Eurozone GDP and CPI Preview: How bad news could be good news for EUR/USD

- Eurozone GDP is set to plunge by 3.5%, quarterly, in the first view of coronavirus carnage.

- Economists project a collapse in inflation in April to the verge of deflation.

- Downbeat figures may trigger ECB action, and boost EUR/USD.

When the dead mounted in northern Italy in late February – that is when markets began noticing. The big bulk of hard data published at the end of April – just before the European Central Bank announces its rate decision – will provide hard evidence of coronavirus' carnage.

Plunge in output

European countries entered lockdowns throughout March and ground their economies to a halt. That will likely be reflected in devastating Gross Domestic Product figures in the first quarter of 2020.

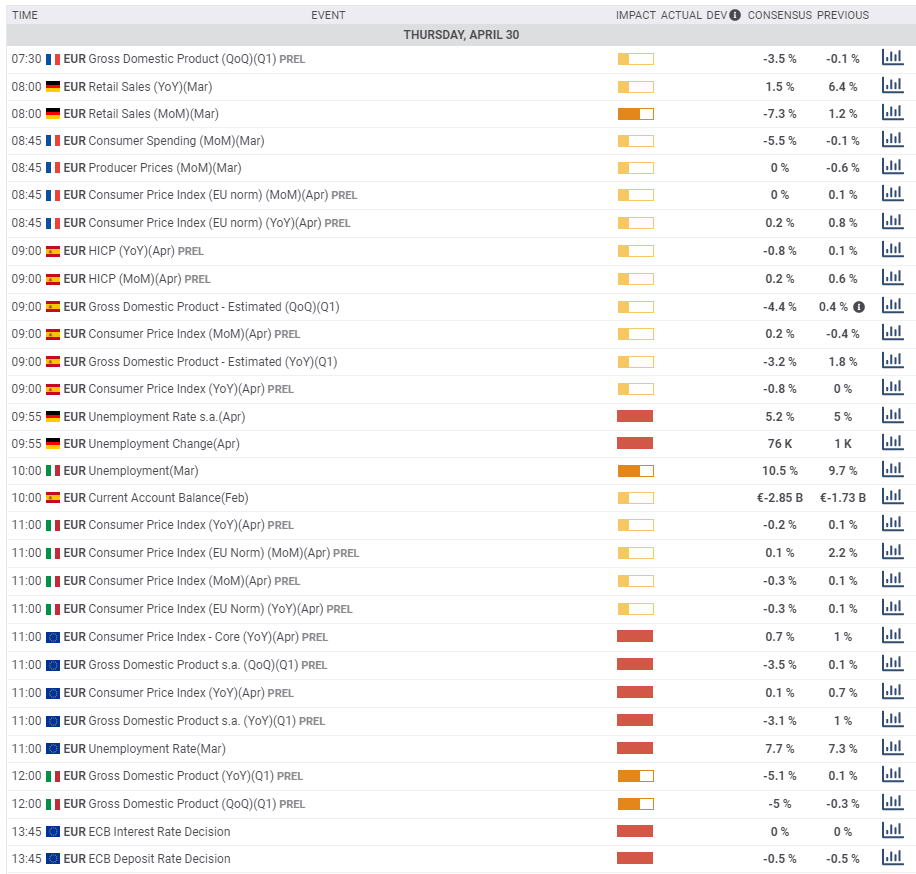

While the range of economists' estimates is wider than usual, there is no doubt that the currency zone suffered a significant contraction in the first quarter – and that the second quarter will likely be far worse. The economic calendar is pointing to a dive of 3.5% quarterly and 3.1% yearly.

The publication for the whole eurozone is preceded by figures from France, the second-largest economy, which is set to suffer along the lines of the entire bloc. Spain, the fourth-largest economy that imposed a strict lockdown, is next up, and contraction is set to hit 4.4% quarterly. Italy, the third-largest economy, may have seen output fall by 5%.

Germany, the "locomotive" of the eurozone, releases figures next week, yet the pandemic has not hurt it as much as other large economies. The eurozone statistic will likely have the most significant impact, yet the publication competes with inflation data.

Falling prices

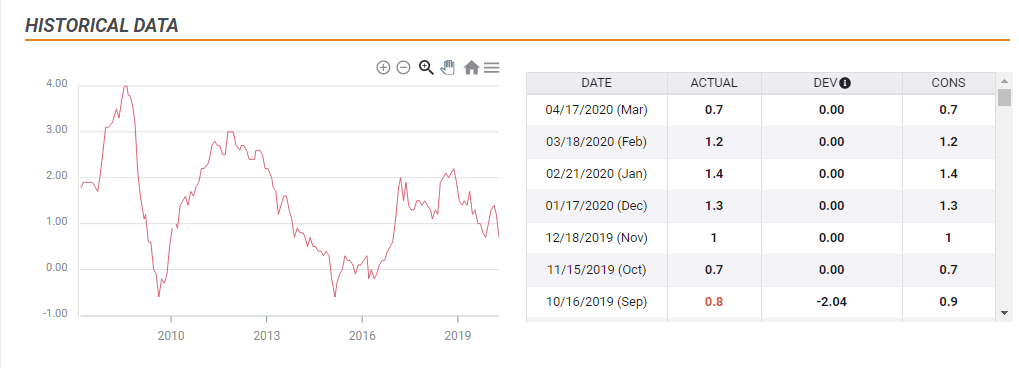

The ECB officially has "one needle in the compass" – headline inflation. Annual Consumer Price Index stood at 0.7% in March and core CPI at 1%, far from the "2% or close to 2%" target of the central bank. It is set to become much worse in April's preliminary release – falling to 0.1% on the headline and 0.7% on the core.

If CPI drops below 0% – outright deflation, it would ring alarm bells in Frankfurt, where the ECB is based, and across the continent. Falling prices cause consumers to wait for them to further decline, weighing on the economy.

Also here, the statistics for the entire bloc are preceded by reports from the largest countries, yet these carry less weight.

Employment data are also due out throughout the morning, with the eurozone jobless rate set to climb from 7.3% to 7.7% for March. However, it is a somewhat lagging figure and with so many data points coming out, it is probably at the bottom of the list.

ECB context – why bad news is good news

Christine Lagarde, President of the European Central Bank, has been a proponent of monetary support as well as fiscal stimulus – supporting coronabonds. Lagarde and her colleagues will announce their decision less than three hours after the all-European figures are released and will certainly take them into account.

The bank announced the Pandemic Emergency Purchase Program( PEPP) – a new bond-buying program worth €750 billion in an extraordinary meeting in March. IT has been since deploying them at a rapid clip and without substantial fiscal action, that money may run out.

Will the ECB enhance its efforts? The chances are low, but devastating data may convince it otherwise. If the bank acts sooner rather than later – such as in its June meeting when it publishes new forecasts – governments could borrow and spend. Stimulating the battered eurozone economies would boost the euro.

Lagarde and fellow doves at the bank have a battle with the hawks led by Jens Weidmann, President of the German Bundesbank. Northern countries and their representatives at the ECB want to avoid financing indebted countries without justification.

Yet if the situation is dire, these hawks may change their minds. Therefore, the worse the data comes out, the higher the chances for stimulus and the better for the euro.

All in all, the redder these figures are, the greener the euro may go:

Conclusion

Eurozone growth, inflation, and also employment figures will probably be worrying amid the coronavirus crisis – and get worse in the coming months. However, as this big bulk of statistics is released ahead of the ECB decision, devastating data may trigger more stimulus and boost the euro.

More: ECB Preview: The only game in town could be in lockdown, three mostly negative EUR/USD scenarios

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.