Euro slides, left seizes French election vote

DXY, bond yields ease; US jobless rate climbs

Summary:

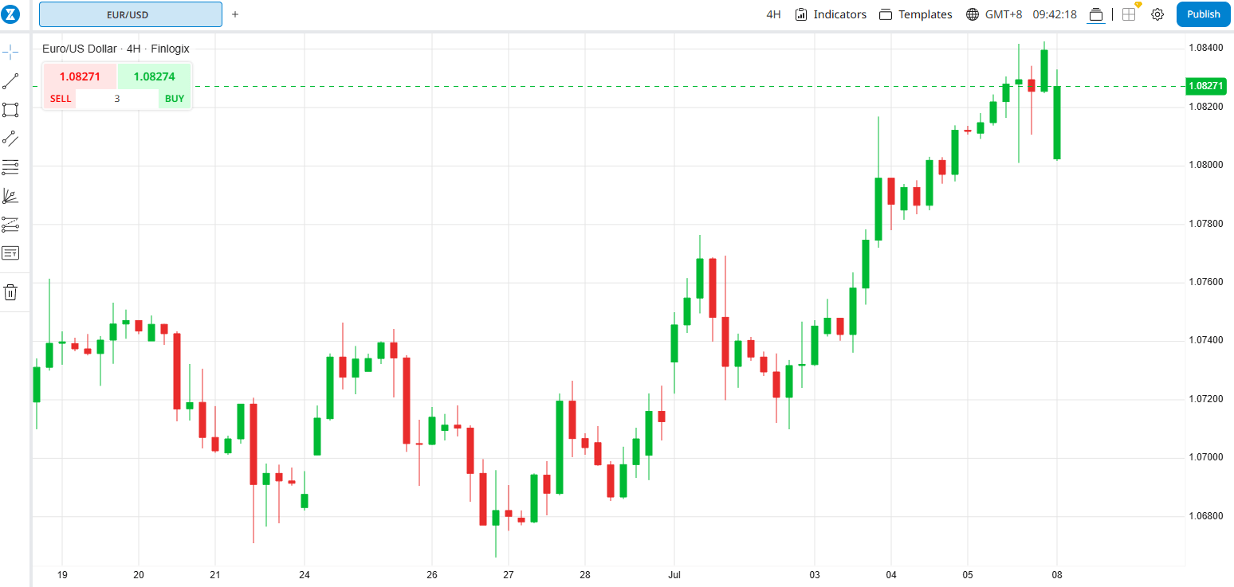

Financial markets were set for a choppy opening following news that the leftist coalition had won the French election. After edging higher in New York, the Euro slid 0.3% lower to 1.0805 from its 1.0840 close.

The shared currency fell following initial projections in France’s legislative elections which showed that the leftist alliance was heading for a shock victory. The New Popular Front whose campaign for a sharp increase in government spending unsettled investors.

The Euro also lost ground against the other major currencies. The EUR/JPY cross slumped 0.5% to 173.77 (174.35 Friday), while EUR/GBP dipped 0.36% to 0.8445 (0.8473).

In the UK, a win by the center-left Labor Party in the parliamentary election saw some analysts suggesting the political shift could benefit the British Pound. The Labor Party has advocated economic stability as a priority and committed to closely stick to strict spending guidelines.

Sterling (GBP/USD) soared to settle at 1.2814 from 1.2760 Friday, its highest level in nearly a month. After 14 years of Conservative leadership, markets saw the Labor victory as reviving Britain’s role as a haven amidst political uncertainty in other regions.

Elsewhere, Friday’s US Payrolls report saw the Jobless Rate climb to 4.1% from 4.0%, which weighed on the Greenback. While Payrolls gained to 206K, beating forecasts of 190K, it was lower than 272K previously. Previous Payrolls data were also revised lower.

The downward revisions reinforced expectations that the Fed would cut rates by 25 basis points twice in 2024. The Dollar Index (DXY), which gauges the value of the Greenback against a basket of 6 major currencies, eased 0.24% to 104.87 (105.15).

The benchmark US 10-year treasury yield dropped 8 basis points to finish at 4.28% (4.36%). Germany’s 10-year Bund yield settled at 2.55%, down from 2.60% previously.

Against the Japanese Yen, the US Dollar fell 0.49% to 160.78 from 161.23 Friday. Lower US bond rates weighed on the USD/JPY pair. Rising risk aversion also supported the Japanese currency.

The Australian Dollar (AUD/USD) edged higher against the Greenback to finish at 0.6737 from 0.6727 previously. The Greenback eased modestly against the Asian and Emerging Market currencies (USD/EMFX).

USD/CNH (Dollar-Offshore Chinese Yuan) closed at 7.2870, from 7.2925 Friday. Against the Singapore Dollar, the Greenback (USD/SGD) slipped to 1.3492 (1.3512). The USD/THB pair slumped to 36.47 from 36.65 Friday.

Other economic data released Friday saw Germany’s Industrial Production fall to -2.5% from -0.1% previously, and lower than estimates at 0.2%.

The Eurozone’s Retail Sales dropped to 0.1%, lower than forecasts at 0.2%. US June Non-Farms Payrolls climbed to 206K, beating expectations at 190K, but lower than 272K previously.

- EUR/USD – The Euro initially rallied to 1.0840 from 1.0812 in late New York Friday before sliding to 1.0805 currently in early Asia. Election results in France which saw the leftist alliance heading for victory, weighed on the shared currency.

- USD/JPY – Against the haven Japanese Yen, the Greenback slumped 0.5% to 160.78 (161.23). In another choppy trading session, the USD/JPY pair traded to an overnight high at 161.39 before easing. The overnight low recorded was 160.31.

- GBP/USD – The British Pound gained versus the US Dollar, settling at 1.2793 from 1.2760 Friday. Sterling soared to an overnight high at 1.2817 before easing to its New York close. The British Pound traded to an overnight low at 1.2755.

- AUD/USD – The Aussie Dollar climbed against the Greenback to 0.6737 (0.6727). Overnight, the AUD/USD pair soared to a high at 0.6753 before easing. The Australian Dollar traded to an overnight low at 0.6709. The EUR/AUD pair slumped to 1.6045 from 1.6075 on Friday.

On the lookout:

The week begins with a light economic calendar. Japan kicks off with its Average Cash Earnings for May (f/c 2.1% from 2.1% - ACY Finlogix), Japanese May Current Account (f/c +JPY2450 billion from +JPY2051 billion – ACY Finlogix).

Australia follows with its Australian May Home Loans (m/m f/c 2% from 4.3% - ACY Finlogix), Australian May Investment Lending for Homes (f/c 4.5% from 5.6% - ACY Finlogix). Germany starts off Europe with its German May Balance of Trade (f/c +EUR 20.3 billion from +EUR 22.1 billion – ACY Finlogix).

Next up is the Eurozone Sentix Investor Confidence Index (f/c -0.6% from 0.3% - Forex Factory). The UK releases its BRC June Like-for-Like Retail Sales (y/y f/c 0.2% from 0.4% - FX Street). The US rounds up today’s economic data releases with its May Consumer Credit Change (f/c USD 8.65billion from USD 6.4billion – FX Street).

Trading perspective:

The Dollar eased against most of its Rivals as US treasury yields fell. The exception was the Euro (EUR/USD) following early reports of a sharp victory for the leftist coalition. Expect Asian markets to start on a choppy note with the focus on Europe and the French Parliamentary election. In the UK, a Labor win lifted the British Pound against the Greenback and other currencies, particularly those of Europe.

Key events that lie ahead this week are Fed Chair Jerome Powell’s semi-annual monetary policy address to Congress as well as US CPI, PPI and July Michigan Consumer Sentiment.

- EUR/USD – Look for a choppy start to the shared currency. Traders will be focused on developments in France on the Parliamentary Election results. The Euro has immediate support at 1.0780 followed by 1.0750 and 1.0720. Immediate resistance can be found at 1.0840, followed by 1.0870 and 1.0900. Look for a volatile start in the Euro today. Likely range: 1.0740-1.0840. Tin helmets on, watch the developments, trade the range.

GBP/USD – Sterling benefitted from the Labor win following 14 years of Conservative leadership. Political uncertainty in the rest of Europe will see the British Pound as a haven, providing support for Sterling against its European counterparts. The British Pound has immediate resistance at 1.2820 followed by 1.2850. Immediate support can be found at 1.2770 and 1.2740. Likely range today: 1.2730-1.2830. Trade the range.

USD/JPY – The US Dollar slumped against the Japanese Yen to 160.78 from 161.23 Friday. Immediate support today lies at 160.40 (overnight low traded was 160.30). The next support level is found at 160.10 followed by 159.80. On the topside, look for immediate resistance at 161.10, 161.40 and 161.70. Likely range today: 160.30-161.30.

Trade the range. Any buildup of turmoil in Europe could see flows into the Japanese Yen.

AUD/USD – The Aussie Battler settled at 0.6737, up modestly from 0.6727 Friday. Look for immediate resistance today at 0.6740 followed by 0.6770 and 0.6800. Immediate support can be found at 0.6710 (overnight low traded was 0.6709). The next support level lies at 0.6690 followed by 0.6660. Look for the Aussie to consolidate in a likely range today between 0.6675-0.6775. Trade the range.

Have a good week ahead all, happy trading.

Author

Michael Moran

ACY Securities

Michael has over 40 years’ FX experience, including running FX trading desks for some of the largest banks in the world.