European Central Bank Preview: More recalibration or actual tightening?

- The European Central Bank is meant to finish the PEPP on March 2022.

- Fresh inflation and growth projections will likely be the main market catalysts.

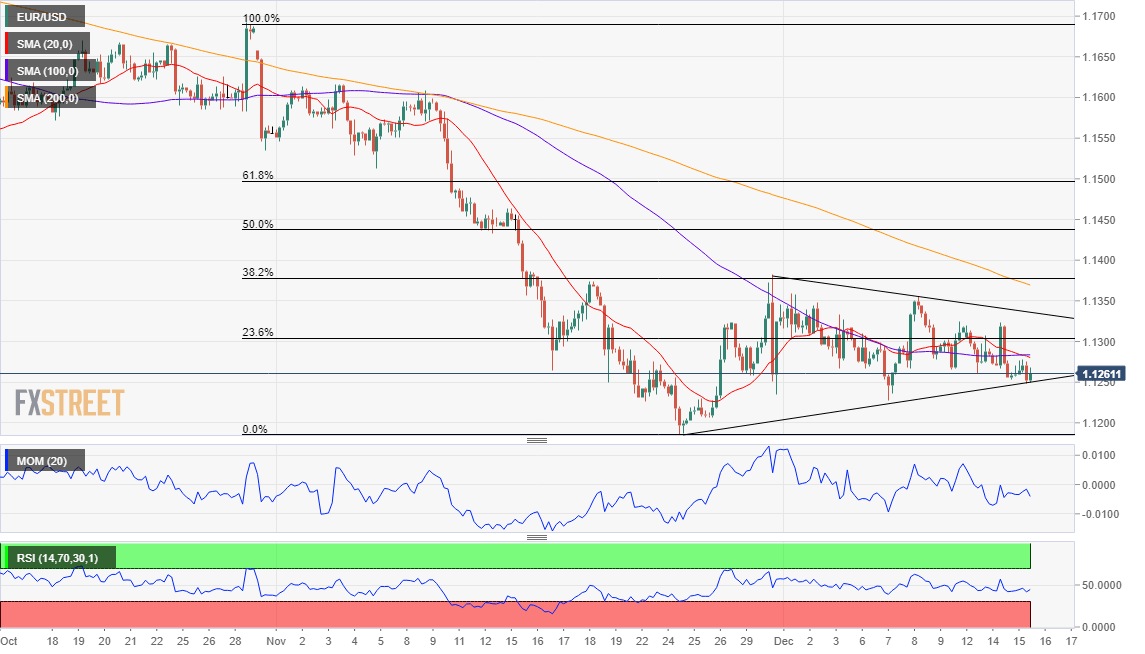

- EUR/USD in a bearish trend and heading towards 1.1000.

The European Central Bank will announce its decision on monetary policy and present fresh economic projections on Thursday, December 16. There’s no doubt that rates will remain unchanged, with the main refi rate, the marginal lending rate and the deposit rate staying at 0%, 0.25% and -0.5% respectively. However, the central bank will offer fresh Economic Projections too. Back in September, the ECB had forecast GDP growth to come in at 5.0%, 4.6% and 2.1% in 2021, 2022 and 2023, respectively. Inflation was expected at 2.2%, 1.7% and 1.5% in the same years.

Recalibrating financial support

Overheating inflation and slowing economic growth have been the main themes in the last quarter of the year, not only in the EU. Several central banks decided to tighten their monetary policies to tame inflation, while the latest outbreak of the Omicron coronavirus strain poses a challenge to progress.

The ECB, however, is among those central banks that are still in wait-and-see mode. President Lagarde & Co. announced in their November statement that “judging on the basis of the current developments, net purchases under the PEPP could be expected to come to an end by March 2022.” The same has been repeated by several members of the central bank these days, while Lagarde noted that they have additional ammunition in the case if further support is needed.

Will they decide to maintain the Pandemic Emergency Purchase Program beyond March 2020? and at what pace of monthly buying? It currently runs at around €60 billion per month, while the Assets Purchase Program (APP) is sized at €20 billion per month.

The ECB is not in the position to abruptly cut off 75% of its financial support, so it could either announce a reduction of the PEPP size post-March 2022, which will hit Lagarde’s credibility, or cut it as expected, but at the same time increase the APP. “Recalibrate.” as Lagarde said a couple of months ago.

The ECB has made it clear that it is “very unlikely” that they would hike rates in 2022, insisting that higher inflation will likely be temporary. Nevertheless, market participants are expecting an upward revision to inflation projections, for this year and the next ones. Growth, on the other hand, can suffer a downward revision as the region is currently struggling with restrictions due to the rapid spread of Omicron. The scenario should be overall bearish for the shared currency.

EUR/USD possible reaction

The EUR/USD pair is on a bearish trend and trading not far from its 2021 low. It seems quite unlikely that, whatever the ECB decide, it can change course. In the rare case the pair surges with the announcement, it can reach 1.1380, a level where sellers are ready to add shorts. It’s yet to be seen where the pair could settle after the US Federal Reserve announcement, but the main bearish target is the 1.1000 threshold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.