Eurozone PMIs important for the Euro next week [Video]

![Eurozone PMIs important for the Euro next week [Video]](https://editorial.fxstreet.com/images/Macroeconomics/Countries/Europe/Eurozone_countries/Eurozone/european-union-flags-18011747_XtraLarge.jpg)

Economists see another rate hike in the euro area, but some skepticism remains about whether the rise will happen in September or at a later time. Preliminary business PMI figures for August could provide fresh insight on Wednesday at 08:00 GMT. Even if there's another bad report, a September rate hike might still happen, but it could also be the last. The euro could extend its downleg in this case, unless the Fed chief sends strong dovish signals during the Jackson Hole Symposium.

Eurozone economy between recession and stagnation

ECB president Lagarde could not clarify if interest rates will rise by another quarter percentage point in September at her latest press conference in July. Instead, she messaged investors that the rate decision will be based on data as inflation is abating, but it’s not at the 2.0% target, while growth risks are pointing downwards.

The truth is that the eurozone economy is not in a great shape. Some member states such as the Netherlands and Poland have already confirmed two negative consecutive quarters despite the bloc barely avoiding a technical recession in Q2.

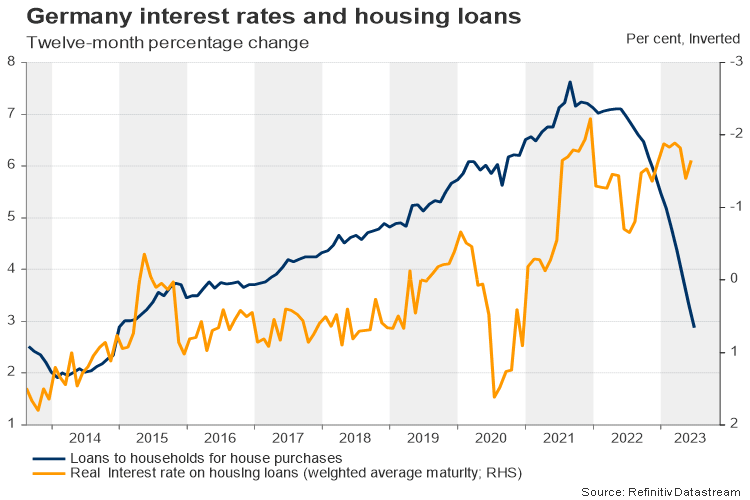

Germany, Eurozone’s growth engine and the fourth largest economy in the world, is also at the edge of a cliff even before rate increases start to have a real impact on the economy. The ongoing war in Ukraine that restricted access to cheap gas prices, worker shortages that weigh on the manufacturing sector, and economic woes in China, are dampening hopes for a quick recovery, with IMF analysts foreseeing a 0.3% German contraction in 2023.

August flash business PMIs to ease further

On Wednesday, the preliminary S&P Global PMI survey for August could be more evidence that the euro area is still treading water. The manufacturing index is expected to slip to 42.5 in August from 42.7 in July. Likewise, the services gauge could retreat from 50.9 to 50.4, driving the composite index marginally lower to 48.5 in the contraction area. German and French PMI indices could send the first warning over a struggling eurozone business sector half an hour earlier.

September rate hike loses popularity

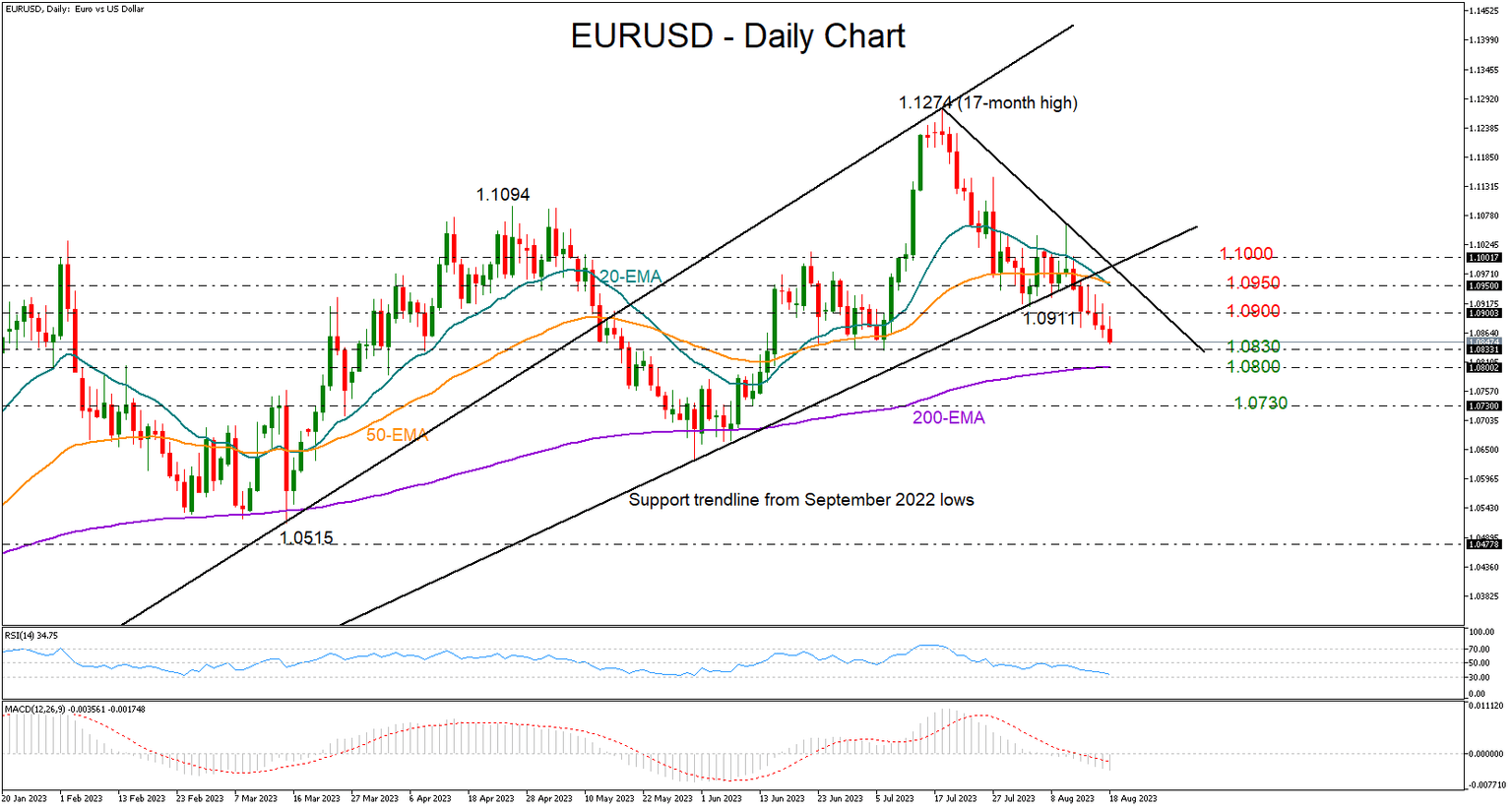

The probability of a 25bps rate hike had fallen to 63.8% in futures markets on Friday from above 70% previously. A bleaker-than-expected business PMI survey could change the odds to a flip coin, likely sinking the battered euro/dollar into the 1.0800-1.0830 support zone. The pair has suffered an ugly 4.0% downfall over the past month on the back of signs the US economy is relatively more resilient, whereas eurozone’s economic conditions are fragile enough to question whether there is a need for another rate hike by the end of the year.

Investors forecast a terminal interest rate slightly higher at 4.0% in the eurozone while pricing a small chance for two rate cuts in the second and third quarters of 2024. It may take some time until core inflation eases towards the central bank’s 2.0% symmetrical target, especially if inflation expectations stay above that level over the next couple of years. Therefore, the central bank could stay open to additional tightening, though given that the biggest part of the tightening phase is behind us, policymakers could debate only moderate rate increases in the months ahead.

It’s worthy to mention that household savings have fallen back to pre-pandemic levels in Germany and households’ demand for loans has plummeted to the lowest in nine years. Hence, a more cautious approach on the monetary front would not be very surprising.

In the event the eurozone’s business PMI figures show some improvement, setting the stage for a September rate increase, euro/dollar could return to 1.0900. The 20- and 50-day exponential moving averages (EMAs) could attract attention as well around 1.0950, though for an impressive recovery above the constraining trendlines and the 1.1000 round-level, Fed chief Jerome Powell will need to sound surprisingly dovish at his Jackson Hole speech next Friday.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.