European stocks meander lower as US markets close for Independence Day

European stocks slid early on Monday as they continue to run up and down well-worn ranges. On Friday, the S&P 500 rose for a 7th straight session and notched another all-time high after a strong jobs report. The nonfarm payrolls report indicated US employers added 850,000 jobs last month, the strongest number in 10 months and a sign that hiring is accelerating as pandemic-era support is scaled back. However, the unemployment rate rose to 5.9%, against expectations it would fall to 5.6%. In all this was a positive report for stocks, indicating solid-but-not-too-hot economic recovery and keeping the Fed on the course the market sees it on. Yields fell, with the 10-year back to its lowest since March, and the dollar eased back after being bid up all week. The soft finish last week for the dollar has continued into Monday but we should caution that the Independence Day holiday today, held over from yesterday, will keep US markets closed, and maybe keep equities from making any serious moves. Overnight Asian shares were steady as the Caixin services PMI fell to a14-month low.

Bidding war intensifies: Morrisons shares leapt again after management said over the weekend they have accepted a £9.5bn offer from Fortress. The deal values the stock at 252p, a 42% premium to the undisturbed price, plus a 2p special dividend. Apollo Global Management said in a statement this morning that it is now considering an offer. Shares this morning trade up 11% at 267p, reflecting a premium to the agreed bid that indicates investors believe there could be more juice to be squeezed from this particular bidding war. I think there could well be another offer or two and 280p might be seen before it’s a knockout. We’ve talked fairly regularly about the amount of private equity money there is waiting for UK companies, which are cheap vs peers. Given our interventionist chancellor wants to open up the listing process to make it more appealing to list in London, he may also want to consider ways to shore up the defences of public companies. When you look at UK valuations vs US and even European peers it’s still too cheap.

Talks among OPEC members and allies continue today after the cartel failed to reach agreement on a planned increase in production last week. The UAE remains the obstacle to the OPEC+ group raising output by an extra 400k bpd each month from August through to December, slowing turning on an extra 2m bpd by the end of the year. It would also extend the production agreement through to the end of 2022. The UAE, which threatened to leave OPEC last year, says it unconditionally supports a deal but is seeking better terms. Essentially it wants more share, saying that the original output deal no longer reflects the country’s production capacity. WTI for August trades above $75, with the market fundamentals apparently bullish whether there is a deal or not. An unusually sedate oil market around a drawn-out, disputed OPEC meeting tells you the market is tight and 400k bpd is not enough to right it.

Solid run up in gold as yields came off but $1,800 remains obdurate defence. Watching potential bullish MACD crossover. TIPS are supportive with the 30yr inflation protected yield negative and at its lowest since February.

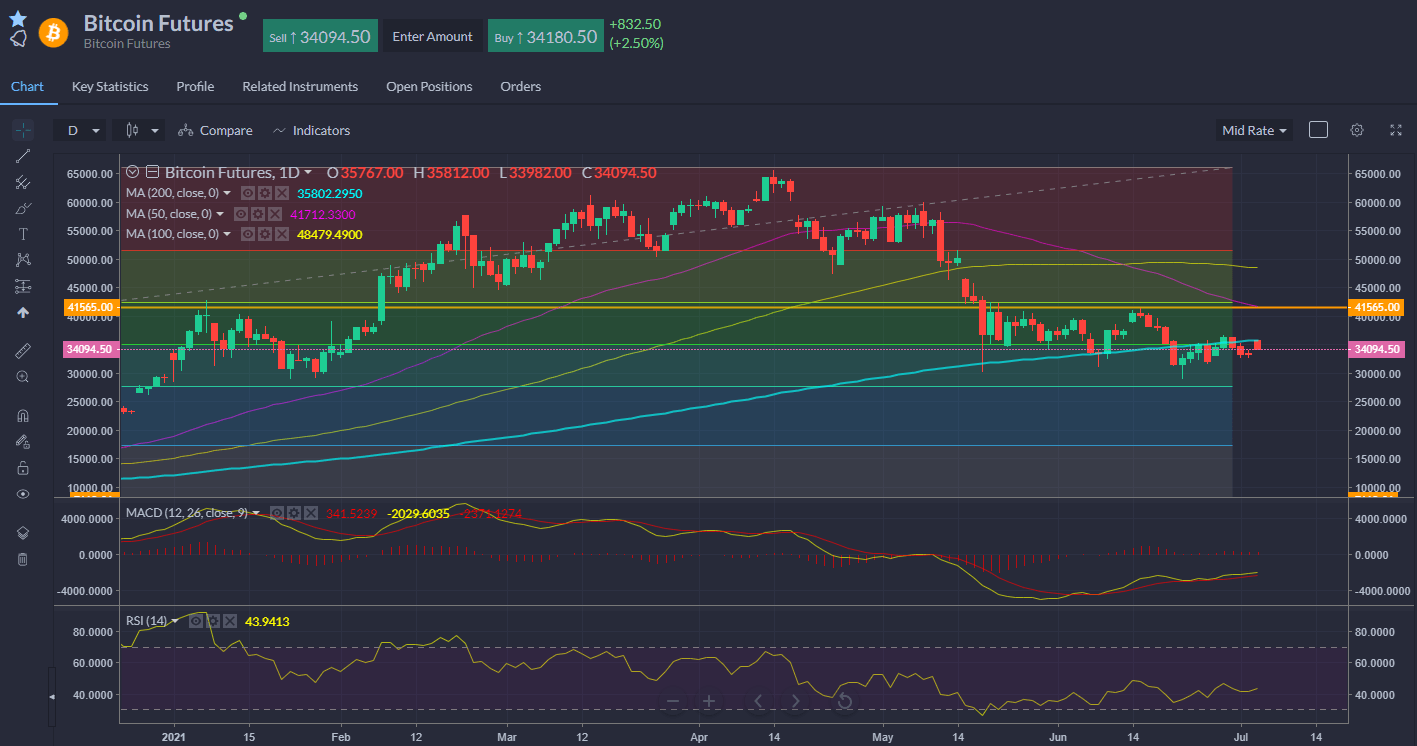

Bitcoin futures holding under the 200-day SMA.

Author

Neil Wilson

Markets.com

Neil is the chief market analyst for Markets.com, covering a broad range of topics across FX, equities and commodities. He joined in 2018 after two years working as senior market analyst for ETX Capital.

-637610683969650776.png&w=1536&q=95)