With stocks stabilizing after yesterday's slide, the US dollar traded higher against all of the major currencies. Part of the strength can be attributed to a larger than expected rise in non-manufacturing activity. Service sector activity expanded at its fastest pace since November according to ISM and the business activity index rose to its highest level in 13 years. But there was weakness underneath the surface with the employment index falling to an 8 month low and the prices index slipping to its lowest since 2017. In other words, job growth and inflation are slowing. These reports show the vulnerability of the US economy and the likelihood of a weaker NFP on Friday. New home sales rebounded in December but the improvement was offset by a revision to the January report that erased nearly half the gain. ADP will be released tomorrow along with the Federal Reserve's Beige Book and while some of the Fed districts could report some improvements related to confidence, the only thing that matters this week are jobs. If ADP comes in decent, which means anything greater than 175K, the dollar could hold onto its gains with USD/JPY prime for a stronger break of 112. However if ADP reports job growth less than 150K or NFPs rise less than 150K on Friday, the gains we've seen in USDJPY could evaporate quickly.

EUR/USD, which had been holding above 1.13 finally broke through this support level to fall to its weakest level in 2 weeks. This was despite an upward revision to EZ PMIs and the rebound in consumer spending. The problem for the euro is that despite these data improvements, the European Central Bank is still thinking about more stimulus and increasing the supply of cheap money. A new targeted long term refinancing operation is expected sometime in the next 2 to 3 months and the sooner they commit to it, the more pressure there must be to boost growth.

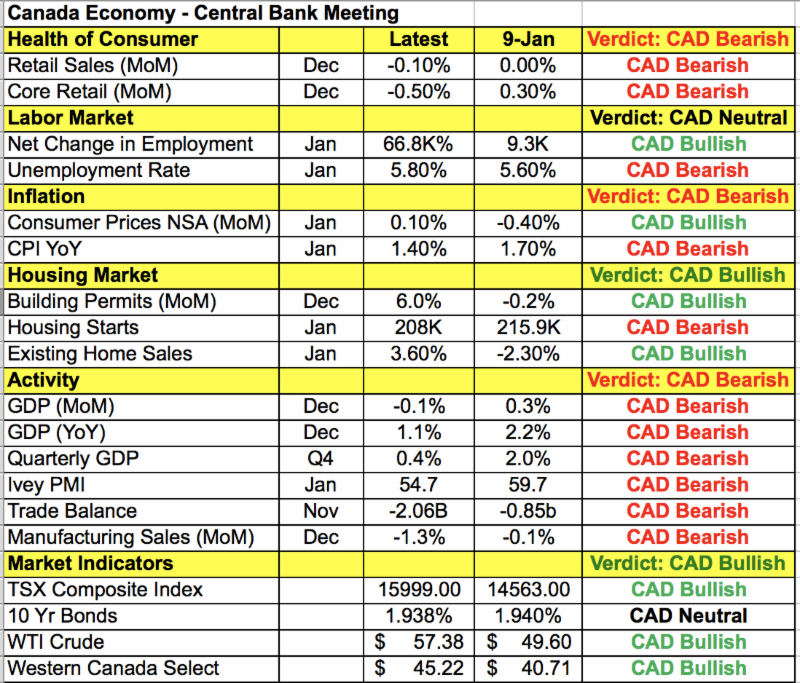

The focus shifts to the Canadian dollar with the Bank of Canada making a monetary policy announcement tomorrow. The Bank of Canada also has a lot to consider this month because while the labor market is strong the rest of the economy is weak. When the central bank last met, they lowered their GDP and inflation forecasts. These changes were validated by the latest reports, which showed quarterly GDP growth slowing to 0.4% from 2%. Annualized CPI growth also dropped to its weakest level in more than a year. At the same time, oil prices are recovering and the Federal Reserve appears to be slowing their pace of tightening. We don't expect the Bank of Canada to change their policy stance but having raised interest rates 3 times last year, they are in no position to do so at this time again. USD/CAD is trading at its highest level in more than a month ahead of the rate decision and a dovish outlook could send it to 1.34. The IVEY PMI report will be released alongside the Bank of Canada's rate decision and this report takes on increased importance ahead of Friday's employment report.

The Reserve Bank of Australia's monetary policy announcement had a limited and short-lived impact on the Australian dollar. In a matter of seconds, AUD/USD spiked higher and retreated lower after the central bank said the pickup in inflation will be gradual and an unchanged policy is what they need to keep growth and CPI on track. Later this afternoon, RBA Governor Lowe will shed more light on their outlook. Economic data continues to improve with the services index rebounding and the current account balance shrinking. Fourth quarter GDP numbers are also due for release tonight and the improvement in trade leads us to believe that the pace of growth accelerated towards the end of the year. The New Zealand dollar on the other hand extended its losses despite reports of higher dairy prices, commodity prices and house prices.

Last but not least, sterling ended the day unchanged despite a significantly better manufacturing PMI report. Services activity accelerated towards the end of the year, taking the composite index back up to 51.5 from 50.3. However data continues to be overshadowed by Brexit and panic about the possibility of no deal is growing. The UK is asking for backstop guarantees but the EU doesn't want to budge. Time is running out, there's still a lot of work to do and the government is also making contingencies in the event of a no deal Brexit by asking the EU to secure citizen rights, something they had asked for last week as part of a "mini-deal" that was swiftly rejected.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD gains ground above 0.6300 ahead of Chinese data

The AUD/USD pair gathers strength to near 0.6325 during the early Asian session on Monday. The uptick of the pair is bolstered by the weaker US Dollar and special plans from the Chinese government to boost consumption and raise incomes.

EUR/USD: A move to 1.1000 re-emerges on the horizon

EUR/USD enjoyed a broadly upbeat run last week, extending its strong recovery and briefly surpassing the 1.0900 handle to reach multi-month highs. Although the rally lost some momentum as the week wore on, the pair still ended with a solid performance on the weekly chart.

Gold: Bulls act on return of risk-aversion, lift XAU/USD to new record-high

Gold capitalized on safe-haven flows and set a new record high above $3,000. The Fed’s policy announcements and the revised dot plot could influence Gold’s valuation. The near-term technical outlook suggests that the bullish bias remains intact.

Week ahead: Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears.Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

Week ahead – Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears. Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.