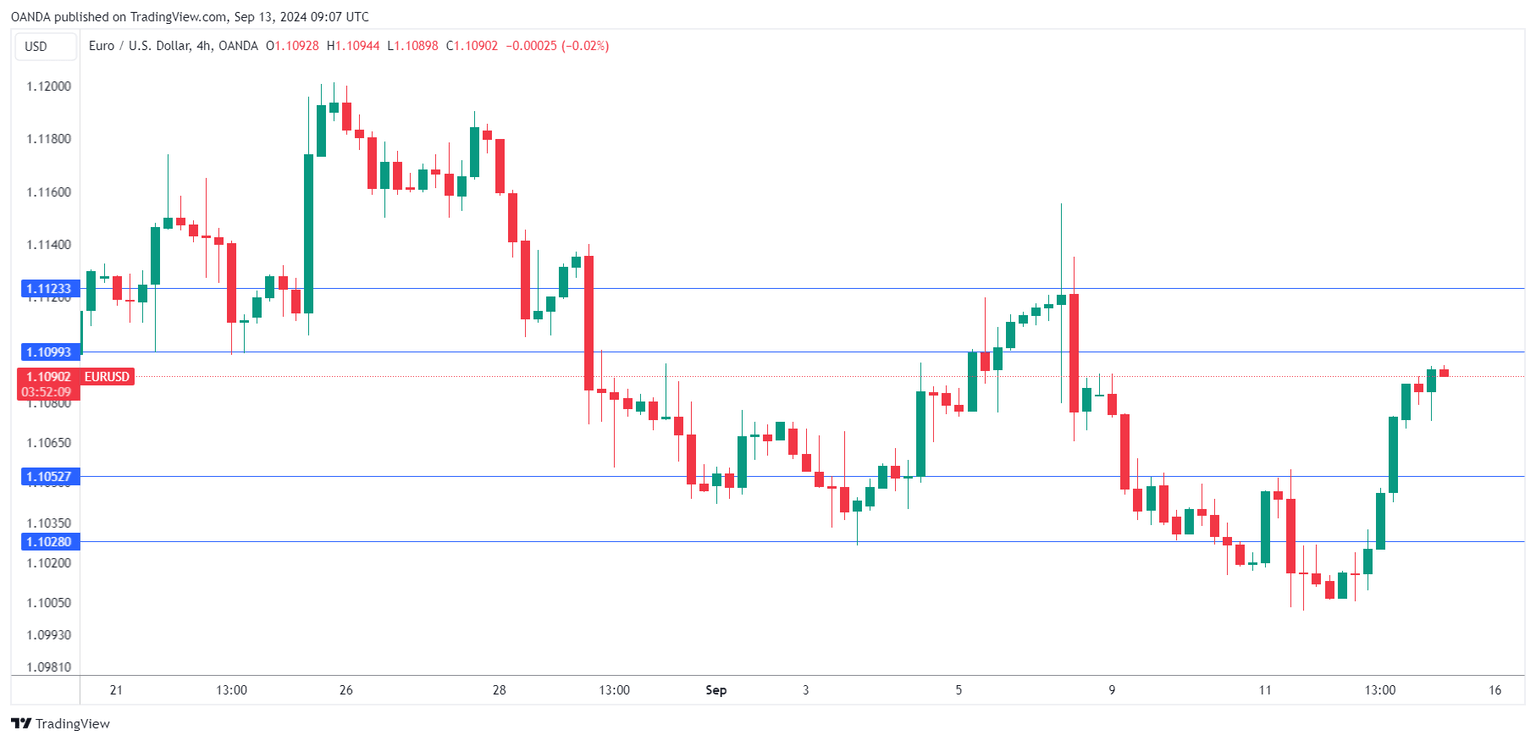

Euro rises after ECB cuts interest rates

The euro has extended its gains on Friday. EUR/USD is trading at 1.1091 in the European session at the time of writing, up 0.13% today. The euro has climbed 0.7% since the ECB’s rate cut on Thursday.

ECB lowers rates to 3.5%

The European Central Bank delivered as expected on Thursday, trimming the key interest rate by 25 basis points to 3.5%. This was the second rate cut in the current rate-lowering cycle, as the ECB responded to falling inflation and a deteriorating eurozone economy.

The war against inflation is largely won, which enabled the ECB to deliver the rate cut. Inflation in the eurozone has dropped to 2.2%, close to the target of 2%. The ECB updated inflation forecast was unchanged from June, with inflation expected to average 2.5% in 2024 and 2.2% in 2025

At a press conference, ECB President Lagarde reiterated that rate decisions would be made “meeting by meeting” based on economic data, essentially ditching forward guidance. Lagarde sounded somewhat hawkish, noting that wage growth remains high and the labor market is still resilient. The ECB is being cautious and has signaled it will take a slow approach to further cuts and the markets are looking at a cut in December. If economic conditions suddenly worsen, the central bank would have to consider a rate cut next month.

The Federal Reserve meets next week and rate cut odds continue to swing wildly. The US producer price index eased to 1.7% y/y in August, down from a downwardly revised 2.1% in July and below the market estimate of 1.8%. This sent the odds of a half-point cut soaring to 41%, up from just 13% yesterday, according the CME’s FedWatch. The Fed meeting is live, with plenty of uncertainty as whether the Fed will cut by 25 or 50 basis points.

EUR/USD technical

-

EUR/USD faces resistance at 1.1099 and 1.1123.

-

There is support at 1.1052 and 1.1028.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.