EUR/USD Weekly Forecast: The US Consumer Price Index could twist Fed’s hand

- United States' upbeat employment-related data put investors between a rock and a hard place.

- Eurozone inflation eased further in March, clearing the path for an ECB rate cut in June.

- EUR/USD is technically bearish despite the latest bounce, 1.0694 at sight.

The US Dollar strengthened at the beginning of the week but could not maintain its momentum and turned lower, helping EUR/USD recover from an over one-month low of 1.0724. The rally was a result of broad US Dollar weakness caused by diminishing odds of a rate cut in the United States.

Last Friday, Federal Reserve (Fed) Chairman Jerome Powell said that, given the economic resilience and inflation holding above the central bank’s goal, policymakers are in no rush to trim interest rates. Throughout this week, multiple Fed officials got on the same train, cooling down hopes for a loosened monetary policy. As a result, EUR/USD recovered up to 1.0875.

Meanwhile, the Euro found strength in the Hamburg Commercial Bank (HCOB) and S&P Global final estimates of the March Services and Composite Producing Managers Index (PMI), which surprised with a pivotal shift in the services sector's trajectory. The HCOB Germany Services PMI increased to 50.1 from 48.3 in February, while the Eurozone index improved to 51.5.

The pair changed course once again ahead of the weekly close amid stronger-than-anticipated US employment-related data. Mid-week, the ADP survey on private job creation showed the private sector added 184K new positions in March. Finally on Friday, the Nonfarm Payrolls (NFP) showed the economy added 303K new jobs, much better than the 200K expected. Also, the Unemployment rate fell to 3.8% from 3.9%. Finally, Average Hourly Earnings rose 0.3% in the month and are up 4.1% over the past year. The solid employment report put investors in an uncomfortable position. On the one hand, it indicates the US economy keeps growing at a healthy pace, which means better earnings and profits. On the other, it also supports the Fed’s case of holding rates at the cycle's peak. US policymakers have repeatedly noted that a loosening labor market would be a pre-condition for rate cuts, alongside easing inflation.

Other US data was mixed yet generally encouraging. The ISM Manufacturing PMI jumped to 50.3 in March from 47.8 previously, ending a sixteen-month losing streak. The Services PMI, however, eased from 52.6 to 51.4, missing expectations but still indicating expansion.

Across the pond, Germany reported that the Harmonized Index of Consumer Prices (HICP) rose 2.3% YoY in March, according to preliminary estimates, while the EU informed the annual HICP at 2.4% in the same period. The readings eased from March ones and were below the market expectations, backing the case of interest-rate cuts in Europe.

US inflation and the European Central Bank

The macroeconomic calendar will feature the US March Consumer Price Index (CPI) next week. The country will also publish the Producer Price Index (PPI), which will complete the inflationary picture for March.

In the Old Continent, the European Central Bank (ECB) monetary policy decision stands out. President Christine Lagarde and her policymakers’ colleagues have been paving the way for a June hike, at the point market players are speculating whether the ECB will act before the Fed. The ECB is expected to keep interest rates unchanged again in April while preparing markets for a reduction in a couple of months.

Other than that, the calendar will include the preliminary estimate of the US April Michigan Consumer Sentiment Index and German Industrial Production and the final estimate of the Harmonized Index of Consumer Prices (HICP).

EUR/USD technical outlook

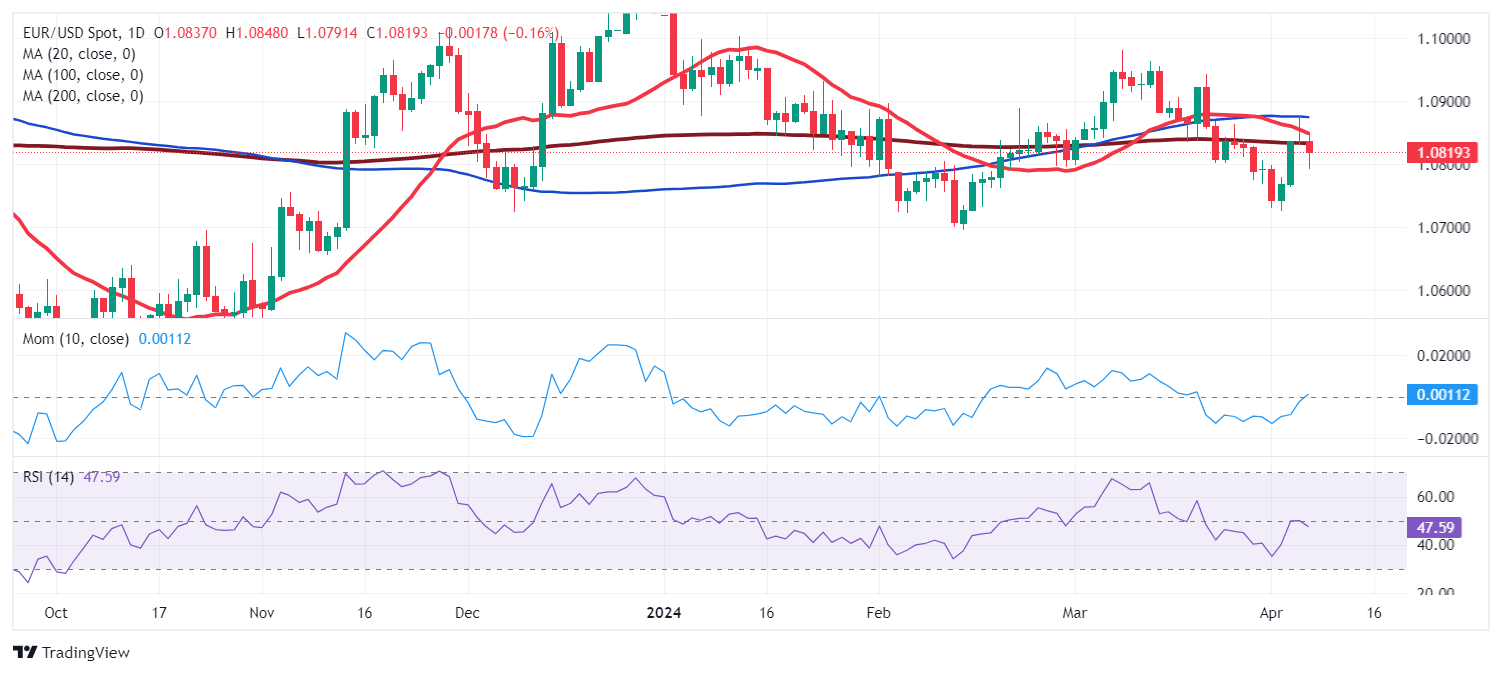

The EUR/USD pair struggles to retain the 1.0800 mark and it is little changed for a second consecutive week. The long-term technical picture skews the risk to the downside. In the weekly chart, the pair met sellers around a flat 20 Simple Moving Average (SMA), providing dynamic resistance at around 1.0870. The longer moving averages are also directionless, with only the 100 SMA below the current level, acting as dynamic support at 1.0626. Technical indicators, in the meantime, remain within negative levels, although with moderated downward strength.

Bears retain control, according to technical readings in the daily chart. EUR/USD spent most of the last week trading below all its moving averages, with a short-lived spike towards a bearish 20 SMA attracting sellers. At the same time, technical indicators were unable to overcome their midlines and began shifting south, anticipating another leg lower in the upcoming days.

A slide through 1.0770 exposes a critical support level at 1.0694, February’s monthly low. Further slides below the latter put 1.0600 at sight. Should the pair recover, it would need to beat the 1.0870 level to be able to extend gains, initially towards 1.0940 and then to 1.1000.

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Apr 10, 2024 12:30

Frequency: Monthly

Consensus: 3.4%

Previous: 3.2%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.