Eurozone Inflation Preview: Sticky core prices set to boost Euro

- Economists expect inflation to have fallen in February in the Eurozone.

- Low expectations may result in a hotter outcome, especially in underlying inflation.

- A "sticky" core inflation figure of 3% would disappoint investors expecting rate cuts.

Is inflation under control or about to reaccelerate? That is the dilemma for US policymakers, but it is not lost on Europe – despite recession fears. Preliminary figures for February will shed light on the matter and probably rock the Euro.

Here is the preview of the Harmonized Index of Consumer Prices (HICP) report for the Eurozone in February, due on Friday at 10:00 GMT.

No victory lap just yet

This is (almost) what victory should look like:

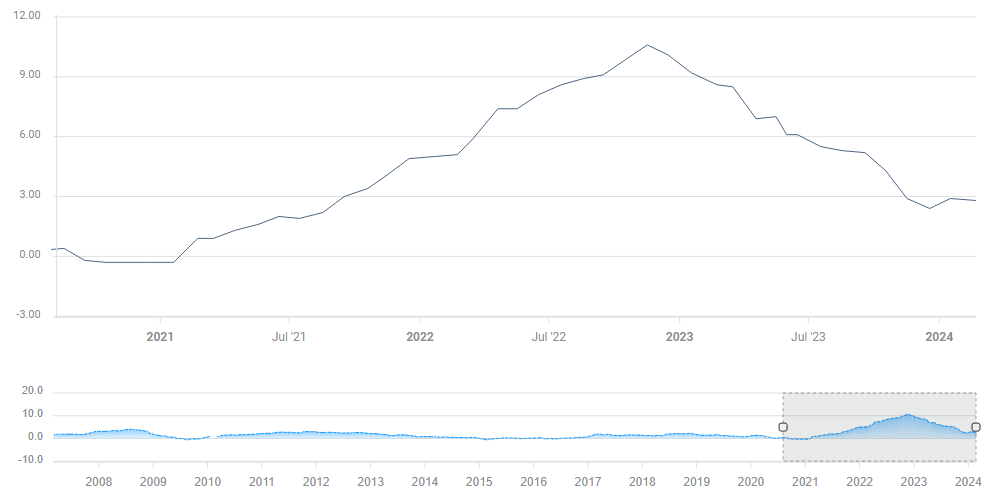

Eurozone HICP. Source: FXStreet

Headline inflation fell from a peak of 10.6% in October 2022 to a trough of 2.4% in November 2023, within touching distance of 2%, the goal of the European Central Bank (ECB). Then, it advanced. Is this a "dead-cat bounce," which will be followed by further falls?

After hitting 2.8% YoY in January, economists expect the HICP to fall to 2.5% in February, thus resuming its falls. That would result from the recent calm in Oil prices and stability in food costs. However, when stripping out volatile items, the picture is more complex.

Sticky services costs

Like the US, Europe is struggling with the secondary effects of inflation, reflected in rising wages. Acceleration in pay results in higher services costs. It is the so-called “sticky” part of inflation, as wages do not fall quickly – especially in Europe, where collective bargaining locks in salary raises for many workers.

Nevertheless, the economic calendar points to an expected drop in Core HICP from 3.3% to 2.9%. The last time underlying inflation hovered below 3% was in February 2022 – just before Russia invaded Ukraine.

However, the sticky nature of wages mentioned earlier could result in a small beat, with 3% or even 3.1%. In such a case, hawks at the ECB would be emboldened to leave interest rates higher for longer. That would also boost the Euro.

If Core HICP misses estimates and tumbles to 2.8% or lower, concerns about a recession will grow, and the Euro will fall. Such a scenario is less likely. An as-expected 2.9% outcome would result in a moderate market response, leaving room for the Euro to move according to the headline HICP and other factors.

Final Thoughts

I expect Core Eurozone HICP to beat estimates due to collective bargaining. If this analysis is correct, the Euro would receive a boost. It is essential to note that early releases from individual countries do not highlight underlying inflation data measured by European standards, so the reading has the potential to provide surprises.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.