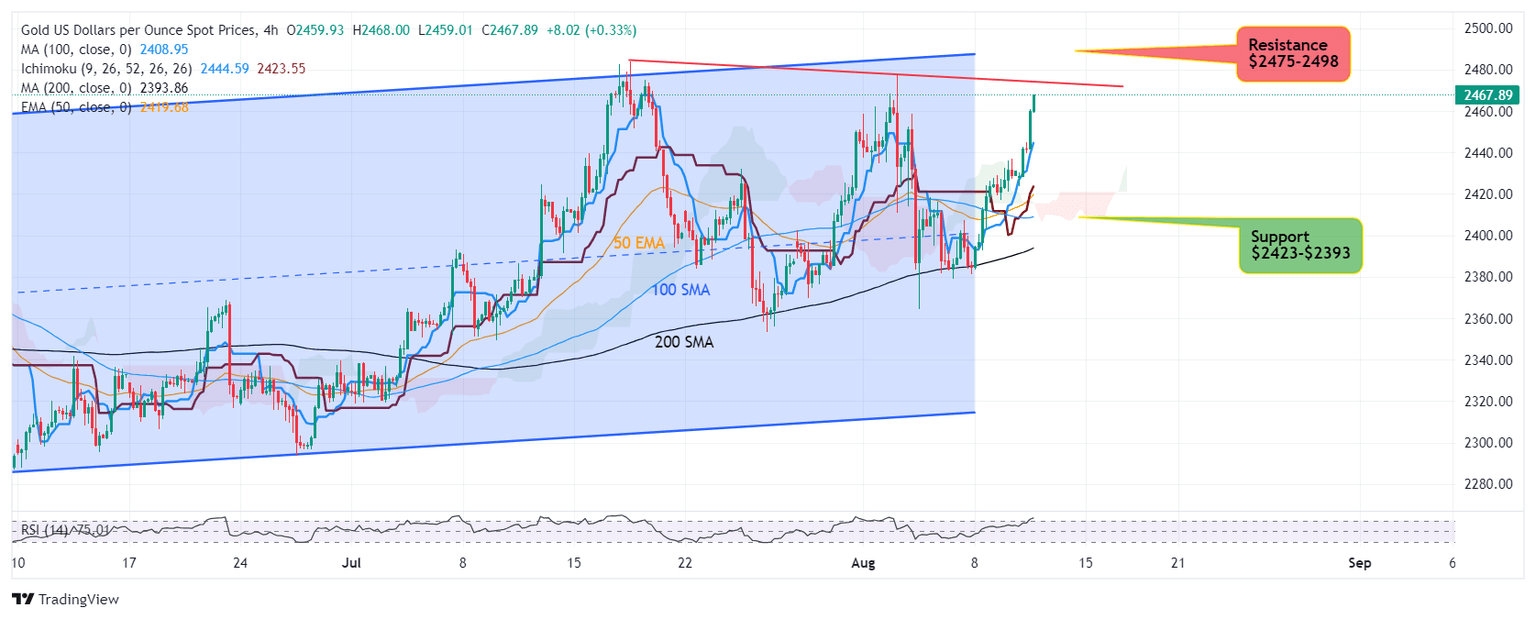

Fears of Middle East escalations boost safe haven buying – Gold eyes $2,500

-

News of possible Iran attack on Israel triggers Gold Rally.

-

Safe Haven buying rush pushes Gold to $2470.

-

Break above $2478 may aim for $2500-$2550

-

Markets pricing in risk premium ahead of any escalations on Iran-Israel.

-

Rising Bets on rate cut by Fed add strength to Gold bullish spike.

Gold price action witnessed heavy buying from today's $2424 low as fears of possible Iranian attack on Israel triggered safe haven rush to safety and Gold demand increased as store of value taking the precious metal to $2470 in a short span of time.

Iran-Israel issue is widely believed to be extremely delicate and sensitive in the sense that both sides are adamant and far from negotiation and refuse any restraint, especially at a point where any escalation can lead to uncontrollable geo political hazzards and turn into a much wider scale conflict.

Additional catalyst comes from rising chances of rate cut by Federal Reserve in September and even an early eamergency cut which has kept bulls in the ring with upper hand.

On price front, Gold bulls are trying to attack recent $2477 high which once cleared, eases the way to extended rally to retest record $2488.

Strong acceptance and enough triggers can push Gold beyond this $2488 high to reach $2500 psychological handle which may target extended bullish leg towards $2525-$2550 over near term.

On the flip side, any significant news on de-escalation may put brakes on parabolic run and rejection from $2478 high or $2488 record will prompt quick correction which may aim immediate support zone $2424 followed by $2400.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.