- The Federal Reserve is set to leave interest rates unchanged in its last meeting of the year.

- Hints about policy in 2020 via the dot plot and other tools are set to moves.

- Comments about the bank will react to incoming data are also of importance.

The Federal Reserve is bracing for a quiet Christmas – but markets are set to rock even if the world's most powerful central bank sits on its hands.

After cutting rates in the past three meetings, the Fed is set to leave them unchanged in its last meeting of the year. It signaled a pause, and Jerome Powell, Chairman of the Federal Reserve, recently said he sees the economy as "more than a glass-half-full."

His comments may have been based on a bounce in investment – as reflected by the recent Durable Goods Orders report. That has been one of the worrying signs. Powell is probably pleased with the upturn of the housing market – which has benefited from the Fed's looser policy. Sales of new homes and prices are rising at a satisfactory pace.

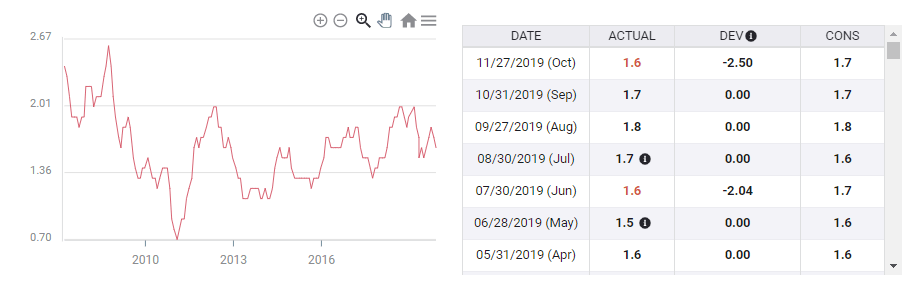

However, since he made those remarks, ISM's forward-looking Purchasing Managers' Indexes have missed expectations, pointing to slower growth in the services sector – and an ongoing contraction in the manufacturing one. Moreover, the rise in inflation has reversed course, with the Core Personal Consumption Expenditure (Core PCE) – the Fed's preferred gauge – slipping to 1.6% annually. The bank's target is 2%.

Core PCE has last exceeded 2% in 2008:

And while the labor market – the bank's second mandate alongside inflation – is creating jobs at a healthy clip, wage growth has stagnated.

Markets will likely look beyond the "on hold" decision, which is fully priced in, and gauge the Fed's policy in 2020. Bond markets are pricing in a rate cut in the second half of 2020, and these projections might be brought forward or pushed back – impacting the dollar.

The greenback will take its cue from these three things:

1) New forecasts

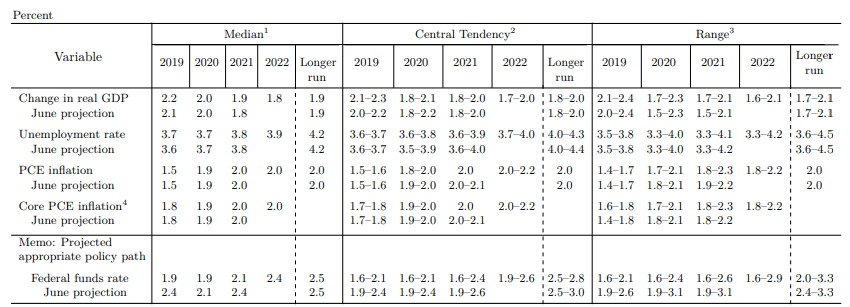

The bank publishes new forecasts for growth, employment, inflation, and, most importantly – interest rates. Minor changes are likely – but any tweak may result in outsized market moves.

The Fed's so-called "dot-plot" provides guidance, even if the Washington-based institution tries to play down its importance. A minor downgrade in rate projections, taking the October cut into account, is probably priced in. A deeper cut in expectations may send the greenback down, while leaving 2020 expectations unchanged may send it higher.

Here are the most recent projections, from September 2019:

Source: Federal Reserve

Throughout the year, markets were ahead of the Fed in forecasting rate cuts, and they may extend this trend now.

2) Economic assessment

Comments about the inflation and employment – the Fed's dual mandate – are of interest. Also, the Fed's opinion about trade – that will be probably be left out of the statement but in Powell's comments may also stir markets.

Investors will initially compare December's statement with the one released in October. Small semantic changes, such as replacing "modest" to "moderate" or "strong" to "solid" concerning the economy, labor market, and inflation, may all make waves.

Later on, Powell's description of the current situation – whether using his glass metaphor or another one – will also have its say in affecting currencies.

3) Reaction function

Perhaps the most critical point is how Powell describes the bank's reaction function – how it will shift from sitting on its hands to changing interest rates. All central banks say they are data-dependent, but they tend to respond differently to incoming information.

Back in October, the Fed Chair said that a material reassessment of the outlook would trigger a rate cut. However, for the Fed to raise rates, a change in future projections is insufficient to raise prices. Powell said that only after inflation rises substantially, will he consider raising rates.

That means the bar for cutting rates is lower than for hiking them.

If he confirms this notion, the dollar may suffer as markets may begin pricing a rate cut more aggressively. However, if Powell dismisses it as a misunderstanding, the greenback has room to rise.

Conclusion

While the Fed likely to leave rates unchanged in its December 2019 meeting, clues about future moves, coming from the dot plot, the description of the economy, and the reaction function are set to rock markets.

More US recession? Not so fast, a calm look at the economy and currencies ahead of the NFP

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD turns lower toward 1.1300 as US Dollar demand picks up

EUR/USD has come under renewed selling pressure and heads back toward 1.1300 n Monday’s European session. The upbeat market mood and a fresh US Dollar uptick undermines the pair amid a quiet start to a critical week ahead.

GBP/USD drops back below 1.3300 on US Dollar strength

GBP/USD returns to the red below 1.3300 in the European trading hours on Monday. Sustained US Dollar strength and easing trade tensions weigh negatively on the pair. Meanwhile, the technical outlook on the daily chart suggests a weakening bullish trend.

Gold price remains depressed below $3,300 amid signs of easing US-China trade tensions

Gold price maintains its offered tone through the Asian session on Monday and currently trades below the $3,300 round-figure mark, down 0.75% for the day. Despite mixed signals from the US and China, investors remain hopeful over the potential de-escalation of tensions between the world's two largest economies.

Bitcoin and Ethereum stabilize while Ripple shows strength

Bitcoin and Ethereum prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.