EUR/USD Weekly Forecast: US inflation and Fed’s decision coming up next

- The European Central Bank delivered a hawkish rate cut, hinting at no action until September.

- The US Federal Reserve will likely stay put when policymakers meet next week.

- EUR/USD keeps losing upward strength, the bearish case builds up.

The EUR/USD pair is finishing a third consecutive week little changed at around 1.0820, and after meeting sellers near 1.0900 for a fourth straight week. Different first-tier events fell short of triggering directional strength around the pair, as investors are still uncertain about what the future may bring. Will central banks act in a timely manner to prevent economic meltdowns, or will moving too soon result in resuming inflationary pressures? One clear thing is that policymakers have already made their bets, and seem willing to stick to them. However, more is needed to shed light on the future.

European Central Bank trims interest rates

The European Central Bank (ECB) announced its decision on monetary policy on Thursday. As widely anticipated, the central bank trimmed interest rates by 25 basis points (bps) each, with the interest rates on the main refinancing operations, the marginal lending facility, and the deposit facility coming down to 4.25%, 4.5%, and 3.75%, respectively.

But it was what the market considered a hawkish cut, as President Christine Lagarde and Co. cooled down expectations for another interest rate cut in July, emphasising that future decisions will depend on upcoming data. In fact, Lagarde said more data will be available when they have projection meetings, suggesting that they may opt to cut interest rates again only in September.

In updated macroeconomic projections compared with the March meeting, the real Gross Domestic Product (GDP) growth outlook has been revised up for 2024, marginally down for 2025 and maintained unchanged for 2026. Regarding inflation, policymakers upwardly revised their projections to 2.5% in 2024 and to 2.2% in 2025, leaving the 2026 perspective unchanged at 1.9%.

The EUR/USD pair met near-term demand with the statement but held below the 1.0900 threshold as the news were pretty much in line with the market’s expectations.

US employment ahead of CPI, Fed

In the United States (US), the focus was on employment. The country released the April Job Openings and Labor Turnover Survey (JOLTS) report, which showed that the number of job openings on the last business day of the month stood at 8.059 million, below the downwardly revised 8.355 million posted in March. Additionally, the Automatic Data Processing (ADP) survey indicated that the private sector created 152K new positions in May, below the 173K anticipated by market players and easing from the previous 188K. More relevant, the ADP report showed annual pay was up 5%. Also, Initial Jobless Claims increased by 229K in the week ending May 31, worse than the 220K anticipated and above the previous weekly raise of 221K.

Finally on Friday, the US published the May Nonfarm Payrolls report. The US Bureau of Labor Statistics (BLS) reported that the economy added 272K new employees in the month, much higher than the 185K expected. Furthermore, the Unemployment Rate rose to 4% from 3.9% in April, while the Labor Force Participation Rate declined to 62.5% from 62.7%. Finally, Average Hourly Earnings rose 4.1% YoY and 0.4% MoM, surpassing expectations.

The US Dollar soared with the news, and EUR/USD retreated towards the 1.0820 price zone after repeatedly failing to extend gains beyond 1.0900. The news basically grants no interest rate cuts by the Federal Reserve (Fed), as inflation remains hot while the labor market is tight.

Federal Reserve to stay pat

The Federal Open Market Committee (FOMC) will undergo a two-day meeting next week, to finally announce its decision on monetary policy on Wednesday. Policymakers pushed back lossening the monetary policy amid persistent inflationary pressures. Ahead of the event, market participants do not expect any action until September, meaning the benchmark interest rate is foreseen steady at the 5.25% - 5.50% range for a seventh consecutive meeting.

The Fed has a dual mandate: to achieve maximum employment and keep inflation under control. Ahead of the central bank’s announcement, the country will release the May Consumer Price Index (CPI) on Wednesday, foreseen at 0.2% MoM and 3.4% YoY. However, it is worth reminding Fed officials do not base their decision on these figures.

Instead, they look at the Personal Consumption Expenditures (PCE) Price Index. Last week, the US Bureau of Economic Analysis (BEA) reported that inflation, as measured by the PCE, held steady at 2.7% Yoy in April, while the core annual reading printed at 2.8%, matching expectations. On a monthly basis, PCE inflation rose 0.3%, as expected, although the core figure came in at 0.2%, slightly below forecast.

Next week’s macroeconomic calendar will include the German Harmonized Index of Consumer Prices (HICP) for May and the US Producer Price Index (PPI) for the same month. Finally, the US will release the preliminary estimate of the June Michigan Consumer Sentiment Index on Friday, foreseen at 73.0 following a reading of 69.1 in May.

EUR/USD technical outlook

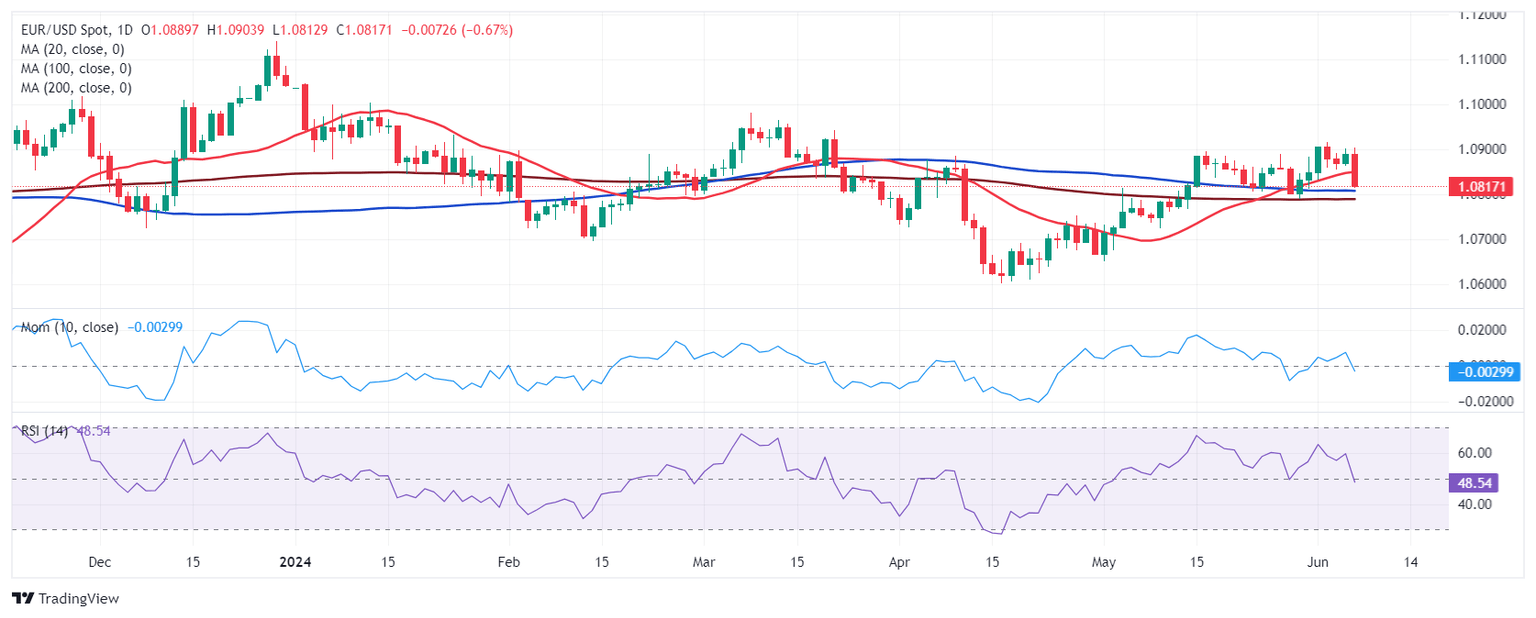

From a technical perspective, the case for a downward extension builds up. The weekly chart shows technical indicators turning marginally lower at around their midlines, which is not enough to confirm a decline but suggests bulls are giving up. At the same time, EUR/USD remains stuck to a directionless 20 Simple Moving Average (SMA) and stands midway between flat 100 and 200 SMAs, with the shorter one providing dynamic support in the 1.0640 price zone.

The daily chart for the EUR/USD pair shows an increased bearish potential. The pair has broken below its 20 SMA, which lost its bullish slope. Furthermore, it is approaching the directionless 100 and 200 SMAs, providing support in the 1.0770-1.0790 price zone. Finally, technical indicators gain downward traction just below their midlines, supporting a bearish extension on a break below the mentioned area. Once below it, the next support comes at 1.0720, en route to 1.0640. The 1.0910 region provides resistance, followed by the 1.0980-1.1000 price zone.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.