet

However, the recent CPI report threw a wrench in markets' spinning wheels and raised the bar for the upcoming rate decision.

America's steaming hot labor market could withstand some moderation as a price worth paying to restore price stability. The risk is that such a cooldown would turn into a deep freeze. As of May, wages have risen at a fast clip of 5.2% YoY, falling behind overall price increases, but still buoying price rises.

Five scenarios

1) Dovish outcome: The minimum scenario is for a rate hike of 50 bps to 1.25-1.50% and a commitment to repeat this feat in July, merely reiterating the bank's stance without committing to further moves. That would serve as a relief for markets, initially sending the dollar down.

However, it would also signal a lax approach on inflation, triggering a sell-off in bonds and sending yields higher. In turn, elevated returns on Uncle Sam's debt would make the greenback more attractive.

This scenario has a low probability, as the recent rise in inflation will likely push the Fed to a stronger stance on fighting rising prices.

2) Gradually raising the bar: In this scenario, the Fed increases borrowing costs by 50 bps and also commits to doing so in July and September. Adding a fourth 50 bps hike to the three already known – May, June and the upcoming one in July – would be a moderate increase in the bank's hawkish stance – merely a minor catch up with reality.

I think that such an outcome would also trigger an initial sell-off in the dollar and a rally in stocks, before a bond sell-off boosts the greenback.

This scenario has a medium-high probability.

3) Ramping up the pressure: The Fed may opt for a more open-ended outlook apart from raising rates by 50 bps. It could say that it would do so in July, September and as long as needed. In that case, markets would plunge on growing uncertainty, sending the greenback up as investors flock to the safety of the greenback. If the Fed is keen on fighting inflation at the cost of an outright recession, stocks would plummet.

While such an outcome could convince markets that long-term inflation is falling, the drop in yields would be insufficient to counter the rush to the dollar. If America cannot lead in growth, other economies would suffer even further, making their currencies less attractive than the greenback.

This scenario has a high probability, as it would signal more determination from the Fed.

4) Surprise 75 bps hike with a dovish twist: In this scenario, the Fed would be reacting to the recent inflation data by abandoning its communication to raise rates by 50 bps, and rather convey a message of urgency. On the other hand, Fed Chair Jerome Powell would say that the bank prefers "front-loading" increases to borrowing costs to avoid further choking down the road. Higher rates now with a lower terminal rate.

In this case, the initial dollar surge would be followed by relief when hearing Powell speak. However, the greenback would continue rising after investors figure out that the Fed wants to keep a lid on the maximum interest rate. An increase in bond yields would drive the dollar higher.

This scenario has a medium probability. That would show that the Fed is also taking higher unemployment – resulting from elevated rates – into account.

5) Shock 75 bps hike with a pledge to do whatever it takes: This extreme scenario would be more about sending a message than action, but it would probably work. The greenback would rise at first in response to the triple-dose rate hike and then extend its gains on the vow to fight inflation. Such a "Volcker moment" – named after the Fed Chair who crushed the economy in the 1980s to bring prices down – would devastate stock markets.

Such an extreme hawkish outcome would weigh on long-term yields, but that would fail to mitigate a plunging stock market. The probability of such an outcome is extremely low, as it would mean the Fed is totally dismissing its employment mandate, going substantially further than deprioritizing it.

Overall, I see the upcoming Fed decision as a win-win for the dollar.

Additional considerations

What about the dot-plot? The Fed publishes forecasts for inflation, growth, employment – and most importantly interest rates, every three months. Projections for the path of the Federal Funds Rate were used to rock markets in several of the previous such decisions. This time, the stubborn nature of inflation, the Fed's failures in projecting it, and the higher importance of Powell's communications about next moves all outweigh the mix of opinions of 17 members.

Dissent could be more important. If several members either vote in favor of a more hawkish outcome, it would help boost the dollar. Saint Louis Fed President James Bullard would be the immediate suspect in opting for a 75 bps hike or stronger communications. If he is joined by others, it would propel the dollar higher at an earlier stage.

What about the balance sheet? The Fed began squeezing its nearly $9 trillion balance sheet at the beginning of the month, at a pace that is set to reach $95 billion in mid-summer. I expect the Fed to stick to its policy, which was only announced last month.

If the bank shocks by announcing a faster pace of reductions – perhaps a rapid run-off of Mortgage-Based Securities (MBS) related to the housing sector – it would give a further boost to the greenback.

Final Thoughts

A "buy the dip" in stocks has now turned into one for the US dollar. The Fed decision on June 15 will likely include several gut-wrenching twists, and I think the dollar would be able to stomach every move and come out on top.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.