Fed January Preview: Three possible scenarios for gold

- FOMC is widely expected to leave its policy rate unchanged.

- A hawkish Fed policy outlook could cap gold's upside.

- XAU/USD could target $1,870 in case US T-bond yields turn south on a dovish Fed surprise.

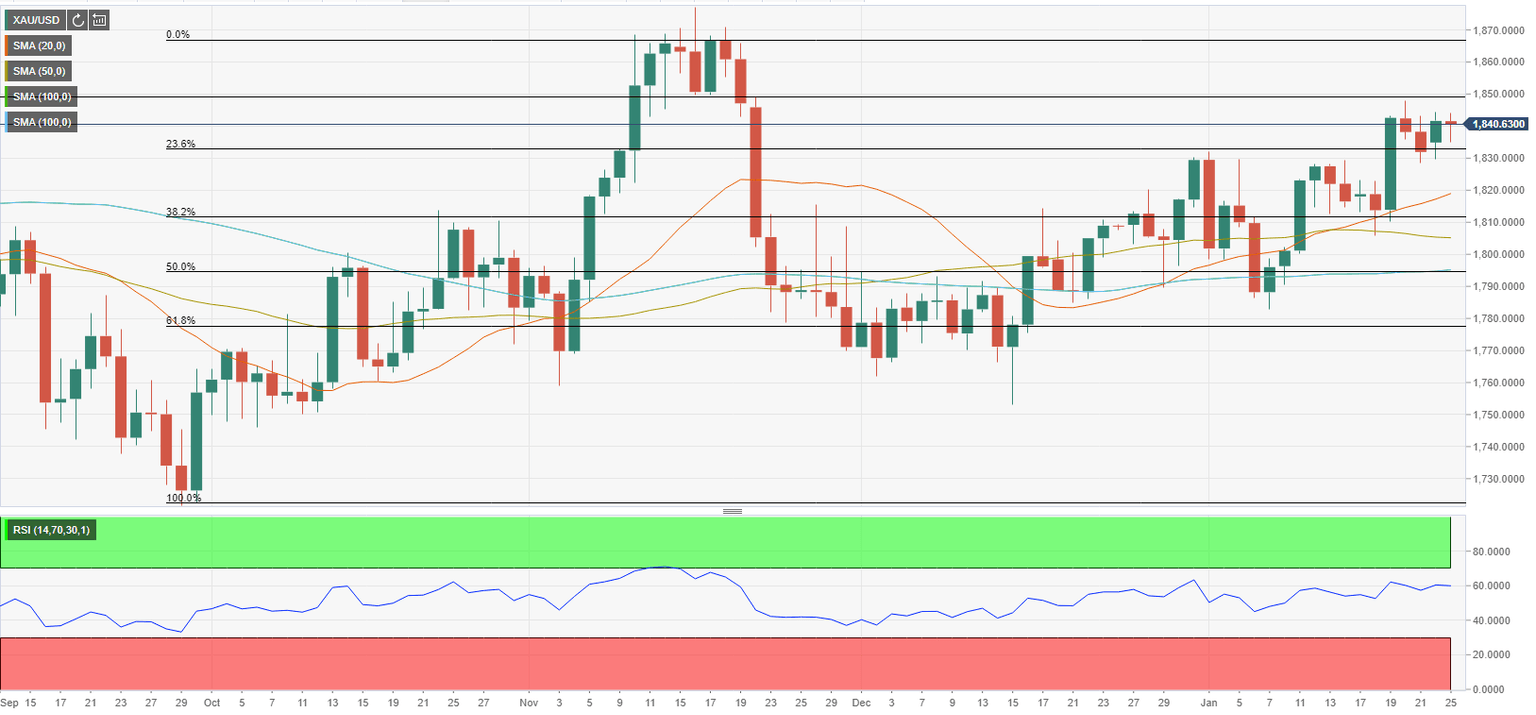

Gold closed the previous two weeks in the positive territory, gaining nearly 2% over the period. The violation of the 200-day SMA attracted technical buyers and retreating US Treasury bond yields provided an additional boost to XAU/USD. Before testing $1,850, however, the pair seems to have lost its bullish momentum, with investors remaining on the sidelines ahead of the US Federal Reserve’s policy announcements on Wednesday, January 26.

The FOMC is widely expected to leave its policy rate unchanged when it concludes its January policy meeting. Nevertheless, there are several uncertainties surrounding the Fed’s policy outlook, and gold’s reaction depends on how aggressive policymakers are willing to be when it comes to tightening.

Dovish scenario: The S&P 500 Index is already down more than 7% since the beginning of the year and the Fed might adopt a cautious tone to reassure markets that they will stay patient after hiking the policy rate by 25 basis points in March. In order to convince market participants, the Fed might also need to suggest that inflation may be close to peaking.

Moreover, market participants will look for fresh clues regarding the timing of the balance sheet reduction. While speaking at his re-nomination hearing, FOMC Chairman Jerome Powell said that they would need two-to-four meetings to come up with a plan to shrink the balance sheet and noted that such an action would be taken toward the end of the year. In case Powell clings to the view that it’s too early to think about the balance sheet, this could be assessed as a dovish development.

Gold is likely to extend its rally on a dovish Fed outcome, which should cause US Treasury bond yields to turn south as well.

Hawkish scenario: It shouldn’t come as a surprise if the Fed were to communicate that a 25 basis points rate hike in March is imminent. The CME Group FedWatch Tool shows that markets are pricing only a 10% chance of the Fed leaving its policy rate unchanged in March.

The FOMC’s policy statement could reveal heightened concerns over the inflation outlook with the coronavirus Omicron variant prolonging supply chain issues. The Fed might want to remind markets that they will prioritize inflation control over employment and signal that they will tighten the policy at an aggressive pace going forward.

Specifically, an increase in the pace of the monthly asset taper, a mention of discussions around a 50 basis points rate hike in March and policymakers’ willingness to start reducing the balance sheet soon after the first rate hike should be seen as hawkish developments.

Although US Treasury bond yields could gain traction on a hawkish Fed outcome, US stocks are likely to face heavy selling pressure and risk-aversion could help XAU/USD limit its losses.

Neutral scenario: FOMC Chairman Jerome Powell might refrain from suggesting that they will have to turn more aggressive to battle inflation while reiterating that they will keep a close eye on data and remain ready to act. In that case, gold could struggle to find direction and investors might opt to wait for Thursday’s fourth-quarter GDP data and Friday’s PCE inflation report.

Gold technical levels to watch for

The yellow metal is facing static resistance at $1,850. A dovish Fed should lift XAU/USD above that level and open the door for an extended rally toward $1,870, where the October-December uptrend ended.

On the flip side, $1,830 (Fibonacci 23.6% retracement) aligns as first technical support. With a daily close below that level on a hawkish Fed policy outlook, gold could slide toward $1,810 (Fibonacci 38.2% retracement, 100-day SMA) and $1,800 (200-day SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.