EUR/USD aims to halt decline as bears hold near-term edge [Video]

![EUR/USD aims to halt decline as bears hold near-term edge [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/piggy-bank-with-falling-coins-gm505796756-79269379_XtraLarge.jpg)

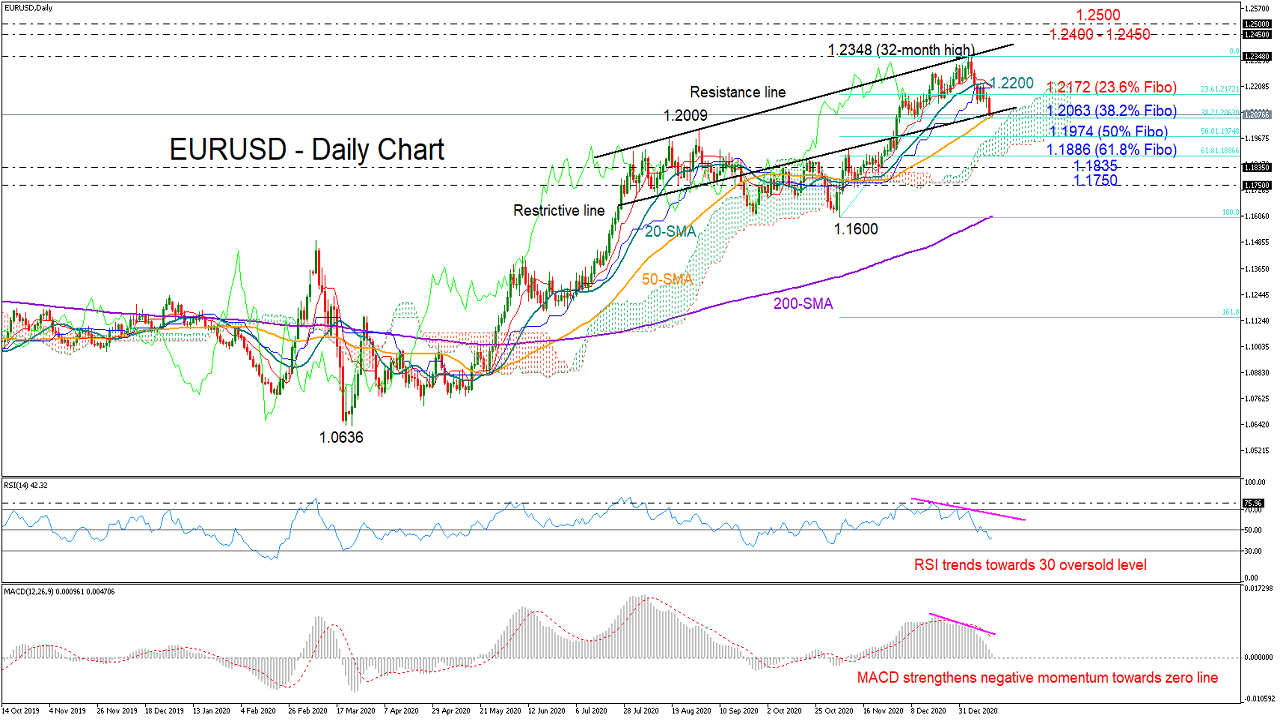

EURUSD started the week in a neutral tone, consolidating last week’s losses around the 50-day simple moving average (SMA), which happens to be near a key restrictive line and the 38.2% Fibonacci retracement of the 1.1600 – 1.2348 upleg, at 1.2063.

EURUSD started the week in a neutral tone, consolidating last week’s losses around the 50-day simple moving average (SMA), which happens to be near a key restrictive line and the 38.2% Fibonacci retracement of the 1.1600 – 1.2348 upleg, at 1.2063.

While this could be an ideal place for a rebound, the momentum indicators continue to provide conflicting signals in favor of the bears. The MACD, comfortably below its red signal line, is converging towards the zero line, while the RSI keeps trending towards its 30 oversold level. Another discouraging sign is the progressing bearish cross between the red Tenkan-sen and blue Kijun-sen lines.

Should selling pressure persist, the 50% Fibonacci of 1.1974 may attempt to add some footing ahead of the 61.8% Fibonacci of 1.1886. Crossing the latter, the price may find immediate support around the 1.1835 barrier, a break of which could prompt another negative correction to 1.1750.

In the case that the 1.2063 area proves a hard nut to crack, the pair may drift towards the 23.6% Fibonacci of 1.2172, while slightly higher, the 20-day SMA could also constrain bullish actions around 1.2200 as it did last week. If the rally gets excessive, the door will open for January’s high of 1.2348, while not far above it the resistance line could be a more challenging obstacle.

Summarizing, EURUSD is maintaining a bearish profile in the short-term picture, and it would be interesting to see if the 1.2063 key level can stabilize the sell-off.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.