European Central Bank Preview: Taper on the table, but don’t get too excited about it

- The ECB will likely start discussing tapering, but nobody expected a clear announcement on it.

- August inflation soared to 3% YoY in the EU, policymakers should take note of it.

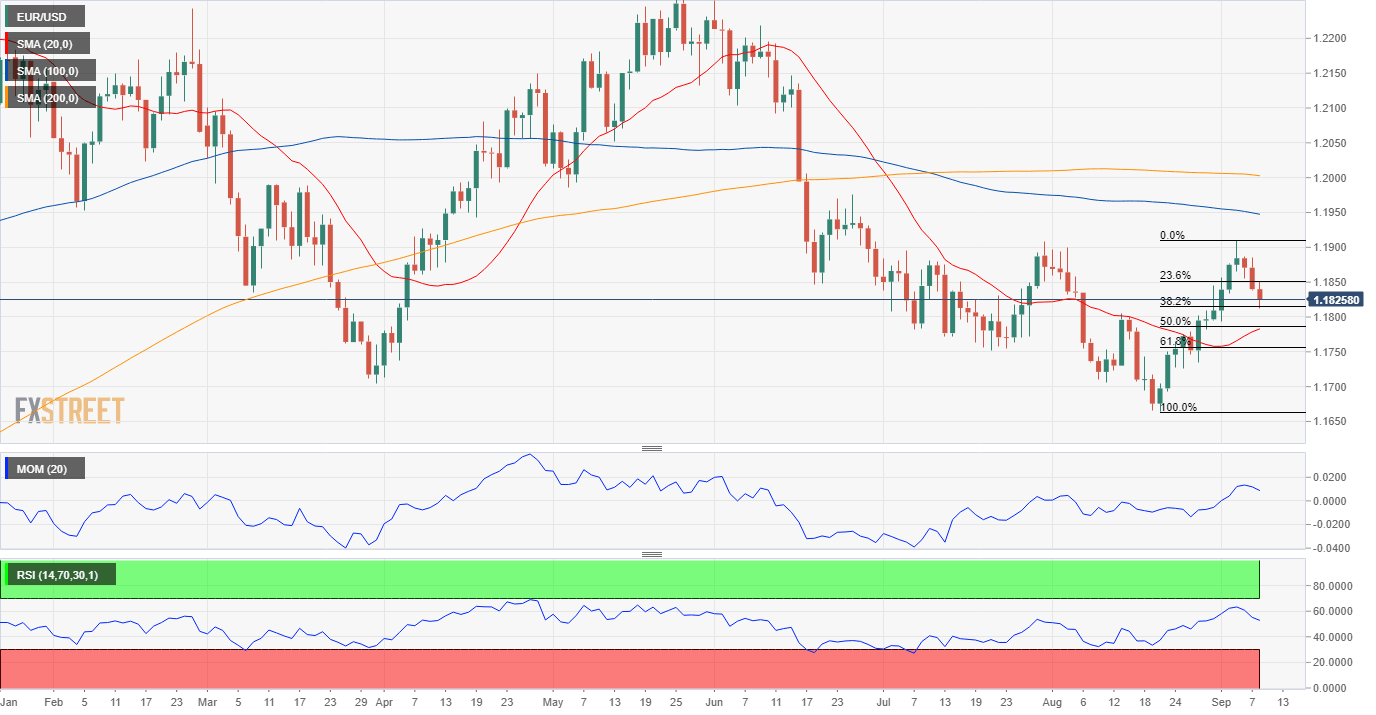

- EUR/USD is in a clear long-term downtrend and could resume its decline sub-1.1800.

The European Central Bank is having a monetary policy meeting on Tuesday, September 9, and market participants are hoping for hints on tapering, although President Christine Lagarde may disappoint them, retaining its cautious tone.

Tapering discussion kicks in

The central bank announced a Pandemic Emergency Purchase Program (PEPP) of €1.85 trillion with the start of the coronavirus pandemic, scheduled to run until March 2020. Like every major central bank, European policymakers aimed to keep borrowing costs low in order to keep credit flowing and support economic growth. The benchmark rate has been trimmed to 0% well before the pandemic started, and chances of a hike are still far away on the horizon.

Back in July, the European Central Bank announced a change in its forward guidance, introducing a “symmetric two per cent inflation target over the medium term,” Clarifying that it does not necessarily imply lower for longer interest rates. According to this latest review, the 2% inflation target has become a ceiling, although it allowed moderated and transitory deviations.

Inflation and growth

Meanwhile, the Consumer Price Index jumped to 3% YoY in August from 2.2% in the previous month, while core inflation doubled from 0.7% to 1.5%. Will or will not the ECB take notice of such high inflationary levels?

Government Council Members have been spreading mixed messages ahead of the event. Most have made hawkish hints, although, on Wednesday, Bostjan Vasle said the EU still needs a ‘highly accommodative monetary policy, as new waves of pandemic may slow recovery. Contradictory to another ECB policymaker, Robert Holzmann, who said that the central bank could normalize monetary policy quicker than expected.

At this point, it seems that the central bank will maintain its ultra-loose policy in place, despite the spike in inflation. However, the tapering discussion will surely be on the table. Whatever policymakers let know about it will set the tone for EUR/USD. Additionally, the ECB is expected to review its inflation and growth forecasts. A better outlook could partially offset a not so hawkish stance from Lagarde & Co.

EUR/USD possible reaction

The EUR/USD pair is in a long-term downtrend, with the latest advance toward 1.1908 still seen as corrective. Now back to battle around the 1.1800 level, the ECB needs to boost the pair beyond the mentioned 1.1908 for the pair to have bullish chances in the mid-term. Unless Lagarde announces a firm intention and a clear path towards retrieving financial support, a 100 pips advance has not many chances.

A more dovish stance is not in the cards, but if it happens, it could be quite a shocker and push the pair lower toward the year low at 1.1663. In any case, if the pair closes the post-ECB decision day sub-1.1800, lower lows for the year are on the table.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.