Euro-zone PMIs preview: Modest expectations may be too high, three EUR/USD scenarios

- Flash euro-zone PMIs are set to show an improvement in November.

- High expectations may lead to a downfall for EUR/USD.

- Only a substantial surprise has room to lift the common currency.

- ECB's Lagarde's speech may steal the show.

Improvements are all fronts – that is what economists expect from Markit's flash Purchasing Managers' Indexes for November. And these projections may be detrimental for the euro.

The old continent's economy has been growing at a snail's pace in both the second and third quarters – a meager 0.2% in each. Germany, the largest, has barely escaped a recession. The continent's powerhouse's output expanded by a meager 0.1% in the three months ending in September, after shrinking by the same percentage beforehand.

PMIs expected to rise, but remain low

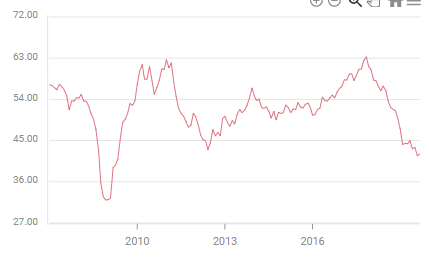

However, investors now expect improvement. The economic calendar shows that forward-looking measures carry expectations for an increase, with Germany's Manufacturing PMI – arguably the most significant figure – is set to advance from 42.1 to 42.9 points.

Nevertheless, even that would be well below the 50-point threshold separating expansion from contraction and would leave the statistic at the lowest levels since 2009.

While France, the euro zone's second-largest economy, is doing better, the composite figure the whole continent is set to increase only to 50.9 – reflecting ongoing dismal growth in the middle of the fourth quarter.

However, while PMIs have been upbeat in the past two months, they have fallen short of expectations in most months this year – and this trend may repeat itself.

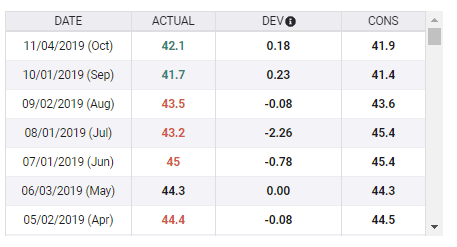

Here are the latest seven German Manufacturing PMI figures, with worse than expected numbers in four cases.

Overall, expectations – which are for a modest increase – may be too high. And that may lead to a downside surprise and a fall for the euro.

Lagarde and Germany

Christine Lagarde, the new President of the European Central Bank, delivers a speech on Friday at 8:00 GMT, minutes before Markit releases its data. If she shocks markets by announcing the need for further immediate monetary policy, the common currency would drop – and markets will likely ignore the PMIs.

Likewise, if she says something along the lines that the ECB has reached its limits, the euro may surge and her words will overshadow the data.

The more likely scenario for Lagarde is that she repeats the bank's call on governments to do more – for Germany to stimulate the economy. The PMIs fit neatly into the debate about the need for an injection of investment by governments.

Some analysts see Germany's escape of a recession as a mixed blessing – as it reduces pressure on Berlin to do more. This logic also applies to the PMIs. If they improve, the largest economy may hold off spending and eventually weigh on the economy. It may also push the ECB to add monetary stimulus – such as additional bond-buying – thus eventually hurting the common currency.

Three scenarios for EUR/USD

1) Within expectations: If the consensus of economists is correct, the improvement in growth prospects leaves them at low levels. It may even prove for German hawks that fiscal stimulus is unnecessary, and that may further weaken the euro.

Euro/dollar may tick down as the ongoing economic malaise is set to continue. This scenario has a medium-high probability.

2) Below expectations: After several disappointments earlier in the year, this scenario has a high probability and would send the euro significantly lower.

While it may encourage Germany to open the purse strings, fears of a recession may take over hopes for a fiscal boost.

3) Above expectations: After two positive surprises in previous months, an upbeat figure cannot be ruled out, but the chances are low.

In this case, EUR/USD would have room to rise and recover amid hopes that the worst is behind us and that Europe may be on course to returning to healthy growth.

Conclusion

November's PMIs are significant for the euro. Markets expect improvement but these expectations may be too high. The reaction also depends on a speech by ECB President Lagarde, taking place at the same time, that may steal the show. EUR/USD may drop in two out of three scenarios.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.