EURUSD Forecast: Will US midterm elections influence US Dollar's performance?

- The US Dollar stays relatively quiet following Monday's decline.

- United States (US) midterm elections are watched closely by investors.

- EURUSD needs to stabilize above parity to preserve its bullish bias.

EURUSD has lost its bullish momentum and declined below parity early Tuesday after having climbed to its highest level in 10 days at 1.0035 on Monday. The US Dollar (USD) stays resilient against its rivals as investors remain cautious on the United States (US) midterm election day.

Market implications of the United States (US) midterm elections

Republicans are expected to gain the majority in the United States (US) House of Representatives by taking five more seats. The race for the US Senate, however, is likely to be tighter. In case Republicans take the US Congress, a risk rally could be witnessed in the US stock markets as such an outcome would not allow Democrats to implement expansionary fiscal policies that could fuel inflation even further. In that scenario, the US Dollar (USD) should find it difficult to continue to outperform its rivals, at least in the near term, and help EURUSD stretch higher.

On the other hand, a split government with Democrats retaining the majority of the US Senate could force investors to seek refuge as that would heighten the uncertainty surrounding the fiscal policy. Although it's not easy to say how the outcome of the US midterm elections could influence the US Federal Reserve's policy outlook, Wall Street's reaction could offer some guidance regarding the US Dollar's (USD) next direction.

Euro (EUR) could benefit from ECB commentary

European Central Bank (ECB) policymakers have been delivering hawkish comments on the Eurozone's policy outlook and the Euro (EUR) could hold its ground if investors are convinced that the ECB will stick to its aggressive tightening stance.

European Central Bank (ECB) Vice President Luis de Guindos said on Tuesday that they will continue raising rates to a level that ensures inflation will come back into line with the ECB's definition of price stability. De Guindos further noted that quantitative tightening in the Eurozone needs to start "sooner or later" and added that he is expecting the inflation trend to be downward in the first half of 2023. Meanwhile, ECB policymaker and Bundesbank President Joachim Nagel reiterated that large rate hikes in Europe are still necessary and argued that the ECB "must not let up too early" on policy normalization. EURUSD showed no immediate reaction to these comments but the Euro could gather strength if other policymakers adopt a similar tone.

EURUSD technical outlook

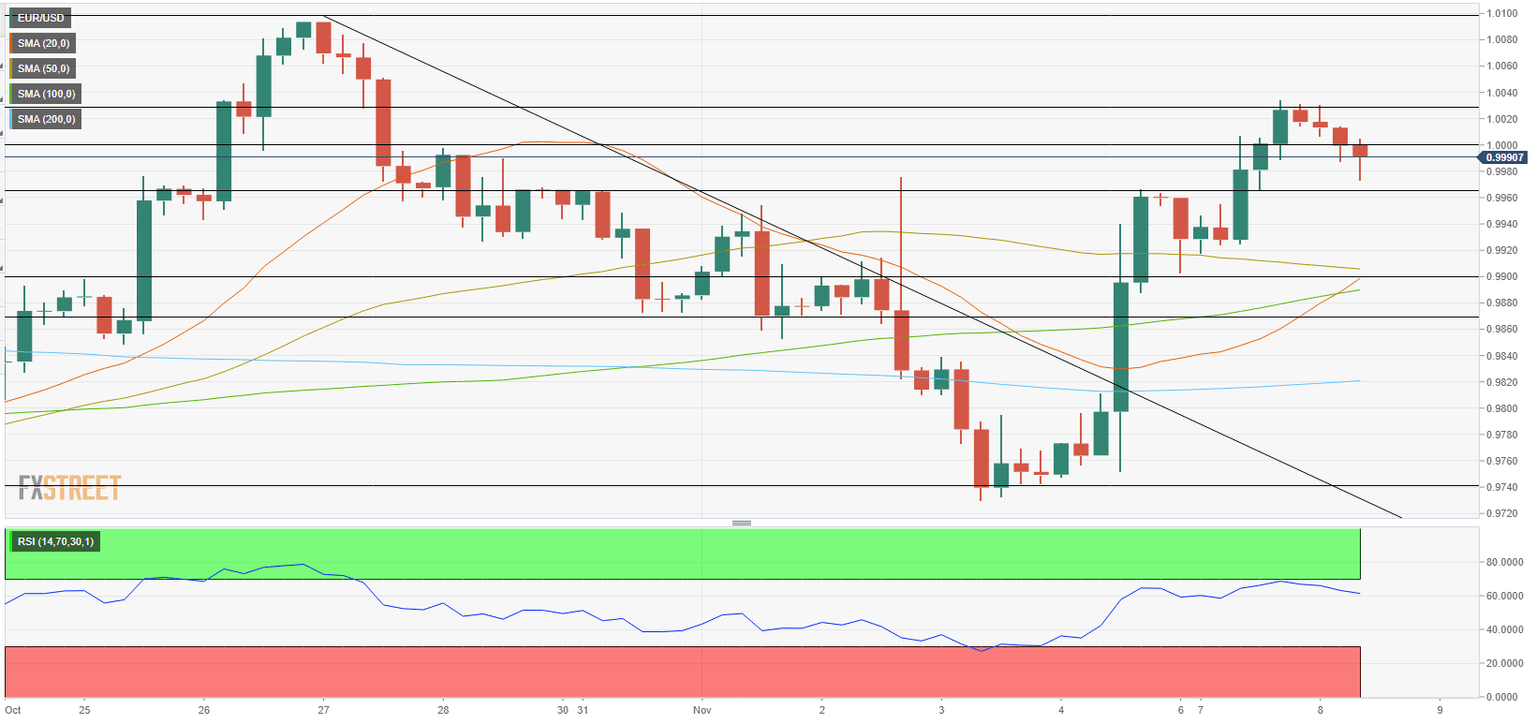

Despite the latest pullback, EURUSD's near-term technical outlook shows that the pair remains bullish. The Relative Strength Index (RSI) indicator on the four-hour chart holds comfortably above 50 and the 20-period Simple Moving Average (SMA) has crossed above the 100-period SMA.

In case EURUSD manages to stabilize above 1.0000 (psychological level, static level), 1.0035 (static level) aligns as next resistance ahead of 1.0100 (psychological level, static level).

On the downside, first support is located at 0.9965 (static level) before 0.9900 (psychological level, 50-period SMA, 100-period SMA) and 0.9870 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.