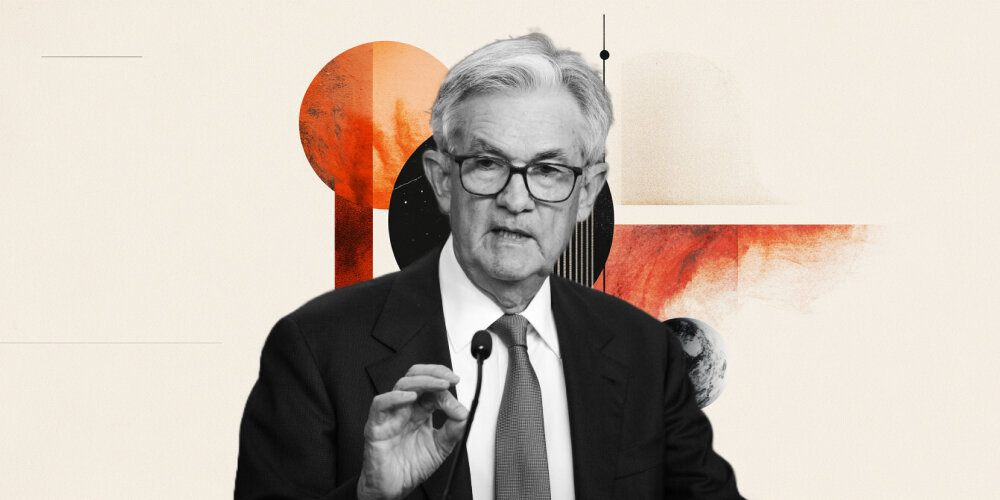

Fed chief Powell admitting tariffs will raise inflation and leave the Fed in a policy pickle

Outlook

The US news today include an auction of 5-year TIPS, March housing starts and permits, the usual weekly jobless claims, and the Philly Fed business survey for April. Nothing much here to move markets, leaving the trade talks with Japan and Italy as the possible news-makers.

We also get more company earnings with tepid warnings about uncertainty going forward, although somebody might get brave and excoriate tariff “policy.” Also today, the Atlanta Fed delivers another fresh GDPNow forecast for Q1. Yesterday the forecast was -2.2% from -2.4% on April 9. The gold-adjusted forecast is less scary at -0.1%. The better outlook arises from real personal consumer spending in part, (retail sales).

After the Lagarde comments this morning once the ECB rate decision is announced, the important thing today is Fed chief Powell admitting tariffs will raise inflation and leave the Fed in a policy pickle. Then Trump threatened to fire him. The most interesting thing about the Trump post is that only the WSJ reports it—not Bloomberg, Reuters, Washington Post or the NYT. Presumably they can’t bear to read his “Truth Social” which is neither truth nor social except for cult members. CNBC finally picked it up after 8 am.

Mr. Powell’s remarks to the Chicago Economic Club got a ton of press attention. He finally said the tariffs are not consistent with the Fed’s mandates on inflation and employment. We are not sure, but more than one analyst thinks Mr. Powell just laid bare Trumps’ lousy grasp of fundamental economics. He was clearly warning of stagflation and perhaps hinting that the Fed will not cut rates when inflation is so obviously about to go up. He did, however, point out that we haven’t seen this problem before so lack the experience to know how to handle it.

Reuters’ Dolan names it a “hawkish twist.” The NYT thinks he laid out a “game plan.” No. He said “We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension. If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close.”

In other words, the Fed faces “what will no doubt be a very difficult judgment" about which of its goals to prioritize. This is not what we would call a game plan.

And oh, yes, when asked, he said “Fed officials are not removable except for cause” and the Fed’s independence is a matter of law. The WSJ reports “Powell said he didn’t believe the Fed’s independence to set interest rates as it sees fit would be compromised because it is ‘very widely understood and supported in Washington, in Congress, where it really matters.’

“He added, ‘We’re never going to be influenced by any political pressure. People can say whatever they want. That’s fine. That’s not a problem. But we will do what we do strictly without consideration of political or any other extraneous factors.’”

He seems not to have met the lily-livered Congress or notice Trump breaking laws left and right.

Trump may take a rebuke from China (so far) but not from “his” people. He appears to want to break some laws again. Trump posted “Powell’s termination cannot come fast enough!” and Powell “is always TOO LATE AND WRONG, according to the front-age story in the WSJ. Powell “should have lowered Interest Rates, like the ECB, long ago, but he should certainly lower them now.”

TreasSec Bessent reaffirmed his support for the Fed’s independence in setting interest rates, saying it is a “jewel box that has got to be preserved.” The WSJ doesn’t give the date of this remark. It shines a tiny ray of light into the nearly inevitable Trump dismantling of the Fed.

Forecast

We are already seeing some position squaring and general tidying up in the FX market ahead of the holiday tomorrow. We can expect nothing less than ever-falling momentum.

We have mixed signals on whether a dollar pushback is in the cards, or not. What you see in the indicators depends on what timeframe you are looking at. On the short-term timeframes, a pullback looks imminent. Everything is wildly overbought and “should” retreat. But it was a giant breakout, after all, and “normal” indicator behavior is not to be trusted.

All the folks trying out AI-trading might want to take note—build a rule into the program that differentiates between a normal breakout and a giant one. Good luck defining that.

And here’s the kicker: it may be a religious holiday weekend, but that is not going to stop Trump from making market-moving remarks. Nobody has the slightest idea on what front, but the guy craves the spotlight so much he can’t possibly go three days without making a fuss. The chances are good it’s something obnoxious and potentially destructive to financial markets.

We advise traders go square around noon today and stay out until Monday.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat