Hello Fellow Traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURNZD published in members area of the website. We’re going to explain the forecast and Elliott Wave Pattern. Before we take a look at the real market expample of Expanded Flat, let’s explain it in a few word.

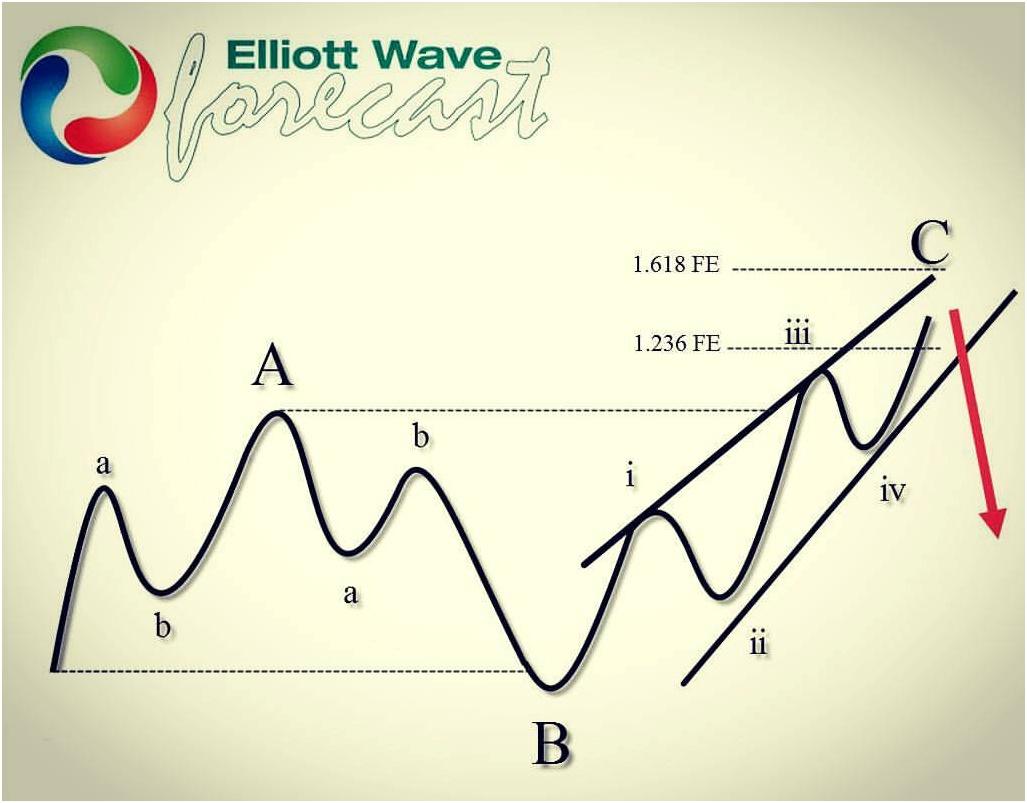

Elliott Wave Expanded Flat is a 3 wave corrective pattern which could often be seen in the market nowadays. Inner subdivision is labeled as A,B,C , with inner 3,3,5 structure. Waves A and B have forms of corrective structures like zigzag, flat, double three or triple three. Third wave C is always 5 waves structure, either motive impulse or ending diagonal pattern. It’s important to notice that in Expanded Flat Pattern wave B completes below the start point of wave A, and wave C ends above the ending point of wave A which makes it Expanded. Wave C of expanded completes usually close to 1.236 Fibonacci extension of A related to B, but sometimes it could go up to 1.618 fibs ext.

At the graphic below, we can see what Expanded Flat structure looks like.

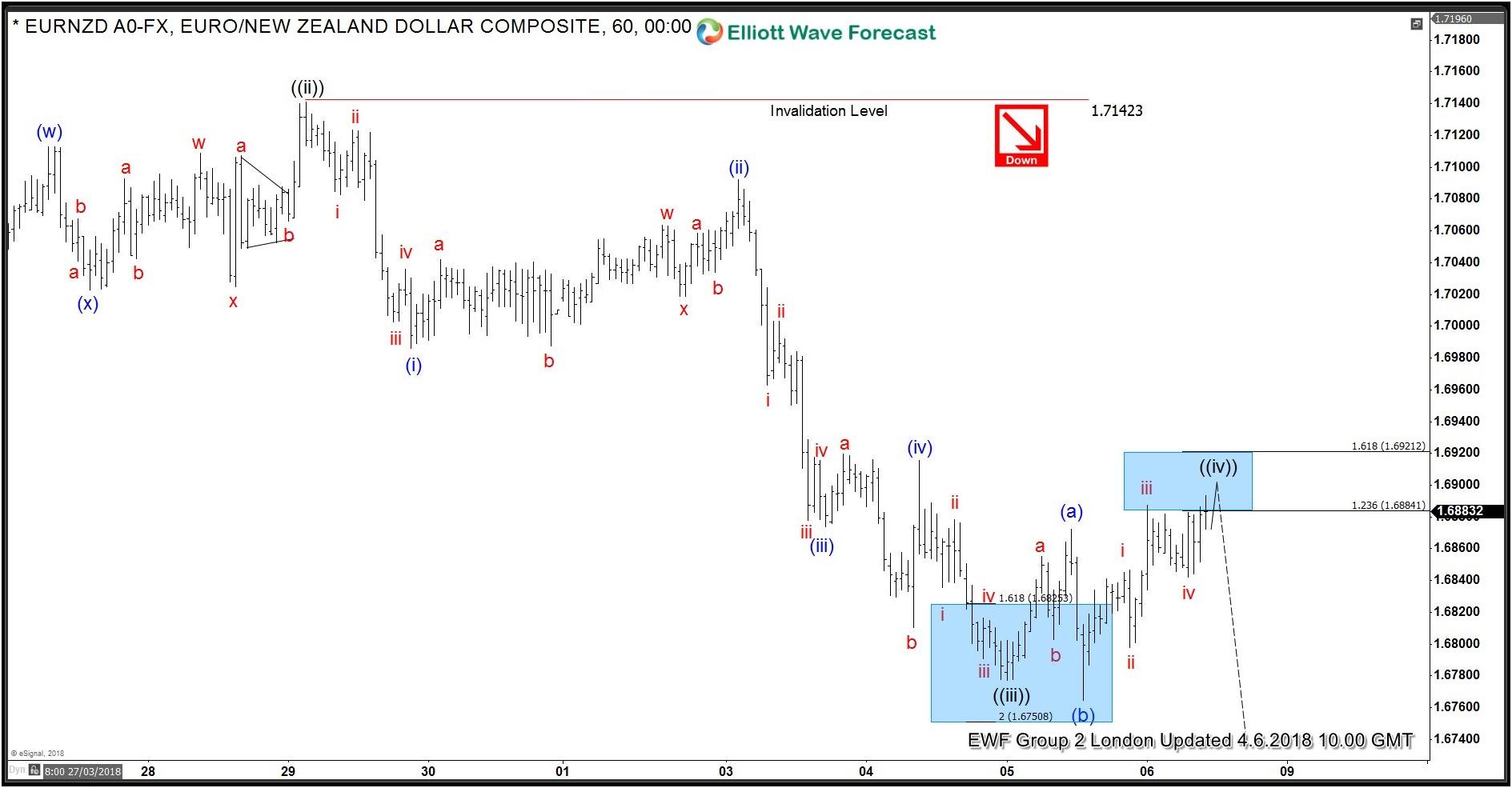

EURNZD Elliott Wave 1 Hour Chart 04.06.2018

As our members know, we’re labeling short term cycle from the 1.71645 peak as 5 waves structure. Wave ((ii)) ended at 1.71423 high and now the pair remains is correcting short term cycle against that peak. As far as proposed pivot stays intact we should ideally see another leg lower in wave ((v)). Currently wave ((iv)) recovery is in progress. It’s unfolding as Elliott Wave Expanded Flat structure, with inner labeleing (a)(b)(c) blue. As we can see wave (b) has broken below the start point of wave (a),while wave (c) has broken above ending point of wave (a) which makes this structure Extended. Currently the pair is ending wave (c) as 5 waves rally from the low. The pair is expected to find sellers at 1.6884-1.6921 area for another leg lower wave ((v)) . Keep in mind not every char is Trading Signal. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Eventually EURNZD has found sellers at proposed area :1.6884-1.6921 and gave us decline in wave ((v)). On April 10th, the pair has made the new low as we expected.

Become a Successful Trader and Master Elliott Wave like a Pro. Start your Free 14 Day Trial at - Elliott Wave Forecast.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0500 ahead of ECB policy announcements

EUR/USD stretches higher above 1.0500 in the European session on Thursday amid a broad US Dollar retreat. However, the upside could be capped amid expectations for more ECB rate cuts in 2025. ECB policy announcements and Lagarde's press conference are on tap.

GBP/USD rebounds toward 1.2800 as US Dollar retreats

GBP/USD recovers its recent losses and heads toward 1.2800 in the European morning on Thursday. The pair bounces as the US Dollar corrects downwards after breaking its four-day winning streak despite higher US Treasury yields. Focus shifts to US PPI and Jobless Claims data.

Gold price sits near one-month high on Fed rate cut optimism and softer USD

Gold price seems to have stabilized following good two-way price swings and trades around the $2,720 area during the early European session, just below the highest level in more than a month touched earlier this Thursday.

European Central Bank set to cut interest rates again amid slow economic growth

The European Central Bank is expected to cut benchmark interest rates by 25 bps at the December policy meeting. ECB President Christine Lagarde’s presser will be closely scrutinized for fresh policy cues.

BTC faces setback from Microsoft’s rejection

Bitcoin price hovers around $98,400 on Wednesday after declining 4.47% since Monday. Microsoft shareholders rejected the proposal to add Bitcoin to the company’s balance sheet on Tuesday.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.