Eurozone: Towards structurally higher savings

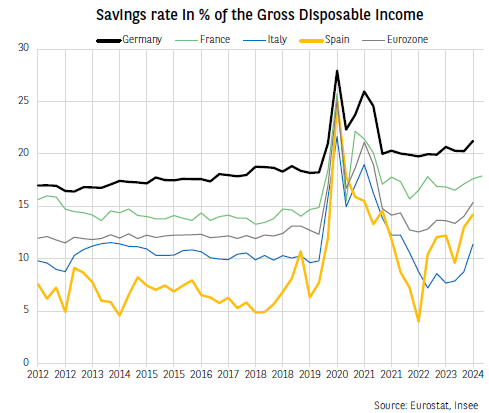

The household savings rate in France has risen further, up from 17.6% of households’ gross disposable income (GDI) in Q1 2024 to 17.9% in Q2 2024, according to the INSEE, i.e. 1 point more in a year. This is also an early sign of an upward trend underway in the Eurozone. While the figures for Q2 are not yet available, the Q1 figures pointed to a savings rate 3 points higher than its pre-COVID level (at 15.4%).

As a matter of fact, the improved position for household purchasing power (with wage growth back above inflation in most countries) has, for the time being, only resulted in a very limited improvement in household confidence, without curbing the still strong desire to build up savings.

Household savings are divided into two components. The first, investment in housing, is weak, particularly due to its decline in Germany and France. It is therefore the second element, financial savings, that has increased. As a result, the proportion of financial savings rose to almost half of total savings in Q1 2024, both in Germany and France, an unprecedented figure.

However, this figure is not just because households are saving more money, but also because they are consuming fewer goods than in 2019. For example, in France, consumption of goods fell from 36.7% of GDI in Q4 2019 to 34.1% in Q2 2024, while consumption of services only increased from 47.4% to 48% of GDI over the same period, with the remainder being saved.

The relative reduction in the consumption of goods within GDI may ultimately prove to be partly structural, which would explain why household consumption is not rebounding despite inflation falling, particularly spending on non-food (textiles, home and personal care), cars and food items.

Households also seemingly have new saving motives, particularly adaptation to climate change. For households, the transition involved in this results in an extended service life for their appliances and equipment (including their cars) and therefore lower consumption, while higher savings would help them to plan ahead for the higher replacement costs in the long run.

Author

Wells Fargo Research Team

Wells Fargo