Euro edges higher as PMIs show improvement

- German, Eurozone PMIs accelerate.

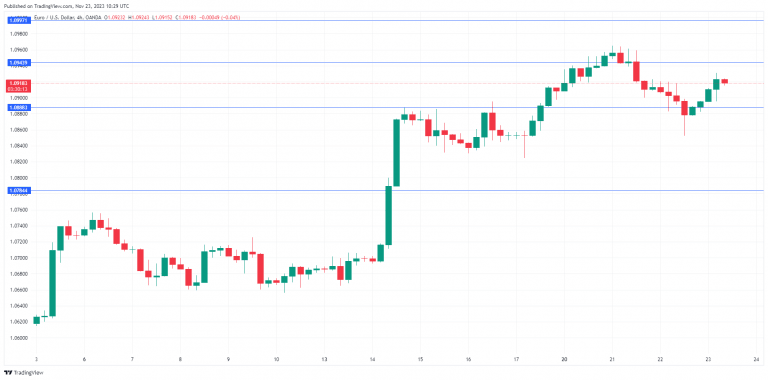

The euro is trading slightly higher on Thursday. In the European session, EUR/USD is trading at 1.0917, up 0.27%.

German PMIs accelerate but still in decline

German PMIs were released earlier today, presenting a cup-half-full-half-empty picture. Let’s start with the good news. German Manufacturing PMI hit a six-month high and the Services PMI a two-month high and both beat the forecasts. However, both manufacturing and services remain in contraction, as the eurozone’s largest economy continues to sputter.

The Manufacturing PMI rose to 42.3 in November (Oct: 40.8) and beat the consensus estimate of 41.2. Services PMI climbed to 48.7 in November (Oct: 41.2) and edged above the market consensus of 48.5. Manufacturing has been in decline since June 2022 and services has posted four declines.

The downturn in the struggling German economy has eased a bit and that bit of positive news has given the euro a slight boost today. The eurozone PMIs also showed a slight improvement but remain in contraction territory.

The soft PMIs suggest that growth in Germany and the eurozone will likely continue to slow, and that could mean disappointing GDP prints for the fourth quarter. Germany’s economy is expected to contract by 0.3% in 2023, while the eurozone is expected to grow by 0.6%. Germany, which not too long ago was a global economic powerhouse, is looking more like the sick man of Europe.

US markets are closed for Thanksgiving, which means we’re unlikely to see much movement with the US dollar. That could change on Friday, with the release of US manufacturing and services PMIs. The consensus estimates for November stand at 49.8 for manufacturing (Oct: 50.0) and 50.4 for services (Oct. 49.8). An unexpected reading from either PMI could shake up the US dollar.

EUR/USD technical

-

EUR/USD is testing resistance at 1.0888. Above, there is resistance at 1.0943.

-

1.0831 and 1.0784 are providing support.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.