- The Eurozone February inflation is foreseen at 0% MoM and at 8.2% annually.

- Higher ECB peak rate bets strengthened after hot French and Spanish inflation data.

- The EUR/USD recovery could gather steam on the hotter-than-expected HICP report.

The optimism surrounding peak inflation seems to be fading, as persistent price pressures in the Euro area’s leading economies are likely to compel the European Central Bank (ECB) to keep up its rate increases this year.

The Eurostat is due to publish the preliminary estimate of the Eurozone Harmonised Index of Consumer Prices (HICP) for February this Thursday at 10:00 GMT.

Hot Eurozone HICP to bolster hawkish ECB bets

The Eurozone annualized Harmonised Index of Consumer Prices is seen softening to 8.2% in February, compared to the 8.6% increase reported in January. Meanwhile, the core HICP is seen steady at 5.3% YoY in the reported period.

The focus, however, is likely to be on the monthly figures, with the HICP in the old continent seen dropping by 0.3% last month as against the previous decrease of 0.2%. The core HICP is likely to show no growth at 0% in February vs. -0.8% prior.

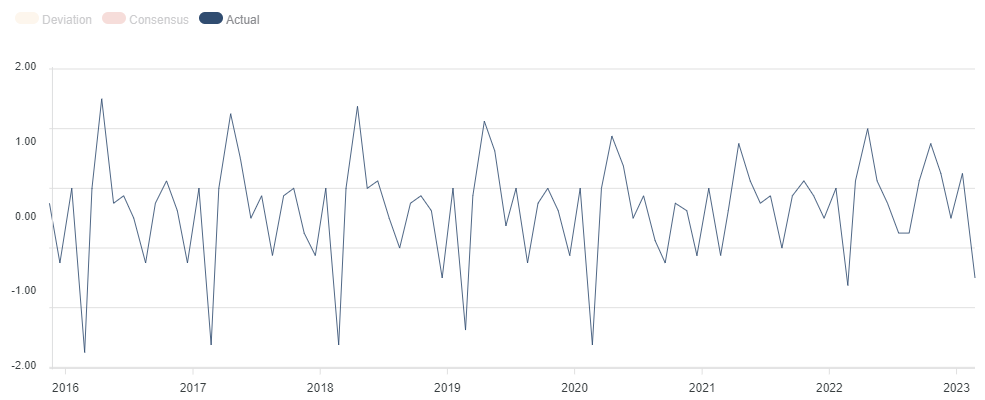

Eurozone Core HICP MoM

Source: FXStreet

The Eurozone inflation data will follow the French, Spanish and German inflation reports. On Tuesday, French and Spanish inflation data rebounded in February across the time horizon, suggesting that there are clear upside risks for the bloc’s HICP in February.

French Consumer Prices Index (CPI) unexpectedly rose 7.2% in the year to February, hitting the highest level since the Euro was launched in 1999. Spanish Consumer Price Index in February also surprised to the upside, arriving at 6.1%, up from January’s 5.9%.

Faster increases in food and services prices offset the steeper decline in energy prices in these leading economies, implying that the Eurozone inflation is also likely to be more sticky than previously thought. Also, it would leave markets wondering how long it will take for inflation to come down to the ECB’s 2.0% target.

European Central Bank President, Christine Lagarde, and her colleagues continue to press on a 50 basis points (bps) rate hike for the March meeting, noting that the rate hike outlook will likely remain data-dependent thereafter.

Hotter-than-expected inflation readings from France and Spain combined with an upside on core inflation led markets to price a 90% probability of a 4.0% terminal rate, a positive shift considering that a 3.75% terminal rate was fully baked just a week ago.

Trading EUR/USD with Eurozone inflation

EUR/USD is struggling to initiate a meaningful recovery above the 1.0600 threshold despite the hawkish ECB expectations. The focus will be on Germany’s HICP release due on Wednesday ahead of Thursday’s Eurozone inflation data.

On Tuesday, Euro area peripheral yields shot through the roof on the French and Spanish inflation surprise. The yield on Germany’s rate-sensitive two-year bund climbed 3.15%, its highest level since the 2008 financial crisis. Hot German HICP data could also see a fresh leg up in the Euro alongside the yields.

On a potential upside surprise to the Eurozone inflation data, the Euro buyers could continue to pile on, providing the much-needed leg to the EUR/USD recovery from 2023 lows of 1.0532.

Any disappointment in the HICP figures could reinforce sellers, sending EUR/USD back toward the 1.0500 mark.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.