Fed December Preview: Will US Dollar selloff continue?

- FOMC is widely expected to raise its policy rate by 50 bps in December.

- The revised Summary of Economic Projections will be scrutinized by investors.

- Terminal rate projections is likely to drive the US Dollar's action.

The US Dollar suffered heavy losses against its major rivals on Tuesday after the US Bureau of Labor Statistics reported that the Core Consumer Price Index (CPI) declined to 6% in November from 6.3% in October. The US Dollar Index lost more than 1% and fell to its weakest level in six months below 104.00 on soft inflation figures.

The Federal Reserve will assess the CPI data in its two-day policy meeting and announce its interest rate decision on Wednesday, December 14. More importantly, the US central bank will publish its revised Summary of Projections (SEP), the so-called dot plot.

Have markets already priced in a dovish Fed outcome? Is there room for further US Dollar weakness ahead of the holiday season? Let’s take a look at possible outcomes for the Fed’s last policy meeting of the year and assess how they could influence the US Dollar’s valuation.

Dovish scenario

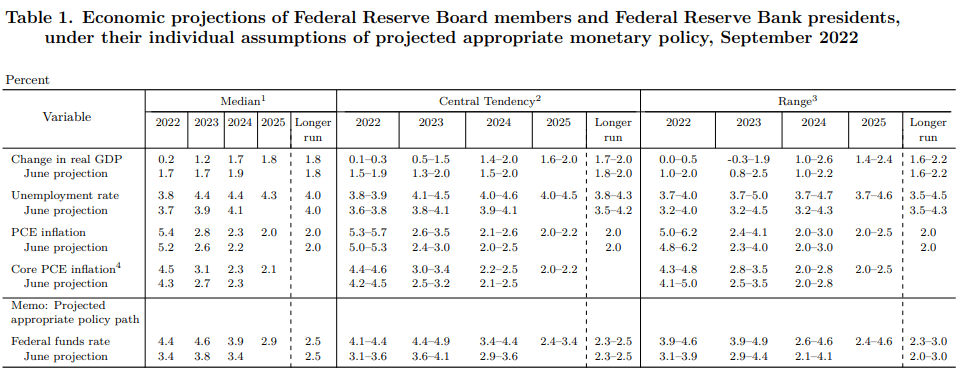

At this point, a 50 basis points (bps) rate hike to the range of 4.25-4.5% shouldn’t be a surprise. In case the dot plot shows that some policymakers saw a small rate cut toward the end of 2023, that could feed into the ‘Fed pivot narrative’ and trigger a decline in the US Treasury bond yields. In turn, the US Dollar would sell off. Similarly, a median terminal rate projection below 5% could be seen as a dovish tilt in the policy outlook and weigh on the US Dollar. Market participants will also pay close attention to inflation and growth forecasts. In September’s SEP, Fed officials saw PCE inflation at 2.8% in 2023 and projected Gross Domestic Growth of 1.2%. In case some policymakers forecast a recession next year, that could force the US Dollar to stay on the back foot. Although it’s unlikely, a large downward revision to the PCE inflation forecast should have a negative impact on the US Dollar’s valuation against its rivals as well.

September Summary of Economic Projections, source: federalreserve.gov

Hawkish scenario

In case the Fed opts for a 75 bps hike, which is extremely unlikely, that would be the ultimate hawkish surprise and provide a boost to the US Dollar. If the Fed raises the policy rate by 50 bps and the dot plot shows a terminal rate projection at or above 5% next year, that would suggest that the Fed will continue to hike policy rates for longer than expected. An upward revision to the PCE inflation forecast for 2023 should also deliver a hawkish message and help the US Dollar gather strength.

Neutral scenario

If the dot plot points to a less aggressive tightening outlook in 2023, as explained in the dovish scenario above, but FOMC Chairman Jerome Powell adopts a hawkish tone, the US Dollar could recover and hold its ground even if the initial reaction is for it to weaken.

Powell could continue to push back against the market expectation for a rate cut in late 2023 even if the Summary of Economic Projections reveals that some policymakers saw the need for such a decision. Powell could also downplay the soft November inflation figures and reiterate his willingness to sacrifice growth in the name of taming inflation. In conclusion, it’s difficult to say, however, whether Powell’s language could have a significant-enough impact on markets if it contradicts the dot plot.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.