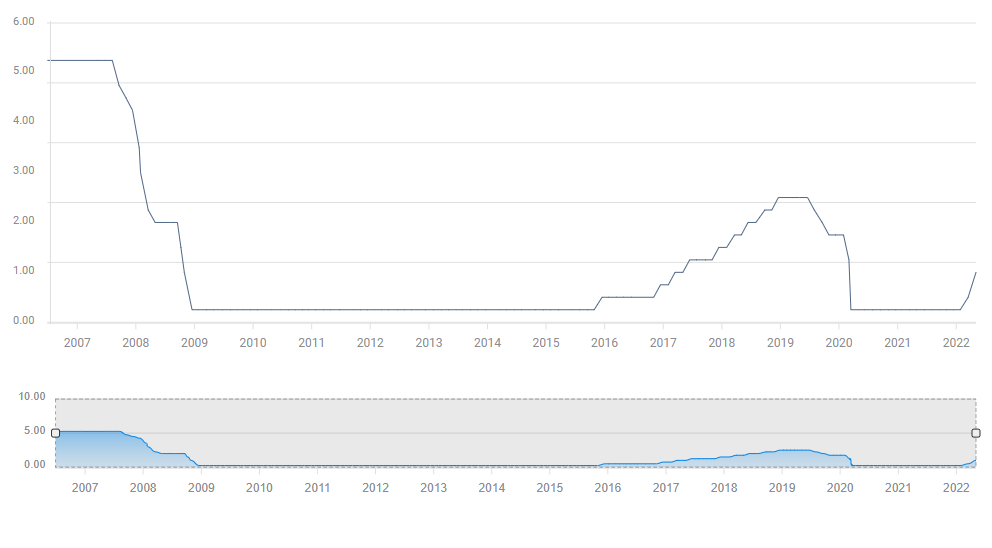

- Federal Reserve raises the base rate 50 basis points to 1.0% as expected.

- Passive bond roll-off to begin in June, reaching $95 billion three months later.

- Massive stock rally as Powell downplays 0.75% hike in June.

The Federal Reserve made good on its promise to fight inflation with the largest rate hike in over two decades, and though it indicated more increases are pending the governors pulled back from more extreme measures igniting a huge equity rally and bringing to a halt the dollar’s month-long surge.

The Federal Reserve Open Market Committee (FOMC), the bank’s policy board, unanimously endorsed a 50 basis point hike in the base rate to 1.0%, its highest since the onset of the pandemic in March 2020. A reduction of the bank’s $9 trillion portfolio will begin in June with $30 billion in Treasuries and $17.5 billion in mortgage-back-securities allowed to roll-off and climbing to $95 billion in three months.

Fed funds

In a somewhat unusual move, Fed Chair Jerome Powell opened his statement by addressing the country directly.

“Before I go into details of today's meeting, I'd like to take this opportunity to speak directly to the American people. Inflation is much too high, and we understand the hardship it is causing. We are moving expeditiously to bring it back down.”

In questioning by the press, direct for the first time in two years, Mr. Powell noted that “assuming that economic and financial conditions evolve in ways that are consistent with our expectations, there is a broad sense on the committee that additional 50 basis increases should be on the table for the next couple meetings.”

The next two FOMC meetings are June 15 and July 27, and if the Fed keeps this schedule that would bring the fed funds rate to two-thirds of the Treasury market expectation of at least 3.0% by year end.

In response to a question about a 75 basis point increase in June, Mr Powell commented that this is “not something that the committee is actively considering.” That remark touched off a massive equity rally that pushed the Dow ahead by 932.27 points, 2.81% to 34,061.0 and the S&P 500 up 2.99%, 124.69 points to 4,300.17. As has been common recently, the NASDAQ led all averages adding 3.19%, 401.10 points to 12,964.86.

NASDAQ Composite

CNBC

The dollar halted its month-long surge losing ground against all the majors though the amounts were relatively modest. The EUR/USD closed at 1.0615, its first trade above 1.0600 in five sessions.

Most Treasury yields declined as the Fed decided not to accelerate its rate campaign, with the largest loss on the short end of the curve.

The yield on the 10-year Treasury slipped 3 basis points to 2.927%. The return on the 2-year bill dropped just over 13 basis points to 2.636%. The yield on the 30-year or long-bond added 2 basis points 3.024%.

At several points in the 45 minutes of questioning, Mr.Powell acknowledged the difficulty of avoiding a recession while curbing inflation.

"The issue will come that we don't have precision surgical tools, we have essentially interest rates, the balance sheet and forward guidance. They are famously blunt tools. They are not capable of surgical precision."

Mr. Powell and the Fed governors know postwar US economic history. They know the incidence of recessions following a tightening cycle since 1950 is about 75%.

The Fed chief’s diffidence on the economy and on the ability of the Fed to engineer a 'soft landing', reducing demand and inflation without raising unemployment, has been taken by the markets to mean that rate increases are tied to economic growth. A likely though unstated corollary is that if growth falters, rate hikes will stop.

Mr. Powell did not say this, but it is inescapable in the huge equity gains and in the declines in Treasury rates and the dollar.

Part of the underlying logic to the Fed’s sudden and rapid conversion to a tightening program is that the governors know the risk of recession rises with every rate increase. They want to do as much to curb inflation as possible, in case and before slowing growth brings the increases to a halt.

Mr. Powell and the Fed are very aware that economic history is not on their side.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.