Fearing the CPI

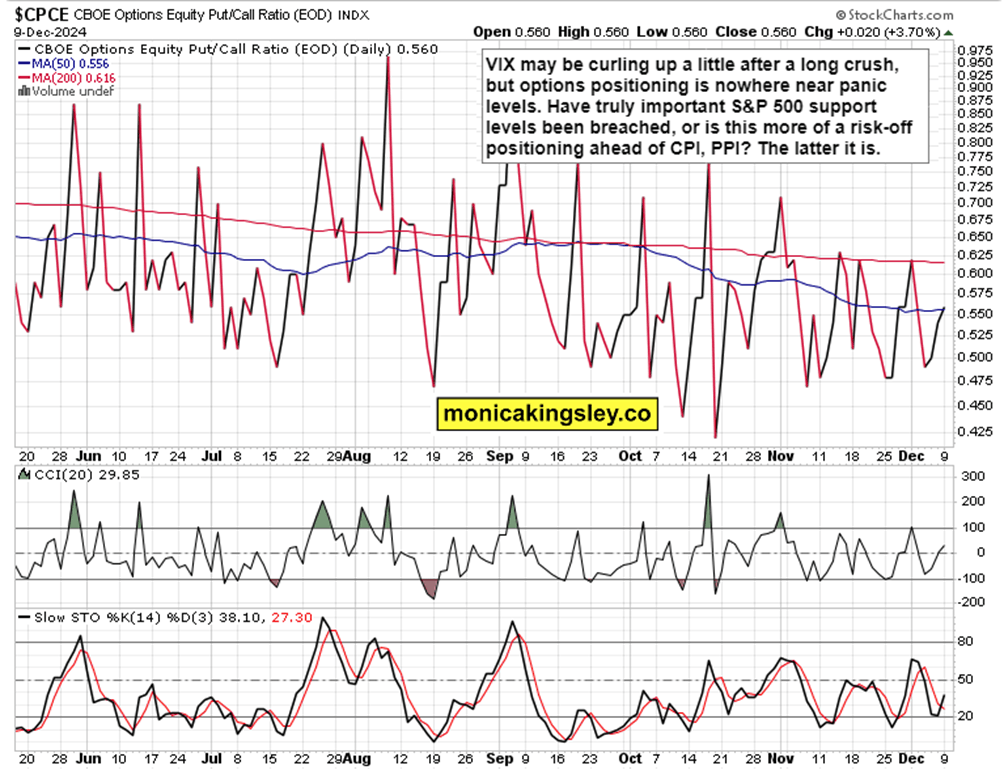

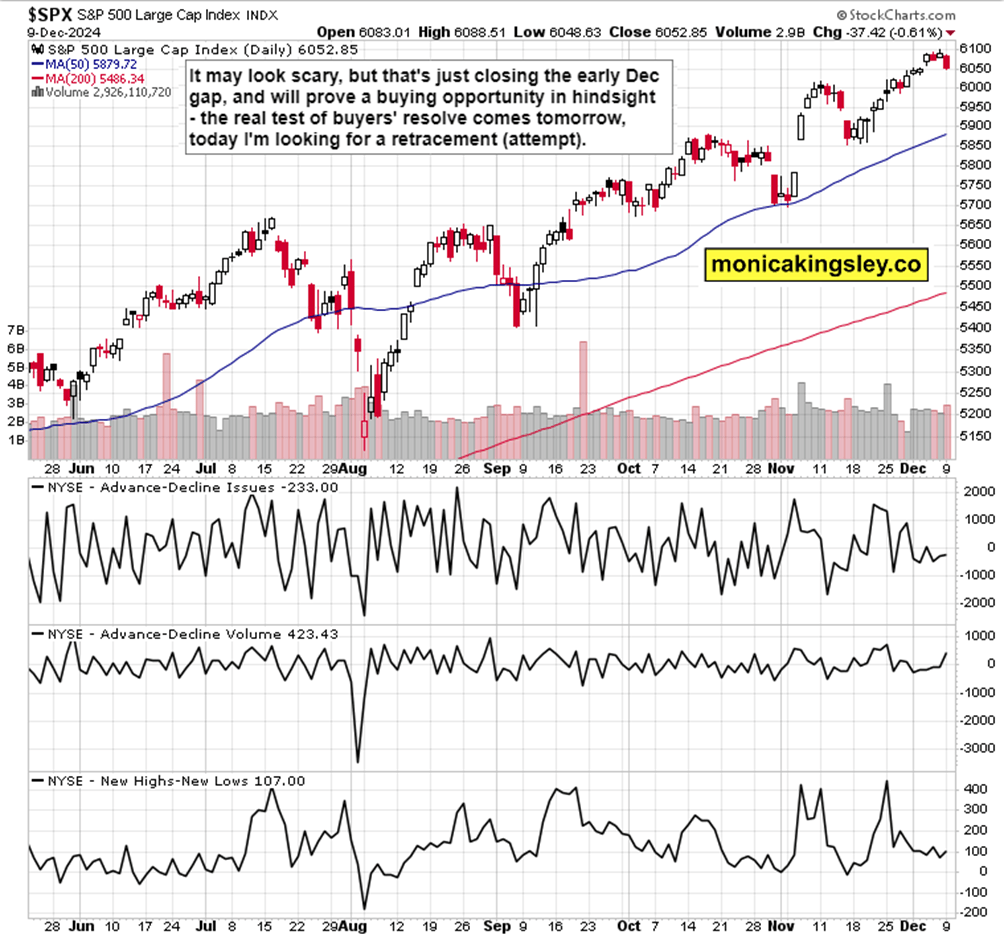

S&P 500 tried opening on a strong note, but just as Friday it fell through my high 6,080s support. Is this a cancellation of Santa Claus rally? I don‘t think so, I take it as cautious positioning for upcoming inflation data as is apparent from the put-to-call ratio chart presented at the end of this introductory part.

There is though way more to cover beyond the big picture across all asset classes that I laid out in yesterday‘s video – let‘s start with quoting extensive weekend analysis, and then updating it with yields (my 10y target revisited), China and Bitcoin to name only three key ones (ORCL earnings didn‘t lift NDX that much by themselves).

(…) keeping the finger on the pulse is so important – and Friday brought very decent jobs data coupled with prior revisions higher that were (correctly) interpreted as strong US economy (good for the consumer, I like latest consumer confidence data too), and these didn‘t send yields rising (more expectations of Fed rate cutting even as we‘re at the very end of the disinflationary times).

Given though very recent Powell positive mention of Bitcoin, it‘s not that hard to imagine rates would be cut with the declining oil and gas prices fig leaf, no matter disinflation being long in the tooth and manufacturing approaching expansionary territory finally. It‘s though rising yields that would ultimately extinguish the soon-to-be apparent economic acceleration – for now, low and declining oil prices serve as a cushion, and stimulus to the consumer and businesses (it‘s almost as a rate cut except that the Fed can‘t print barrels of oil). Other supportive data of good Q1 2025 for the real economy, is auto sales rising and optimistic consumer sentiment translating into retail sales.

CPI I just don‘t know how it can come in hot considering oil, gas being down during the reporting period, and probably rent, financial services and other won‘t make up for it. Disinflation has been stubbornly going nowhere for roughly half a year, and there was a modest uptick lately – not enough to call for a trend change, which is a bit more distinctly seen in PPI. Still, rate cut odds have continued in Friday‘s NFPs direction, ignoring strong data and clamoring for more cuts.

China‘s low inflation data though raise deflation worries, and latest CCP commitment to increase deficit financing is what will bare minimum propel China stocks up today (commodities doubt somewhat). It had already affected all real assets yesterday, changing the charts meaningfully (charts conform to significant macro changes, not the other way round) – that‘s a bullish factor across the board to count with.

Last but not least, Bitcoin is still struggling below $100K, a bit corrective bias (that bearish divergence on 4hr chart played out), and represented cautious trading ahead of CPI – ES 6,082 support turned resistance (I picked deliverately a bit lower figure in the 80s) though can be retested in today‘s session. The real test of bucking slightly underwhelming CPI data comes tomorrow.

Let‘s mve right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 3 more of them, with commentaries.

S&P 500 and Nasdaq

The real support is in the 6,055 area, and I‘m looking forward to see the degree latest leaders (that‘s tech, discretionaries, communications above all) come back, and how well financials and industrials follow. This is not the top of Santa Claus rally, but I‘m not looking for any beat of 6,092 on a closing basis today. Positioning for inflation data rules.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.