European public accounts: The great post-COVID-19 divide

“Not all died, but all were stricken”. While the Covid-19 pandemic spared no one, its consequences, particularly on the budgetary front, were not the same for everyone.

Initially, those who could (the richest countries...) engaged considerable financial resources to limit the consequences of the catastrophe. Emergency compensation funds, coverage of partial unemployment, deferral or cancellation of charges: between 2020 and 2021, some ten points of GDP were transferred from the public to the private sector by various means in the advanced economies. Far from being a French exception, the “whatever it takes” approach has replaced the European Stability Pact, which was put on hold during the Covid period. Germany accepted large deficits, while its debt climbed a step higher, as did many others.

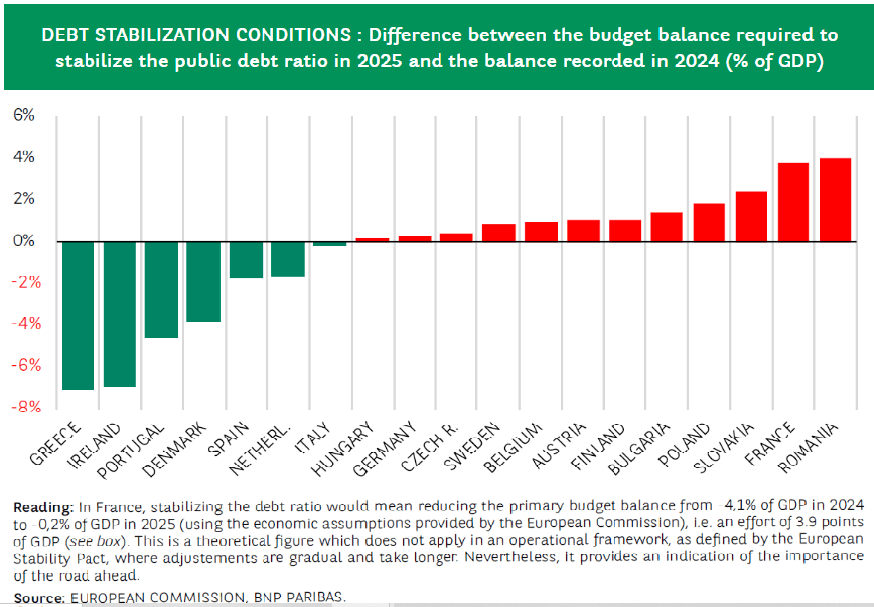

The synchronism was short-lived, however. As soon as the epidemic was under control, government policies ceased to make common cause, and debts began to diverge, some (relative to GDP) returning to pre-pandemic levels, others not. The European pack split into three. Grouped alongside the Netherlands and Denmark on the left-hand side of our graph, the so-called “peripheral” countries (Spain, Portugal, Greece and Ireland) have experienced a kind of return to grace, twelve years after having shaken the Eurozone to its foundations. All of them have been through a serious financial crisis, necessitating severe adjustment programs; all of them have restored their primary budget accounts (excluding interest payments) to such an extent that their debt ratios have not only not drifted, but are now on a downward trend.

Next in line are those for which, barring an economic recession or an unlikely fiscal turnaround, debt dynamics are not far from being stabilized. This group includes most of the so-called “frugal” countries of Northern Europe, as well as Italy. Finally, there are a few cases of more marked drift in public accounts, mainly in Central and Eastern European countries affected by the war in Ukraine (Bulgaria, Poland, Slovakia, Romania), but also in France.

If France finds itself in this position, it's not so much that its debt, even at 113% of GDP, can be considered unsustainable. The interest burden it generates (4.2% of budget revenues in 2024) remains within the European norm; it weighs less than in Italy, Spain or Portugal, and has nothing to do with the Greek precedent (17% of revenues in 2011) sometimes cited as a reference.

The problem is that this situation is tending to deteriorate. With disinflation, France's nominal GDP - the basis of its taxable income - will slow in 2025. France also inherits a primary deficit (excluding interest payments) of almost EUR 120 billion or 4.1% of GDP by 2024, one of the highest in Europe. As a result, its debt-to-GDP ratio is rising, the question being how much longer, and to where. Deemed credible by the European Commission, the budget trajectory previously proposed by the “Barnier” government made it possible to stabilize French debt at around 117% of GDP by 2027. This was to be achieved by reducing the deficit to 5% of GDP by 2025, then progressively below 3% by 2029. Rewritten due to the censure motion, the roadmap that will actually apply remains the main unknown at the start of this year. What is certain, however, is that the constraint of controlling public debt will not loosen.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.