Euro jumps after upbeat manufacturing and services PMI data

The euro jumped today after Markit released upbeat economic numbers from Europe. According to Markit, the manufacturing PMI in the eurozone jumped to 46.9 this month from the previous 39.4. This was the highest it has been in four months. The services PMI rose from the previous 30.5 to 47.3, which was also the highest it has been since February. As a result, the composite PMI rose to 47.5 from the previous 31.9. The growth in manufacturing and services sectors was widespread across the region. The manufacturing PMI in France and Germany rose to 52.1 and 44.6, respectively. A PMI figure above 50 is usually a sign that the sector is improving.

The British pound was little changed against the US dollar even after positive developments from the UK. Data from Markit and CIPS showed that the manufacturing PMI rose to 50.1 in June from the previous 40.7. The important services PMI rose to 47.0 from the previous 29.0. The improvement happened as more people went out shopping as the country reopened. The sector is likely to continue improving after Boris Johnson unveiled plans to reopen some key sectors like restaurants, pubs, and museums. Other data showed that retail sales jumped during the month.

Global stocks rose today as hopes of a V-shaped recovery around the world. In a statement yesterday, Steve Schwarzman, the founder and CEO of Blackstone Group said that he expected a V-shaped recovery in the next few months. The same sentiments have been repeated by other investors like Jim Chanos and Bill Ackman. The numbers released today by Markit show that this is possible. Still, the biggest concern is that new infection cases in the United States are rising. Yesterday, the country confirmed more than 26,558 new cases, which is higher than the 16,000 that were confirmed a month ago.

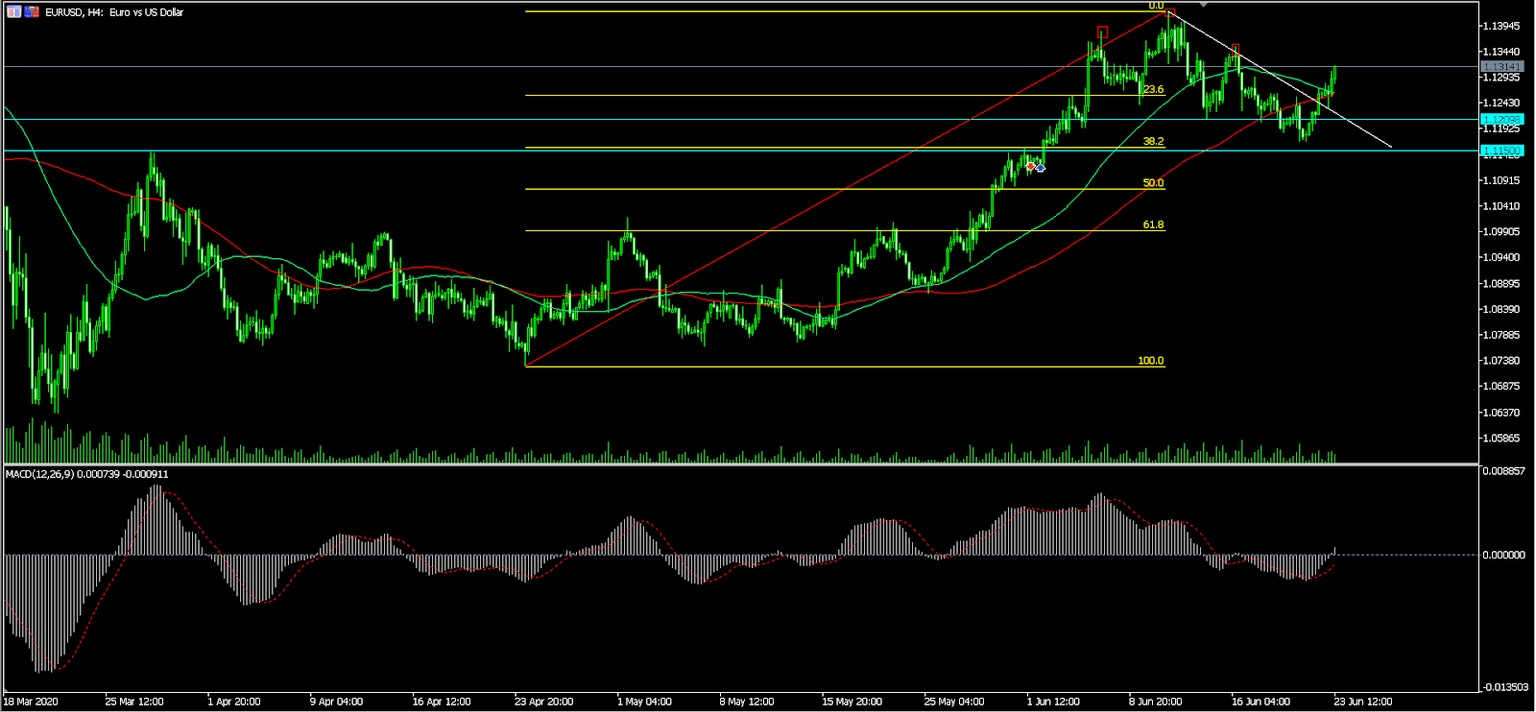

EUR/USD

The EUR/USD pair rose to an intraday high of 1.1311, which is the highest it has been since June 16. On the four-hour chart, the price is above the 50-day and 100-day exponential moving averages. Also, the histogram of the MACD has moved from the lower side. Most importantly, the pair has moved above the descending trendline shown in white. This implies that the price will continue rising as bulls attempt to retest last week’s high of 1.1417.

XBR/USD

The XBR/USD pair rose to an intraday high of 44.0, which is its highest level since early March. The price is above the 50-day and 100-day exponential moving averages on the daily chart. It is also above the resistance line of the ascending triangle pattern and is approaching the 50% Fibonacci retracement level. This means that the pair may continue rising as bulls attempt to test the next resistance at 45.

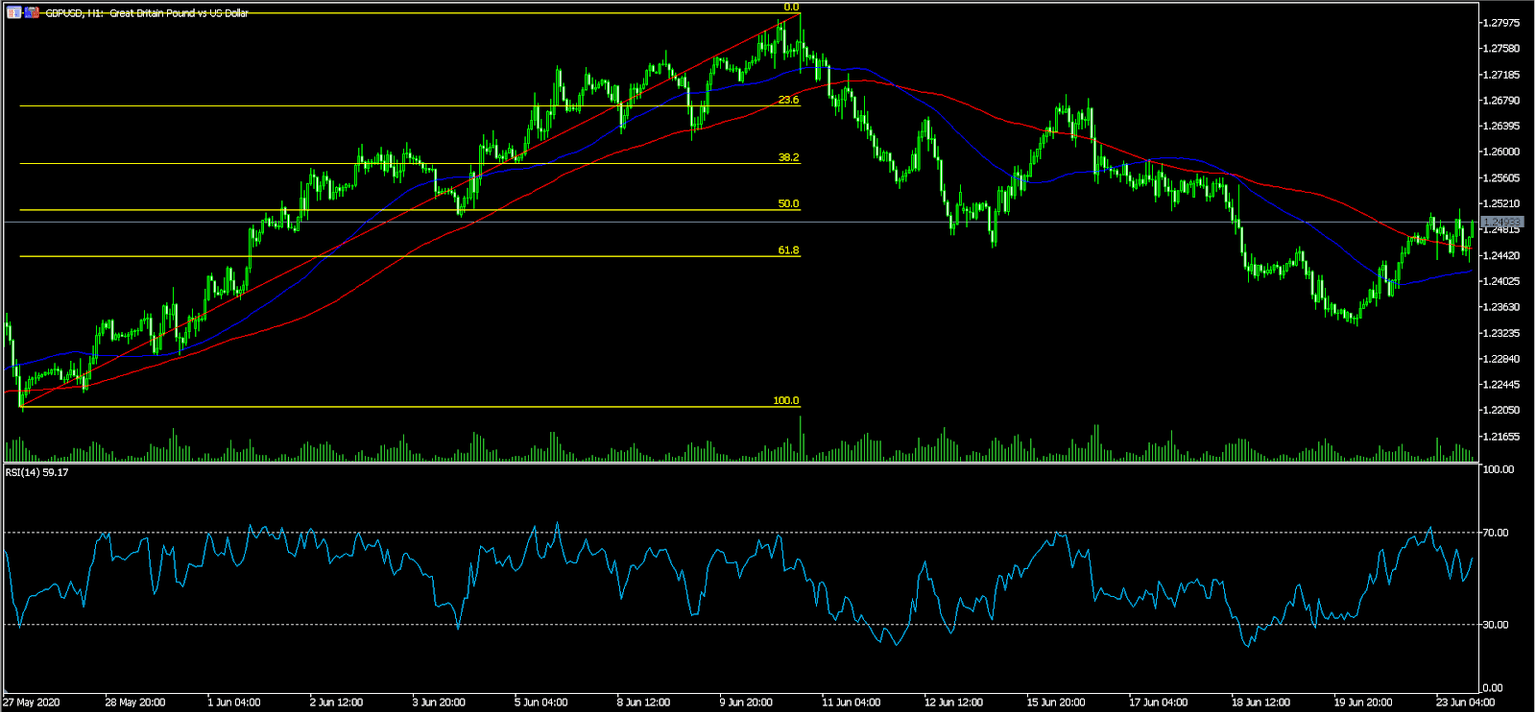

GBP/USD

The GBP/USD pair was little changed today as traders reacted to UK PMI numbers. The pair is trading at 1.2488, which is higher than yesterday’s low of 1.2431. On the daily chart, the price is slightly below the 50% Fibonacci Retracement level. It is also slightly above the 50-day and 100-day exponential moving averages. The RSI is slightly below the overbought level of 70. Therefore, the pair may continue rising as bulls target levels above 1.2500.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.