ECB and FED sealed EUR/USD's fate

2015 has been indeed the year of the Central Banks, particularly when referring to the EUR/USD pair. It was right at the beginning of the year when both Central Banks' leaders promised measures in completely opposite directions: the US Federal Reserve ended its facilities programs in October 2014 and began then announcing a "back to normal" run that was finally fulfilled in December with a rate hike of 25bp.The ECB on the other hand did the "whatever it takes" promised by Draghi back in 2012 and announced a €1.1 trillion quantitative easing program at the beginning of this year, expanding it softly also in December.

The EUR/USD pair started the year at 1.2101 and closed it at 1.1280. The bearish momentum in the pair extended down to 1.0461, and reversed course when the FED failed to pull the trigger in April, as initially expected. Ever since, the pair lacked directional strength until October, when it resumed its decline following the latest announcements of both Central Banks: US Yellen promised a rate hike before the year end, whilst EU Draghi said he was ready to raise the bet, and extend QE.

Both did as promised early December, yet the pair advanced afterwards, pointing for a positive monthly close. Why? Because Yellen had became extremely foreseeable, finally raising rates when the financial world had it already priced in, whilst Draghi announced the poorest extension of QE possible, sending European stocks markets sharply lower, and therefore helping the common currency in its latest recovery.

Win-win scenario for the greenback

Now hovering right below the 1.1000 figure, there's little more the pair can do this year, moreover as no major data is pending of release. So what's next from here?An educated guess is that the USD will end up winning the battle during this 2016, moreover if the ongoing policies are maintained by both Central Banks. The strength and length of the US rally will depend solely on the pace of future rate hikes in the US.

_20151222152529.png)

From a technical point of view, the dominant bearish tone remains firm in place, although it has long lost downward momentum. The monthly chart shows that the technical indicators are barely recovering from oversold levels, but that the pair is way below its moving averages, indicating that bears maintain the lead. The same chart also shows how strong buying interest is around the 1.0500 region and pretty much confirms that a break below the level is required to start speculating above parity as a probable target for 2016.

_20151222152602.png)

Parity will indeed be a major psychological support, which means that a break below should only fuel the panic sell-off, down to 0.9600, where the pair has several monthly highs and lows from 2001/2. A strong EUR seems out of the picture for now, with advances up to 1.1250 likely to be seen as barely correctives by market players. Should the pair recover above this last, it will need to retake the next resistance at the 1.1440/90 region, where the pair's advance stalled several times over these last few months.

In the weekly chart the pair is also correcting higher, but overall bearish, as the price stands below a flat 20 SMA, while the technical indicators have recovered from oversold levels but remain far below their mid-lines, also supporting the bearish case.

Anyway and as usual, the market will be full of imponderables that can change markets' perception of currencies in a blink. Trade what you see and not what you believe, and you can't get it wrong.

EURUSD Point & Figure Charts Forecast by Gonçalo Moreira, CMT

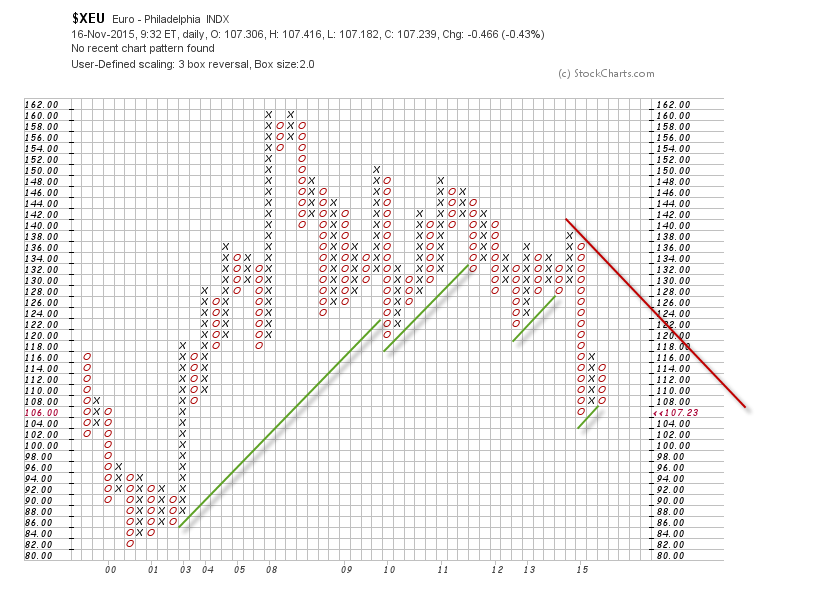

From a long-term perspective, as portrayed in the 3-box reversal chart below, the EUR/USD is really under the pump. The large column of Os -where each box corresponds to a 200 pip depreciation- drawn from the 1.3900 top is the one anchoring the objective bearish line (in red) dictating the bearish trend since last year. As long as this line is not violated, a point and figure analyst will consider the trend as bearish.

On this same resolution we don't have a double-bottom continuation signal yet. Only a firm break below 1.06 would print the sell signal and invalidate the green line nascent from a 1.0600 box. Likewise, only a close above 1.18 would generate double-top signal and threaten the 45 degree objective trend line.

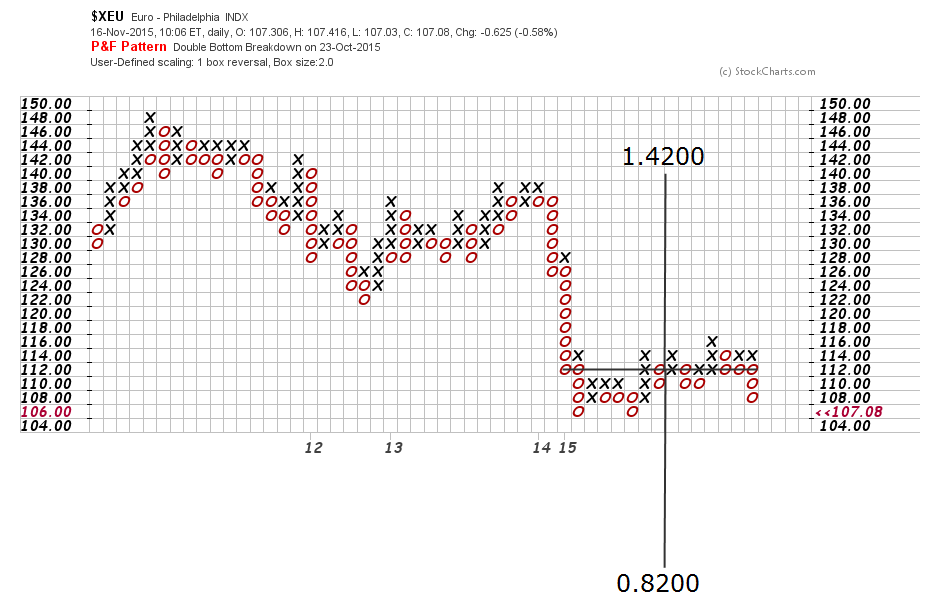

If we visit the EUR/USD 1-box reversal chart we can establish an horizontal count on both directions. On the upper side, a break above consolidation points to 1.4200, while on the way South, and reafirming the 3-box analysis, the calculation brings us below the historic low of 0.8400 to 0.8200

Read also other related articles about what 2016 could bring for the markets:

Currencies

GBP USD Forecast 2016

USD JPY Forecast 2016

Central Banks

ECB Forecast 2016

RBA Forecast 2016

PBoC Forecast 2016

FED Forecast 2016

BoE Forecast 2016

BoJ Forecast 2016

SNB Forecast 2016

Commodities

Gold Forecast 2016

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD remains offered and below 1.1300

EUR/USD is feeling the squeeze, revisiting the area around 1.1280 as the US Dollar gains extra momentum on Tuesday. Mixed domestic data from Industrial Production and Economic Sentiment haven't done the Euro any favours either.

GBP/USD keeps the bullish stance in the low-1.3200s

After hitting fresh six-month peaks near 1.3250, GBP/USD is now under a tepid selling pressure due to a strong comeback in the Greenback, causing it to retreat toward the 1.3200 support area. Next on the UK docket are inflation figures, expected to be released on Wednesday.

Gold embarks on a consolidative move around $3,200

Gold is holding its own on Tuesday, trading just above $3,200 per troy ounce as it bounces back from earlier losses. While a more upbeat risk sentiment is bolstering the rebound, lingering concerns over a deepening global trade rift have prevented XAU/USD from rallying too aggressively.

XRP, Dogecoin and Mantra traders punished for bullish bets, will altcoins recover?

Altcoins are recovering on Tuesday as the dust settles on US President Donald Trump’s tariff announcements last week. The President has repeatedly changed his mind on several tariff-related concerns, ushering volatility in Bitcoin and altcoin prices.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.